Global Capital Flight Triggers Bitcoin Boom

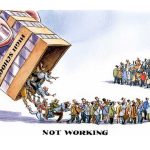

The world of finance is abuzz with the recent surge in Bitcoin investments, fueled by a growing trend of foreigners withdrawing their funds from China. According to a report by Reuters, foreign investors have accelerated their capital flight from China during May, prompting a surge in interest and investments in the leading cryptocurrency. This article delves into the implications of this significant development and explores why Bitcoin has become an attractive investment option amidst a shifting global landscape.

Foreigners Pull More Money Out of China

Recent data reveals that in May 2023, foreigners have significantly increased their capital outflows from China, reaching staggering levels. The reasons behind this sudden surge in capital flight can be attributed to various factors, including economic uncertainties, regulatory concerns, and geopolitical tensions. These concerns have spurred foreigners to seek alternative investment avenues, with Bitcoin emerging as a frontrunner in this new investment landscape.

Bitcoin

A Safe Haven Amidst Turbulence

In times of uncertainty, investors often turn to safe-haven assets to protect their wealth and preserve its value. Traditionally, gold has been the go-to option during turbulent periods. However, the emergence of cryptocurrencies, particularly Bitcoin, has introduced a new dimension to the concept of safe-haven investments. Bitcoin’s decentralized nature, limited supply, and potential for long-term growth make it an appealing choice for investors seeking shelter from the storm.

Bitcoin’s Growing Popularity

The increased interest in Bitcoin as an investment option is not solely driven by capital flight from China but also by its growing popularity worldwide. Over the years, Bitcoin has evolved from an obscure digital currency to a recognized and widely adopted asset class. Its acceptance as a means of payment by major companies and institutions, coupled with the endorsement of influential figures and celebrities, has catapulted Bitcoin into the mainstream.

Market Volatility and Bitcoin’s Appeal

Bitcoin’s meteoric rise in value over the past decade has not been without its fair share of volatility. The cryptocurrency market, including Bitcoin, is infamous for its price swings, which can be both a blessing and a curse for investors. While volatility can lead to substantial gains, it also carries inherent risks. However, as traditional markets face uncertainties, some investors view Bitcoin’s volatility as an opportunity rather than a deterrent. They see the potential for significant returns and are willing to weather the storm in pursuit of substantial profits.

The Future of Bitcoin

As we navigate through a rapidly changing financial landscape, the future of Bitcoin remains uncertain yet promising. While regulatory challenges and market fluctuations pose risks, Bitcoin continues to attract investors seeking diversification, decentralization, and potential long-term growth. Its increasing adoption and the technological advancements that underpin it further solidify its position as a transformative force in the world of finance.

Bitcoin’s rise in popularity as foreigners pull more money out of China highlights the shifting dynamics of global investment. As economic uncertainties and regulatory concerns loom large, investors are actively seeking alternative options to safeguard their wealth. Bitcoin’s decentralized nature, limited supply, and potential for substantial gains make it an enticing choice for those in search of a safe haven amidst the storm. With the future of traditional markets uncertain, Bitcoin’s journey is one to watch closely as it continues to redefine the global financial landscape.

Unveiling the Road Ahead: Bitcoin’s Fate in the Face of Regulation and Adoption

Amidst the changing tides of the global financial arena, Bitcoin has emerged as a transformative force, captivating the attention of investors worldwide. However, as governments scramble to regulate and adapt to this evolving digital landscape, one burning question remains: Will Bitcoin’s meteoric rise be sustained, or will it face challenges that could potentially alter its trajectory? Join us in the next article as we explore the regulatory.

More form Live Trading News!

KXCO Building the Markets of the Future