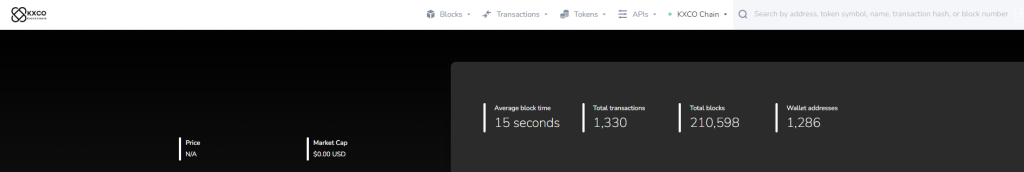

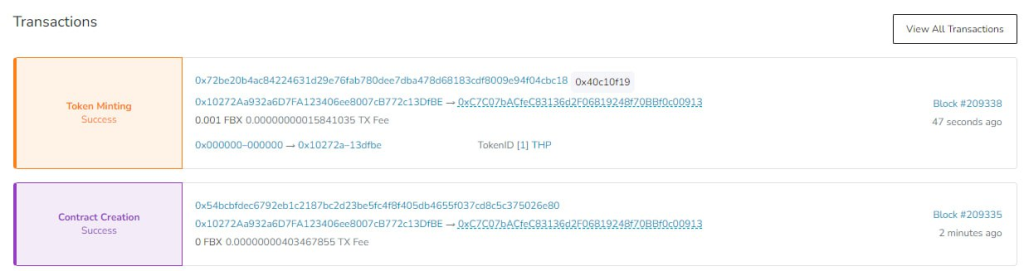

Real Estate Blockchain Test Phase, Real Estate Tokenization, Peer-to-Peer (P2P) Mortgages, Aggregation of Mortgage Pools have all been successfully tested. The tests were run on KXCO Chain1 and $FBX is the currency that settles all fees and charges on chain.

Real Estate Tokenization

KXCO announce that a successful test phase of real estate tokenization on the KXCO blockchain has been completed. This exciting development opens up new possibilities for investors to participate in the real estate market through KXCO blockchain technology.

Real estate tokenization involves representing ownership of real estate assets as digital tokens on a blockchain network. This allows for fractional ownership, sole ownership, partnerships and community led projects with transferability and documentation of assets to the highest regulatory standards , providing greater liquidity and accessibility to investors.

With the successful test of real estate tokenization on the blockchain, we have demonstrated the potential for this technology to revolutionize the real estate industry.

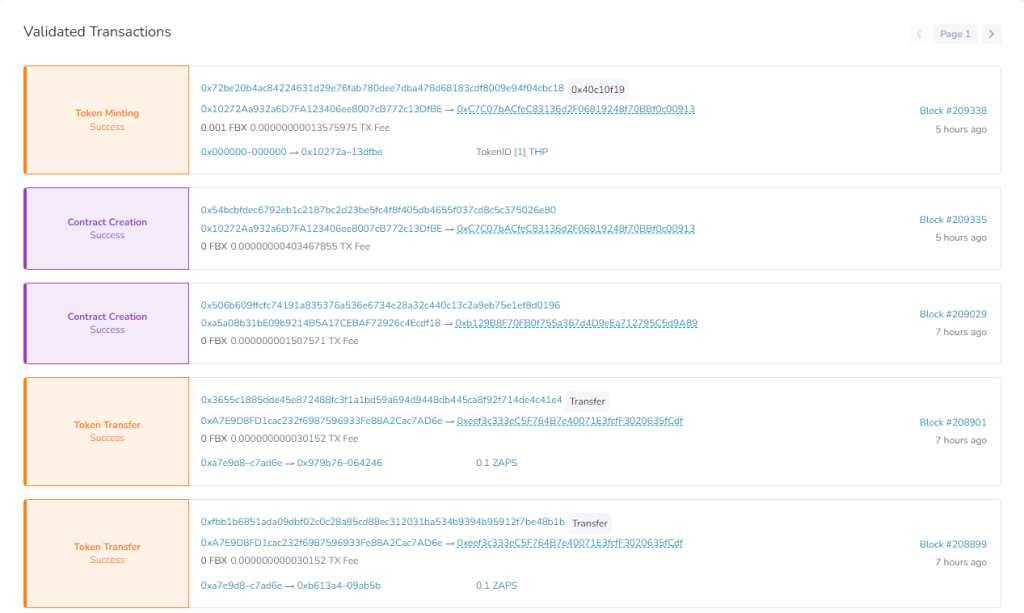

Demonstration graphics for the test

This development could bring many benefits to the real estate industry, including increased liquidity, new markets, reduced transaction costs, and improved transparency. Tokenization on the KXCO blockchain allows for fractional ownership, meaning investors can purchase smaller portions of properties, making real estate investment more accessible to a wider range of people.

We are excited to continue exploring the possibilities of real estate tokenization on the blockchain and look forward to seeing the impact this technology will have on the industry.

As with any new technology, real estate tokenization on the blockchain must comply with existing regulations to ensure transparency and protect investors. Here are some considerations KXCO guidelines built in to the process for meeting the regulations of real estate tokenization:

- Legal Framework: Before initiating a tokenization project, it is important to ensure that the legal framework in the relevant jurisdiction permits it. The legal structure of the tokenization should comply with existing securities laws, property laws, and any other relevant regulations.

- KYC and AML: Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance is crucial to ensure that token sales are not used for illegal activities. Tokenization platforms should implement strict KYC and AML procedures for their investors.

- Accreditation and Investment Limits: Depending on the jurisdiction, investors may be required to meet certain accreditation criteria and investment limits. Token issuers should ensure that investors meet these criteria to comply with regulatory requirements.

- Disclosure Requirements: Token issuers should provide complete and transparent disclosure of the investment risks and benefits to investors. This includes details on the real estate asset being tokenized, the expected returns, and any associated fees.

- Transfer Restrictions: Token issuers should implement transfer restrictions to prevent unauthorized transfers and comply with securities laws.

- Custody and Security: Real estate tokens should be held in secure custody by a reputable custodian. The tokenization platform should also implement strict security measures to prevent hacking and theft.

By following these considerations, real estate tokenization on the KXCO blockchain can comply with existing regulations, ensuring transparency, and protecting investors. It is important to work closely with legal and regulatory experts to navigate the complex regulatory landscape.

Peer-to-Peer (P2P) Mortgages

KXCO is also pleased to announce that the company has successfully developed the ability to facilitate Peer-to-Peer (P2P) mortgages on the blockchain. This is a significant development that will revolutionize the traditional mortgage industry by providing a secure, transparent, and cost-effective platform for borrowers and investors to connect directly.

KXCO P2P mortgage platform leverages the power of blockchain technology to remove intermediaries, reduce costs, and increase transparency. With the KXCO platform, borrowers can obtain loans at lower interest rates than traditional mortgages, while investors can diversify their portfolios with a new asset class.

KXCO P2P mortgage platform is built on a secure blockchain network and utilizes smart contracts to automate the processing of mortgage payments, fees, and escrow. The platform also incorporates sophisticated algorithms and data analytics to assess borrower creditworthiness and determine appropriate interest rates.

The platform incorporates robust KYC and AML procedures to ensure compliance with local regulations and prevent money laundering and other illegal activities. KXCO have also implemented an escrow mechanism to hold funds securely until the mortgage terms are met, and a transparent dispute resolution mechanism in case of any disputes.

KXCO are excited to be at the forefront of this disruptive technology and are committed to ensuring the success and sustainability of P2P mortgages on the blockchain. KXCO offers a secure, transparent, and cost-effective solution that will benefit borrowers, investors, and the entire mortgage industry.

Aggregation of Mortgage Pools

Aggregation of mortgage pools on the blockchain can provide benefits such as increased liquidity, more diverse investment opportunities, and greater transparency. Here are some considerations for aggregating mortgage pools on the blockchain:

- Tokenization: To aggregate mortgage pools on the blockchain, the underlying assets need to be tokenized. This allows investors to purchase fractional ownership in the pools and trade them on digital asset exchanges.

- Smart Contracts: Smart contracts can be used to automate many aspects of mortgage pool aggregation, including the creation, management, and distribution of the pools. This reduces the need for intermediaries and can increase efficiency and transparency.

- Risk Assessment: Aggregating mortgage pools requires a sophisticated risk assessment process to determine the creditworthiness of the underlying assets. This may involve using machine learning algorithms to analyze borrower data and credit scores.

- Legal and Regulatory Compliance: As with any financial transaction, aggregating mortgage pools on the blockchain must comply with local laws and regulations. This includes ensuring that the tokens issued are properly registered and that investors meet eligibility requirements.

- Security: Blockchain technology provides a secure and tamper-proof ledger, but it is important to ensure that the underlying technology and infrastructure are robust and secure.

- Liquidity Risks: While aggregating mortgage pools can increase liquidity, it also introduces the risk of sudden price fluctuations. This risk can be mitigated by diversifying investments across multiple pools and using risk management strategies.

Aggregating mortgage pools on the blockchain can provide investors with new opportunities to diversify their portfolios and access a broader range of mortgage assets. However, it is important to address technical, legal, and regulatory challenges to ensure the success and sustainability of this approach.

KXCO is Chain1 is the 1st client developed under the KXCO umbrella. It is built with Java, and it offers several benefits that make it an attractive choice for organizations looking to build blockchain solutions.

While FBX is the Chain Currency for KXCO you can pay in any Fiat or Digital Asset, the system will automatically process the transaction and buy the required amount of FBX at the same time without you having to do any conversions or additional work, fast, easy and safe.

Buy FBX