As we stand on the precipice of economic revelation, tomorrow marks a crucial day for China as several key economic rates are set to be unveiled. These indicators, ranging from GDP growth rates to unemployment figures, provide a comprehensive snapshot of the nation’s economic health. Let’s delve into each rate, unraveling their significance, and explore the potential impact they may have on China’s economic landscape.

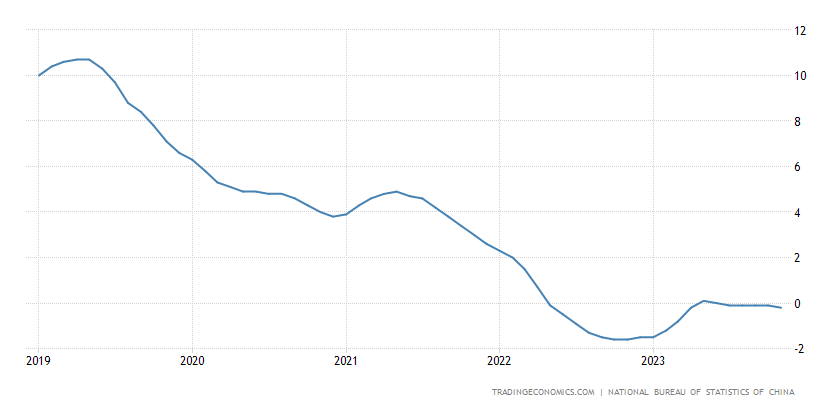

1. House Price Index YoY (HPI YoY): Unlocking Real Estate Dynamics

The House Price Index Year-on-Year reveals the annual percentage change in residential property prices. A rising HPI indicates a growing real estate market, influencing consumer wealth and spending. Conversely, a decline might signal economic concerns. The accompanying graph will illustrate the trajectory of this key indicator, offering insights into the health of China’s real estate sector.

source: tradingeconomics.com

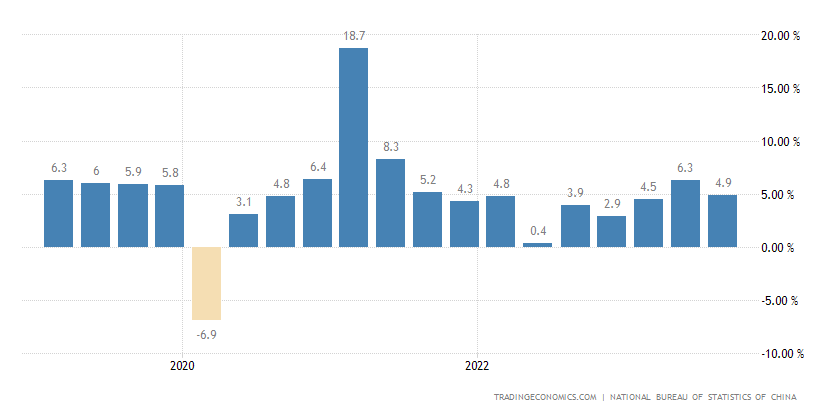

2. GDP Growth Rate YoY: The Economic Compass

The GDP Growth Rate Year-on-Year is a cornerstone metric, reflecting the overall economic health of a nation. A positive growth rate suggests economic expansion, while a negative rate signals contraction. Tomorrow’s announcement will provide a glimpse into China’s long-term economic trajectory.

source: tradingeconomics.com

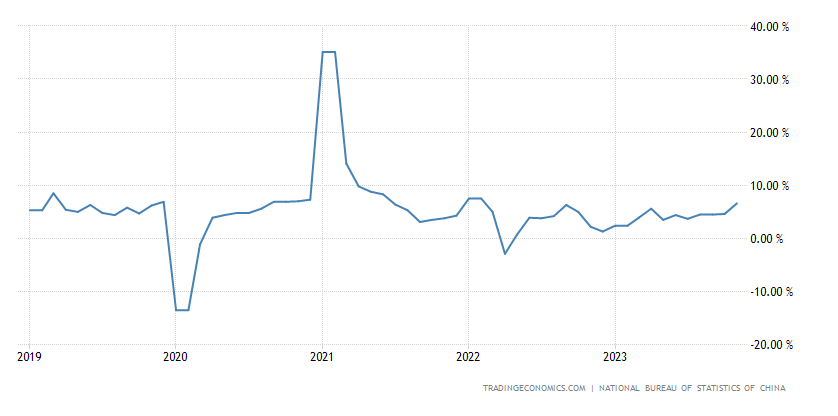

3. Industrial Production YoY: Manufacturing Prowess Unveiled

This indicator measures the annual growth rate of industrial output, offering insights into the manufacturing sector’s vitality. As a key driver of China’s economy, the Industrial Production Year-on-Year rate reflects global demand for Chinese goods and the nation’s industrial health.

source: tradingeconomics.com

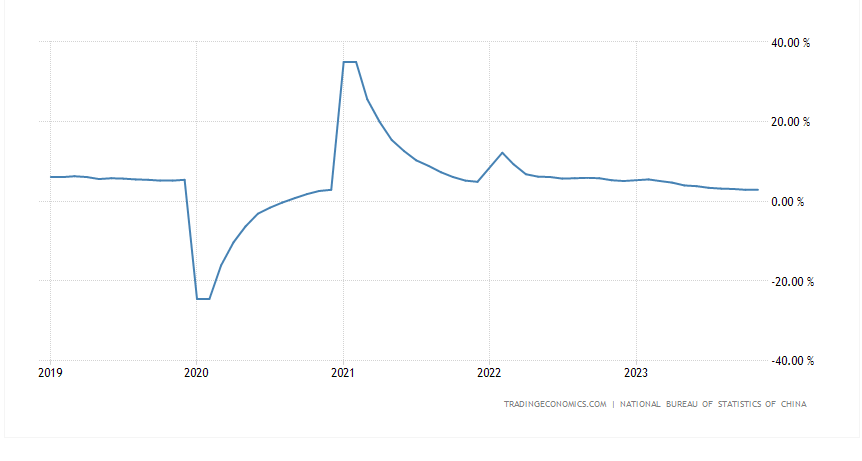

4. Fixed Asset Investment (YTD) YoY: Building for the Future

Fixed Asset Investment Year-to-Date Year-on-Year signifies the annual growth in capital expenditure on infrastructure, property, and machinery. This metric gauges the government’s commitment to long-term economic development and offers clues about future economic prospects.

source: tradingeconomics.com

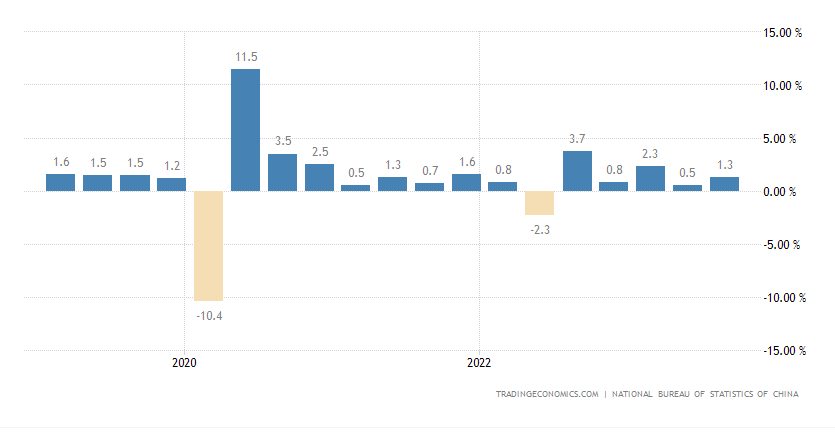

5. GDP Growth Rate QoQ: Quarterly Insights

Examining the GDP Growth Rate Quarter-on-Quarter provides a more immediate perspective on economic trends. Rapid changes in this rate can indicate shifts in economic momentum, revealing how well China adapts to short-term challenges or opportunities.

source: tradingeconomics.com

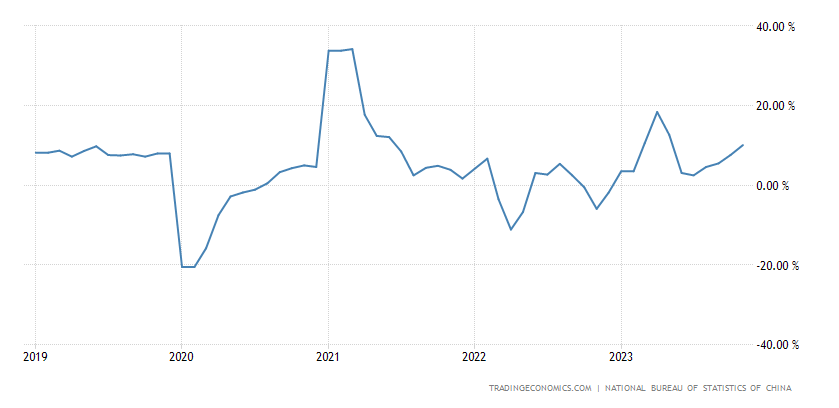

6. Retail Sales YoY: Consumer Sentiment and Spending Habits

Retail Sales Year-on-Year reflects consumer spending patterns. A growing retail sector indicates a robust domestic economy, while a decline may signal economic caution among consumers.

source: tradingeconomics.com

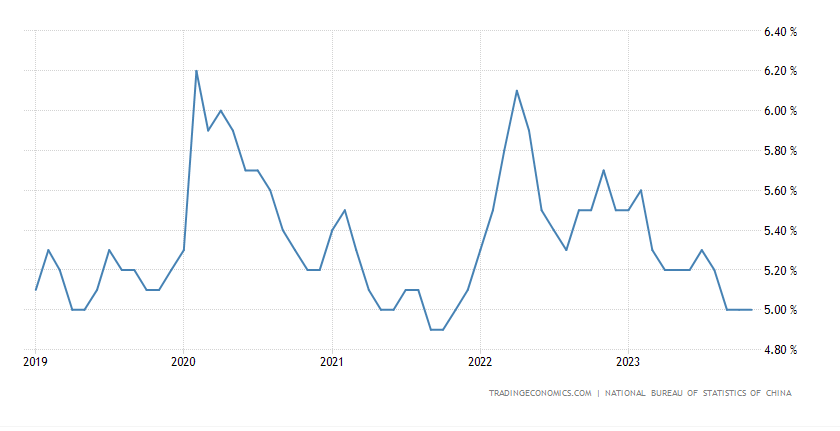

7. Unemployment Rate: Labor Market Health

The Unemployment Rate sheds light on the job market’s health, an essential factor in understanding economic resilience. A rising unemployment rate may indicate economic stress, while a declining rate signals increased workforce participation and economic stability.

source: tradingeconomics.com

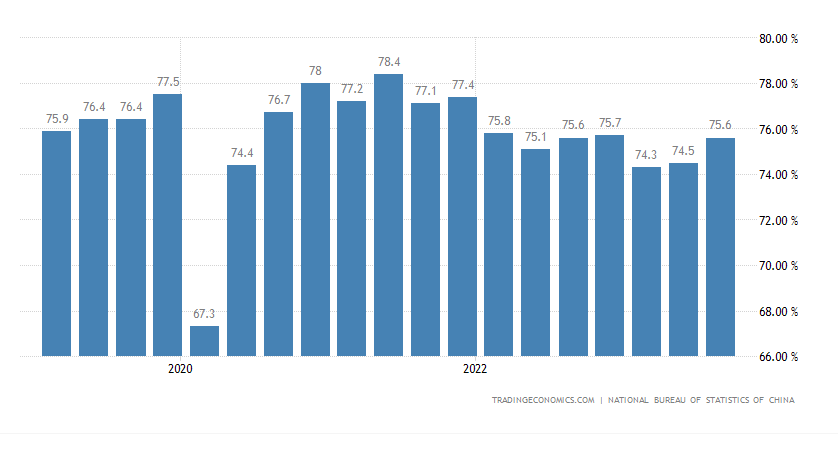

8. Industrial Capacity Utilization: Maximizing Productivity

This metric gauges the extent to which factories are operating at their full potential. A high utilization rate reflects a robust industrial sector, while a low rate may signal underutilization and economic inefficiency.

source: tradingeconomics.com

Summary: Deciphering Tomorrow’s Economic Landscape

As China unveils these economic rates, market analysts, policymakers, and global observers will keenly analyze the data for signs of economic health, potential risks, and areas of growth. The collective impact of these rates shapes China’s economic narrative, influencing investment decisions and policy adjustments.

In conclusion, the National Bureau of Statistics (NBS) Press Conference following these announcements will provide additional context, offering a platform for officials to explain the data, discuss policy implications, and address questions from the media. The collective understanding of these economic indicators is crucial for navigating the future of China’s economic landscape. As we await the unveiling of these rates, the global economic community remains on the edge, ready to interpret and respond to the economic revelations that tomorrow holds.