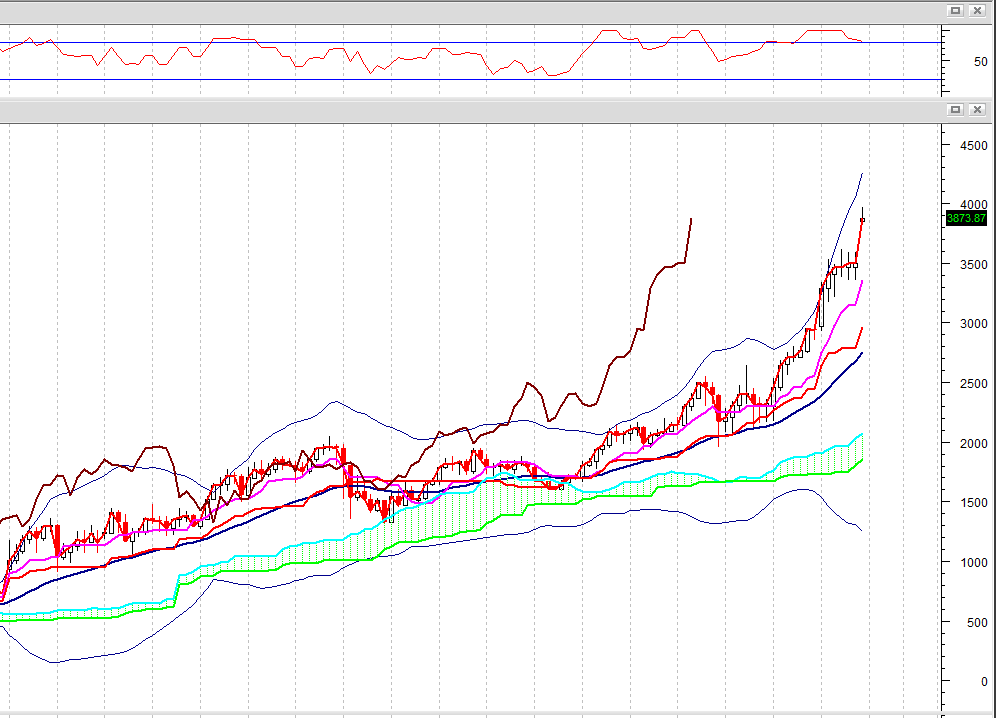

Ethereum looks overbought but is not giving any indication that it is about to slow down.

Technical Outlook

Short Term: Overbought

Intermediate Term: Bullish

Long Term: Bullish

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

FOREX ETH gapped up (bullish) on light volume.

Possibility of a Common Gap which usually coincides with a lack of interest in the security. Common Gaps are fairly irrelevant for forecasting purposes. Four types of price gaps exist – Common, Breakaway, Runaway, and Exhaustion. Gaps acts as support/resistance.

ETH is currently 180.8% above its 200-period moving average and is in an upward trend. Volatility is extremely low when compared to the average volatility over the last 10 periods.

There is a good possibility that there will be an increase in volatility along with sharp price fluctuations in the near future. Our volume indicators reflect very strong flows of volume into ETH (bullish).

Our trend forecasting oscillators are currently bullish on ETH and have had this outlook for the last 42 periods. Our momentum oscillator is currently indicating that ETH is currently in an overbought condition.

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 8 white candles and 2 black candles for a net of 6 white candles. During the past 50 bars, there have been 34 white candles and 16 black candles for a net of 18 white candles.

A long upper shadow occurred. This is typically a bearish signal (particularly when it occurs near a high price level, at resistance level, or when the security is overbought).

A rising window occurred (where the top of the previous shadow is below the bottom of the current shadow). This usually implies a continuation of a bullish trend.

A spinning top occurred (a spinning top is a candle with a small real body). Spinning tops identify a session in which there is little price action (as defined by the difference between the open and the close). During a rally or near new highs, a spinning top can be a sign that prices are losing momentum and the bulls may be in trouble.

Three white candles occurred in the last three days. Although these candles were not big enough to create three white soldiers, the steady upward pattern is bullish.