Goldman Sachs 2023. The U.S. economy is forecast to narrowly avoid recession next year as inflation declines and unemployment rises only slightly, according to economists at Goldman Sachs.

As concerns about an economic downturn and inflation fade, strategists expect investors to demand less compensation for owning stocks instead of risk-free Treasuries (or a decline in the equity risk premium). However, Fed policy is likely to keep gains in the stock market contained.

The labor market is tight, which means policymakers will be reluctant to allow financial conditions to ease.

“The Fed will likely seek to keep financial conditions sufficiently tight to maintain below-trend economic growth and contain inflation,” our strategists wrote. “This policy means limited valuation expansion and limited upside to equities, a key component of financial conditions.”

While not economists’ base case, a U.S. recession is forecast to spark around a 20% decline in the S&P 500. (During the 12 post-war recessions, the S&P 500 fell to a trough that was on average 30% below its peak.)

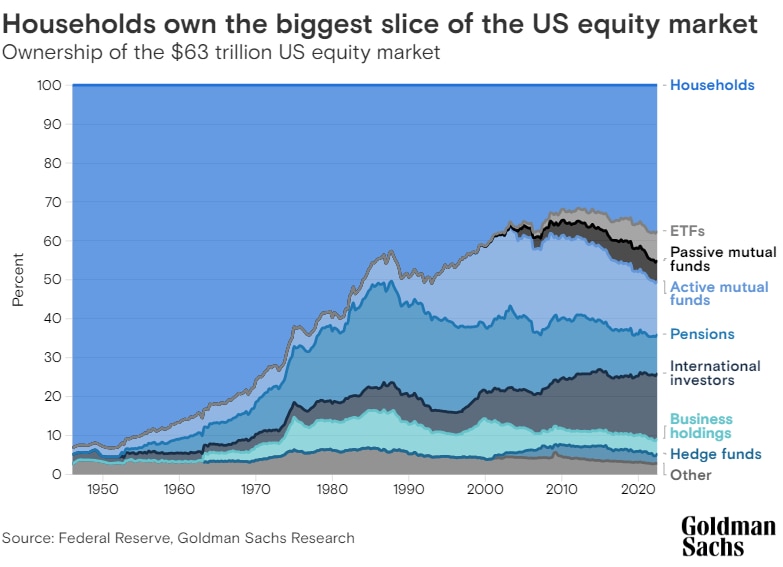

There are several reasons stock prices are vulnerable. Investors appear to be positioned for a soft landing (as suggested by the performance of cyclical stocks versus defensive stocks), according to Goldman Sachs Research. Households, the largest holder of U.S. stocks, still have a lot of money allocated to equities by historical standards, which is another risk for valuations.

Goldman Sachs strategists expect individual investors to reduce their equity holdings next year for the first time since 2018. As households shift some investment to (now higher yielding) bonds, they are expected to reallocate $100 billion out of equity funds. Corporate stock buybacks are also predicted to shrink as earnings-per-share stall.

“Put simply, zero earnings growth will drive zero appreciation in the stock market,” David Kostin, chief U.S. equity strategist, wrote in the team’s 2023 Outlook.

The S&P 500 Index is forecast to turn out flat returns and no growth in earnings in 2023 after declining about 17% this year, according to Goldman Sachs Research.

Goldman Sachs strategists expect the benchmark to fall about 9% in the next three months before rebounding after the Federal Reserve’s tightening cycle ends in May.

Revenue of S&P 500 firms is predicted to rise 4%, in line with nominal GDP growth, but margins will likely shrink, eliminating growth in earnings per share.

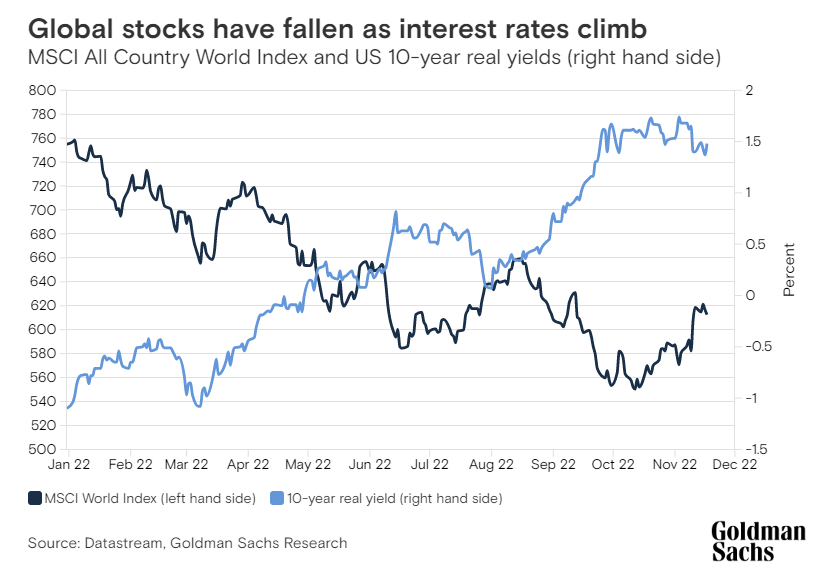

A lot has changed in the past year. The Federal Reserve is hiking interest rates to curb inflation, sharply driving up the cost of capital for U.S. firms from practically nothing to the highest level in a decade. That has translated into a drop in valuations, especially in growth stocks whose earnings are expected to materialize further in the future.

Goldman Sachs Research expects the weighted average cost of capital for U.S. companies to remain high in 2023.

Strategists favor stocks that aren’t as sensitive to changes in interest rates, like companies in healthcare, consumer staples and energy. They also think industries with a history of outperforming when inflation is high and falling — such as medical equipment, semiconductors, and consumer services — could be an opportunity in 2023, as could companies with resilient margins. They expect unprofitable enterprises and firms with vulnerable margins to have lower returns.

The prospects for big tech companies have changed, too. The revenue from tech companies has grown much faster than the overall index for the last decade — 18% for tech versus just 5% for the index. But that extra revenue growth (or premium sales growth) has narrowed dramatically: In the coming years through 2024, our strategists expect revenue from big tech to increase at an annualized pace of 9% versus 7% for the overall index. The valuation premium for big tech has compressed as well.

That said, a peak in interest rates could be a sign that U.S. stocks have reached their bottom. Since 1980, the S&P 500 has rallied by an average of 7% during the three months following a peak in two-year Treasury yields. Over a 12-month investment period, however, returns have varied dramatically depending on whether the economy subsequently entered recession or continued to grow.

“The combination of limited upside in our base case and large downside in the case of a recession means investors should remain cautious in the near term,” our analysts wrote.

The bear market in stock markets is forecast to intensify before giving way to more hopeful signals later in 2023, according to Goldman Sachs Research.

The MSCI All Country World Index of global equities has fallen about 19% this year. Even as stocks have risen somewhat since the summer, our strategists forecast more volatility and declines during this bear market before reaching a low later in 2023. They expect interest rates to peak and for the deterioration in economic growth to stabilize before a sustained rally in equities gets underway.

The fundamentals driving the global equity market have changed dramatically, wrote Peter Oppenheimer, chief global equity strategist and head of macro research in Europe. In the team’s 2023 Outlook, he pointed out that, in a reversal from previous years, the cost of capital has gone up substantially, hitting valuations for fast-growing companies whose profits are expected to materialize in the future. Earnings at the big tech companies have fallen behind analysts’ expectations.

Higher interest rates and commodity prices have made high-quality companies with dependable profits and cash flow more attractive. “There has been something of a reversal of relative fortunes between traditional incumbents and digital new entrants in many industries,” our strategists wrote. They favor companies with high dividends, strong balance sheets and high margins.

At the same time, investors may have to cope with a lingering bear market. There are two main types — “cyclical” ones driven by a slowing economy and rising interest rates, and “structural” ones driven by a shock like an asset bubble or disaster, according to Goldman Sachs Research. This downturn is the cyclical variety, which typically lasts 26 months and takes 50 months for stocks to recover. Equities usually fall 30% and are buffeted by short rallies before the market reaches a bottom in these cycles.

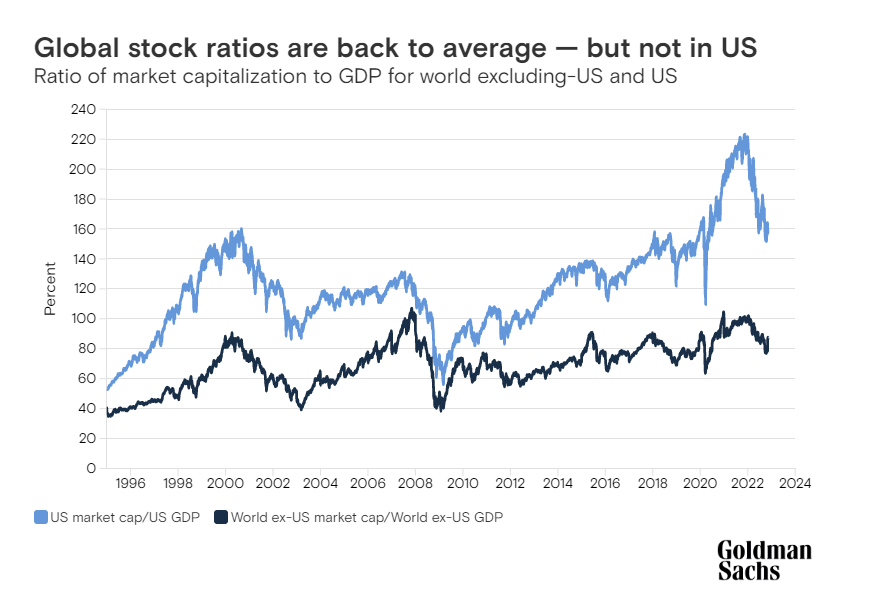

There are several key reasons why our strategists think stocks may fall further. While valuations have declined this year, they started from a very high peak amid ultra-low interest rates. Though many equity markets around the globe are trading at low valuations, U.S. stocks aren’t — American equity valuations are still at levels consistent with the peak of the technology bubble in the late 1990s.

Some of the difference in valuations is probably explained by better expectations for economic growth in the U.S. and a stock market that has a different mix of companies. But even with that in mind, GS Research says it’s difficult to justify why the U.S. market is trading in line with its 20-year average. That’s particularly so when the big tech firms’ margins are under pressure, resulting in job cuts and a decline in investment. And in the meantime, government and corporate bond yields have risen enough that they are becoming a competitive alternative to equities.

Historically, the best time to buy stocks is when economic growth is weak but getting closer to stabilizing. But while the outlook for expansion is expected to improve later this year, that hasn’t happened yet. “Timing is everything,” according to strategists in Goldman Sachs Research. “A weak economy that is still deteriorating is very different from an economy that is getting less bad.”

Goldman Sachs Research forecasts recessions in Europe while the U.S. narrowly avoids a downturn. But even if the world’s largest economy manages to keep growing, our equity strategists say there’s a strong risk investors will price in a higher chance of recession in the U.S. before stocks reach the bottom. Their base case is that earnings are flat in 2023.

The peak in interest rates is likely to be bullish for stocks. However, our strategists think bond yields still have room to rise, in part because U.S. policy makers are focused on keeping financial conditions tighter to help contain inflation. It’s also still unclear how long rates will stay high before central banks are ready to lower borrowing costs. Economists at Goldman Sachs don’t expect any rate cuts from the U.S. Federal Reserve in 2023.

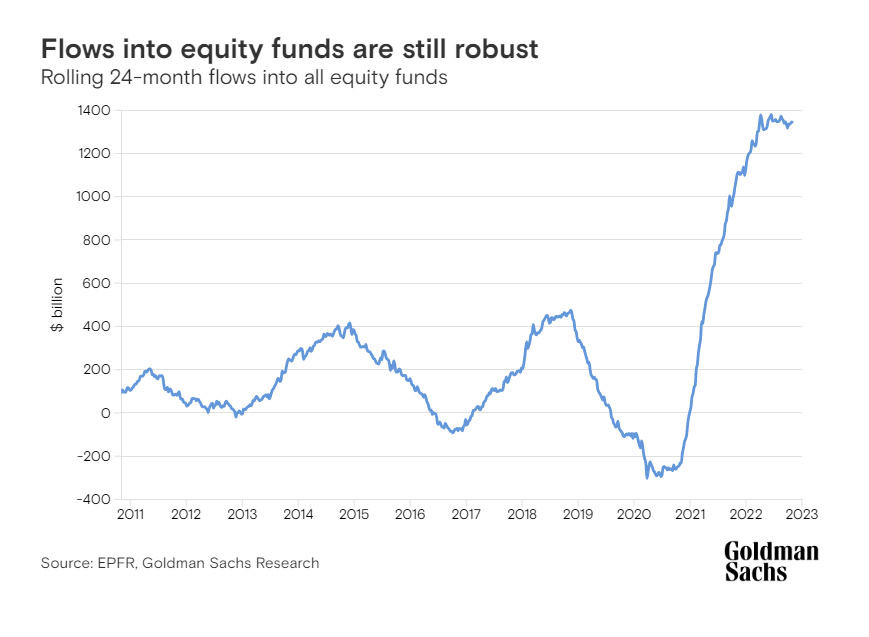

Investor positioning, meanwhile, signals the market hasn’t yet reached its trough. By some measures, investors have become more defensive and have re-positioned their portfolios to take less risk, but flows into equity funds are still robust, especially in the U.S. Our strategists expect to see more signs that investors have capitulated to the bear market before stocks reach a bottom.

The global stock market’s “hope” phase could start later this year, according to Goldman Sachs Research. These recoveries usually start during recessions as valuations climb. Historically it’s been better to invest in stocks just after the bottom than just before it: average 12-month returns are higher one month after the trough than one month before it. “For this reason, we think it is too early to position for a potential bull market transition,” Goldman Sachs strategists wrote.