#markets #capital #stocks #bonds #cryptocurrencies #globalization #Russia #Ukraine #war #economy #inflation #knightsbridge

$SPY $BTCUSD $KNIGHTSUSD $CROWNSUSD $BLK

“The Russia-Ukraine war is fast bringing the globalization era to an end, but keep in mind that the global economy and the financial system will not turn on a dime” –Paul Ebeling

In his annual investor letter released last Thursday, Larry Fink, Blackrock’s founder with $10-T under management, said he remains a believer in the benefits of globalization, “Access to global capital enables companies to fund growth, countries to increase economic development, and more people to experience financial well-being. But the Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades.”

Sanctions imposed by the US and its allies have tried to expel Russia from the global financial system while numerous Western companies have left or suspended operations in the country as a quasi punishment for its invasion of Ukraine. And Russia has expelled others and taken control of the vast infrastructures of those that left.

“Russia’s aggression in Ukraine and its subsequent decoupling from the global economy is going to prompt companies and governments world-wide to re-evaluate their dependencies and reanalyze their manufacturing and assembly footprints, something that Covid had already spurred many to start doing,” Mr. Fink said.

So, as globalization unwinds it makes sense to look at onshore investments, which for US investors would include companies whose major revenues come from domestic sales and whose assets are primarily US-based.

It also makes sense to expect more upward pressure on inflation as shorter supply chains raise costs. Plus, a sharp rise in cryptocurrencies lie bitcoin, ether, knights, crowns and others. As there is no going back to an antiquated model.

So, now the simple trades this yr are areas that have seen underinvestment for years, including US energy and materials infrastructure, plus it looks very likely that this commodity rally will have legs.

This wk the data will reflect a tight US jobs market, with ADP set to release its estimate of March private-sector job creation on Wednesday, while the Labor Department’s official jobs report for the month is due Friday.

Thursday will feature the release of the February reading of Fed’s favorite inflation indicator, the personal consumption expenditure price index. The core PCE price index rose 5.2% Y-Y in January for its fastest pace in 39 yrs.

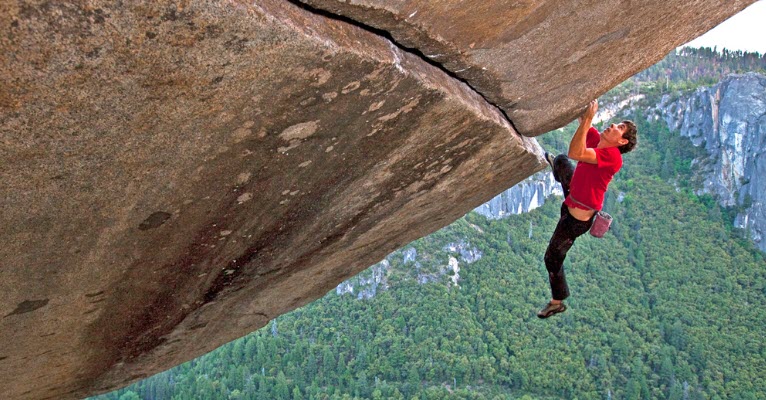

Note: Climbing the wall of worry is a reference to investor behavior during Bull markets, usually at the end of major Bear periods, or general periods of large market gainers,

Have a very prosperous week, Keep the Faith!