#infrastructure #economy #Biden #spending #income#tax $Biden #Trump

$DIA $SPY $QQQ $RUTX $VXX

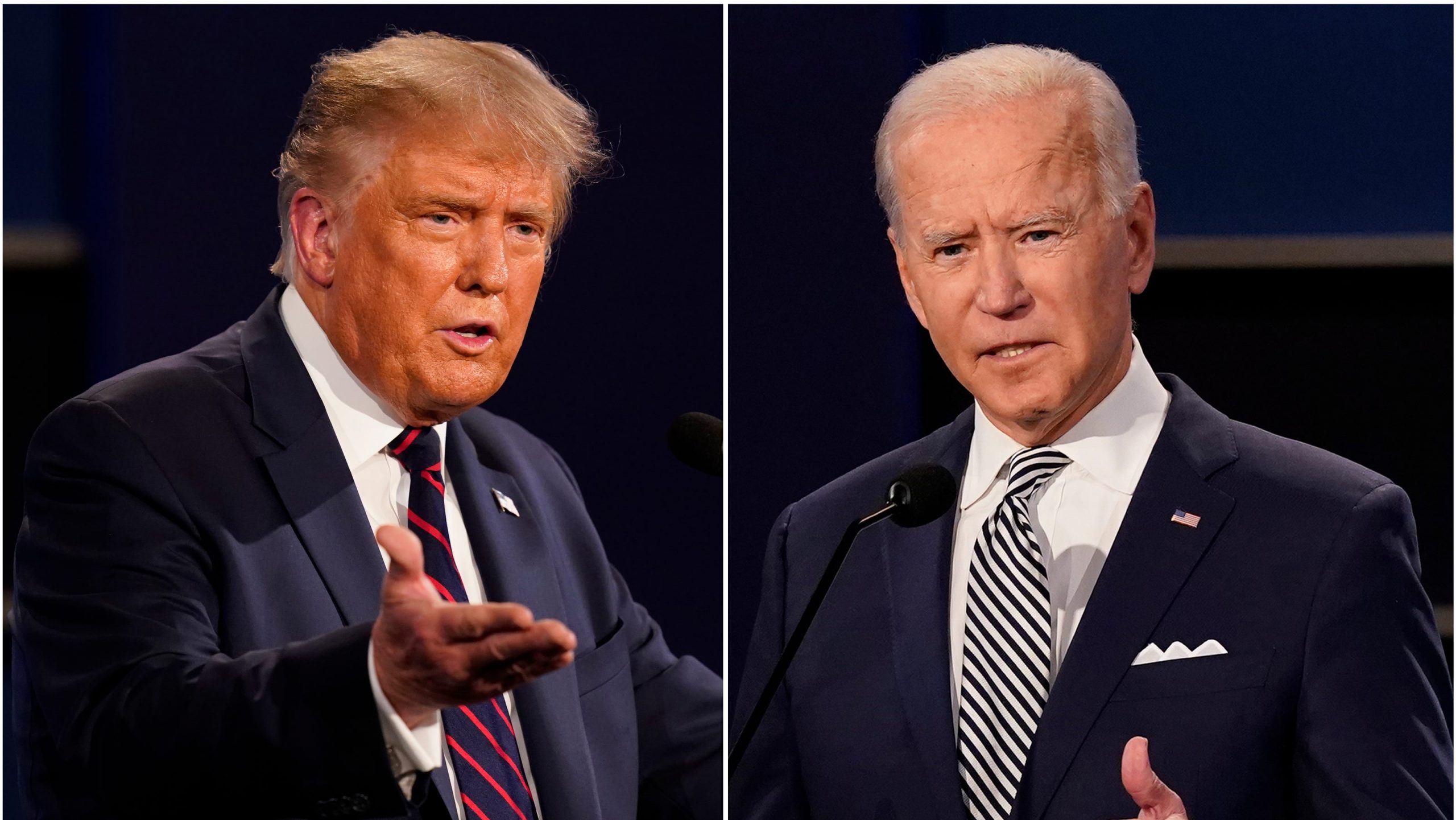

“Mr. Biden’s plan to revamp US infrastructure and expand the social safety net would raise federal spending to its highest mark in modern history” — Paul Ebeling

Democrats want to pay for Mr.Biden’s $4-T package over the next 10 yrs by hiking taxes on the ultra-wealthy and corporations.

Republicans say any tax increase is a “red line” they will not cross.

Here is what the plan, which Congress must approve, currently includes the following

The plan calls for spending $2.3-T on Mr. Biden’s version of infrastructure and jobs plus another $1.8-T on families and education.

To Republicans, infrastructure means roads, bridges and construction projects.

Democrats want to expand the definition to include broadband internet for farmers, electric vehicles and cleaning up pollution in low-income neighborhoods.

There is even less Republican support for the trillions of dollars Democrats want to spend on families to reduce child poverty and help adults find jobs in a changing economy.

Mr. Biden proposes to raise income tax rates for the Top 1% of earners, those making over $500,000 a year. The Top rate would rise to 39.6%, undoing a cut to 37% approved under the Trump administration.

The Biden administration has demonstrated flexibility in an effort to reach across the aisle.

On Thursday, 3 June, Mr. Biden floated a 15% minimum tax for corporations in an effort to recruit Republicans skeptical of the proposed 28% corporate tax rate.

The Biden administration is also proposing to roughly double the tax rate on capital gains. Capital gains taxes are triggered when the owner of an asset, be it a stock or a piece of real estate, decides to sell. Tax is paid on any “gain” or profit, subject to some popular exclusions like part of the profit from selling a primary residence.

The proposal is among several ideas that could slow the concentration of wealth in the United States. The proposal would bring capital gains taxes to their highest level in modern times and well above the 35% peak of the 1970’s.

The top US marginal income tax rate is not on the low end of the range of industrialized countries, but it is lower than in many of them, particularly those in Europe.

Thursday benchmark US stock market indexes finished at:

DJIA -23.34 to 34577.04, NAS Comp -141.82 to 13614.53, S&P 500 -15.27 to 4192.85

Volume: Trade on the NYSE came in at 1.04-B/shares exchanged.

- Russell 2000 +15.4% YTD

- DIA +13.0% YTD

- S&P 500 +11.6% YTD

- NAS Comp +5.6% YTD

HeffXLTN’s overall technical outlook for the Major US stock market indexes is overall Bullish with a Very Bullish bias in here.

Looking Ahead: Investors will receive May Nonfarm Payrolls (NFPs), Nonfarm Private Payrolls, Average Hourly Earnings, Unemployment Rate, and Average Workweek will be reported tomorrow at 8:30a EDT, followed by April Factory Orders Friday

Have a healthy day Keep the Faith!