RealX vs. Private Real Estate Investment

Here is summary of why we think that RealX are far better investment than rental properties in most cases, and then secondly, we want to emphasize why this is especially true today.

RealX Vs. Rental Properties: Why RealX Wins

To make it short: RealX offers higher returns with lower risk and less effort in the vast majority of cases.

Let’s break this down:

Everyone seems to think that rental properties are more rewarding investments, likely because they heard some gurus on YouTube trying to hype up the returns of rentals (all while selling you a course on how to invest in them, of course!).

But here is why this result is completely normal and even expected. RealX IS a real estate investment, and so it does offer the exact same benefits of cash flow, leverage, appreciation, tax benefits, etc. But RealX also enjoys additional advantages:

- RealX enjoys huge economies of scale in management costs. RealX only has a management cost of about 0.3% of assets each year. The management cost of private properties is close to triple that.

- RealX also saves costs on all other fronts: negotiating with contractors, brokers, insurance, banks, building materials, agents etc.

- RealX has better bargaining power with their tenants because of their scale, expertise, and relationships. This allows them to push for bigger rent hikes.

- RealX can skip all brokerage expenses by going directly to property buyers and renters.

- RealX developed their own properties from the ground up to earn even higher returns.

- And many more reasons… RealX is managed by real property experts.

So it really isn’t surprising that RealX would generate higher returns than rental properties. Both are real estate investments, but the RealX structure provides additional benefits that reduce costs and boost upside.

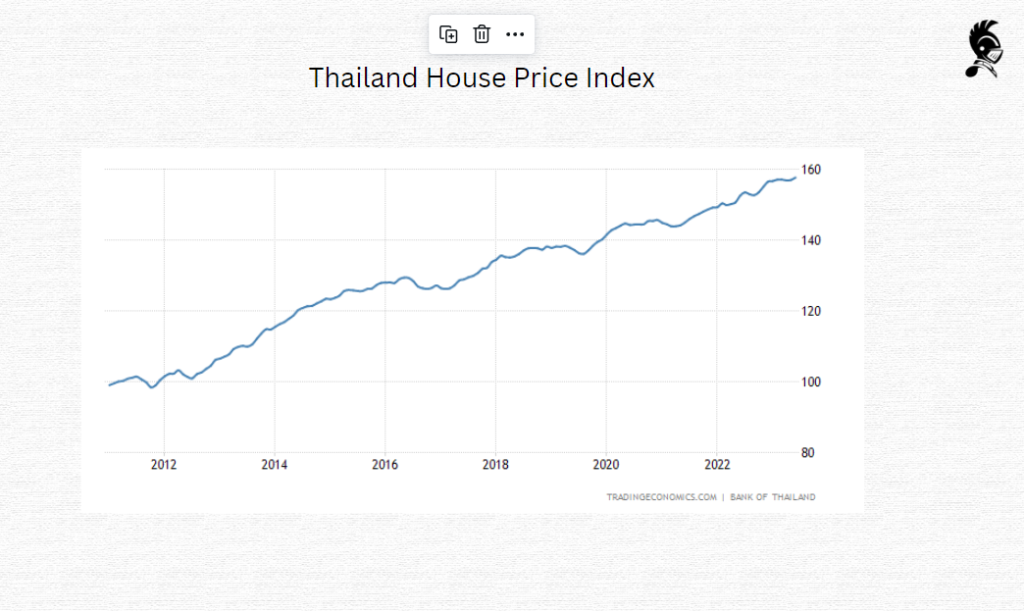

| Year | GDP growth rate (% ) | Average property price (THB per square meter) |

| 2010 | 7.8 | 116,000 |

| 2011 | 8.7 | 130,000 12.07% |

| 2012 | 6.0 | 145,000 25.00% |

| 2013 | 3.6 | 160,000 37.93% |

| 2014 | 2.9 | 175,000 50.86% |

| 2015 | 2.8 | 190,000 63.79% |

| 2016 | 3.2 | 205,000 76.72% |

| 2017 | 3.8 | 220,000 89.66% |

| 2018 | 4.2 | 235,000 102.59% |

| 2019 | 2.4 | 250,000 115.52% |

| 2020 | -6.1 | 260,000 124.14% |

| 2021 | 1.6 | 275,000 137.07% |

| 2022 | 3.2 | 290,000 150.00% |

Lower risk:

RealX is not just more rewarding, they are also a lot safer investments.

A rental property is a private, illiquid, concentrated, highly leveraged, people-facing, management-intensive, and liability-filled investment.

RealX is a public, liquid, diversified, professionally-managed investment that enjoys limited liability.

Even then, some investors will mistakenly think that RealX is riskier because of the volatility of public markets. What they ignore is that rental properties are far more volatile. They just don’t see a daily quote and so they get a false sense of safety. But assuming that you financed your property with 20% equity and tried to sell it on a daily basis, then a 5% lower offer price would result in a 25% drop in your equity value. A 10% lower offer price would cut your equity value in half. This shows you that rental properties are extremely volatile and risky when compared to RealX.

Less effort:

Best of all, RealX is totally passive. You have the best talent in the real estate world working for you, and despite them being paid, it is all very cost-efficient because RealX enjoys huge economies of scale.

This is an important advantage because it allows you to focus on your career or business, which is your primary source of income. It will give you back all the time you would have lost managing rental properties (a huge distraction!).

This is an underrated advantage that people tend to forget in this RealX vs. Rental debate. If your career or business earns you decent money, then why would you waste your valuable time managing rentals, when you could instead focus on maximizing what you can get from your career or business and invest in RealX instead?

It is just not logical. Rentals will earn you lower returns with more risk and much greater effort in most cases.

RealX Vs. Rental Properties: Why TODAY Especially RealX Are Far Better Investments

For the reasons that I explained earlier, I think that RealX make much more sense than rental properties in most cases.

And this is especially true today because of three key reasons:

RealX allows you to invest in real estate at a lower valuation

Today, RealX is priced at the low end of valuations.

Why would you try to buy private real estate when you are presented with such an exceptional deal in the public RealX market?

RealX give you access to a big pool of potential opportunities

The RealX portfolio is vast and versatile.

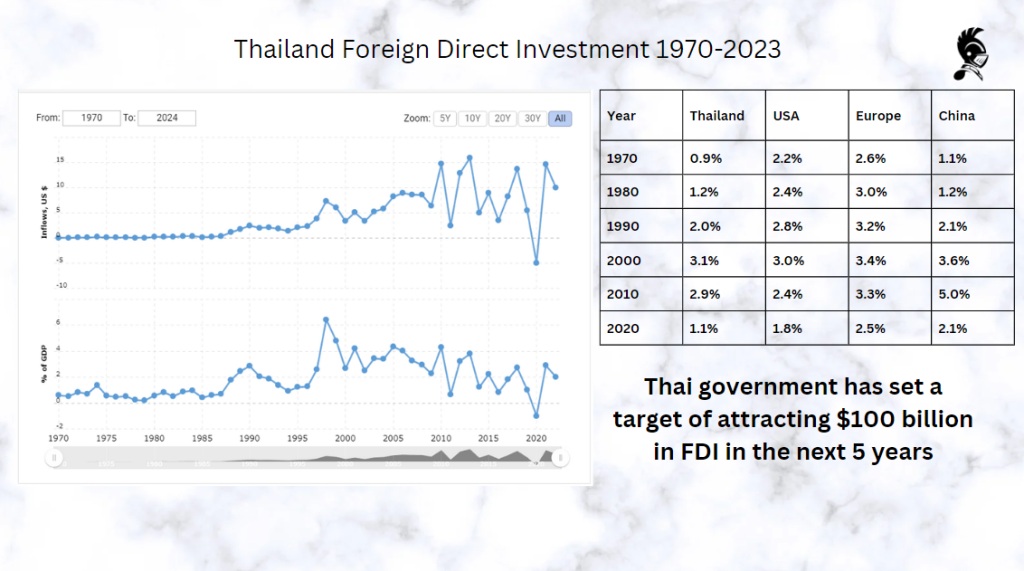

RealX investors invest in prime property in the fast growing Bangkok market.