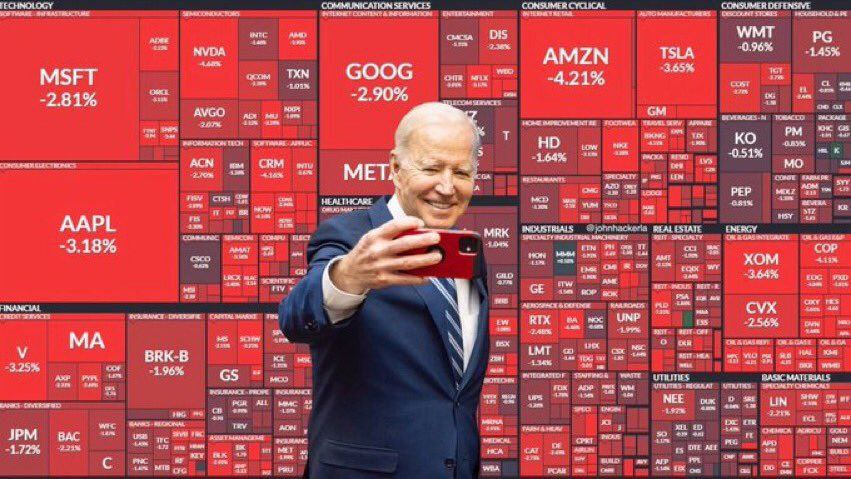

The Fed has raised its benchmark lending rate 11 times over the past 18 months to a level not seen for 22 years as it grapples with inflation still stubbornly above its long-run target of two percent.

After rapidly raising interest rates last year, the Fed slowed down the pace of its hikes over the summer, holding rates steady in June and then raising them by just 25 basis points in July.

Traders currently put the chances of a September pause at more than 90 percent, according to data from CME Group.

– Skip ‘could be appropriate’ –

“Another skip could be appropriate when we meet later this month,” Dallas Fed President Lorie Logan told a conference in Dallas on Thursday, according to prepared remarks.

“But skipping does not imply stopping,” she continued, adding that “further evaluation of the data and outlook could confirm that we need to do more to extinguish inflation.”

The Fed should keep the “water bucket” of future interest rate hikes close at hand in case inflation returns, and “must not hesitate to use it as necessary,” she said.

Logan’s support for a possible September pause echoes comments from Fed Governor Christopher Waller earlier this week in which he suggested that data showing a weakening jobs market meant the Fed should “proceed carefully.”

“There’s nothing that is saying we need to do anything imminent anytime soon, so we can just sit there, wait for the data, see if things continue,” he told CNBC on Tuesday.

“The Fed talking too much can be counterproductive. It can create uncertainty and volatility in financial markets, and it can make it more difficult for the Fed to achieve its policy goals.”

Shayne Heffernan

– Rates in ‘good place’-

New York Fed President John Williams was less direct than Logan in an interview with Bloomberg on Thursday.

“I think we’ve gotten monetary policy in a very good place in terms of we have a restrictive stance of policy,” he said.

The Fed’s interest rate hikes are having “the desired effects of bringing demand and supply more into balance,” he continued, adding that inflation was “moving in the right direction.”

But Williams did not explicitly say if he favored raising or holding interest rates, and urged the Fed to “keep watching the data carefully, analyzing all of that and really asking ourselves the question, is this sufficiently restrictive?”

– The ‘golden path’ –

Chicago Fed President Austan Goolsbee struck a more optimistic tone than both Logan and Williams in an interview with APM’s Marketplace.

“I believe there is a golden path opportunity that is unusual, in recent modern Fed history, to be able to get inflation down without having a recession,” he said.

Analysts have raised the chances of the Fed successfully cutting inflation while avoiding recession, which is also known as a “soft landing.”

“If you look at expectations in the marketplace, there’s a growing confidence that we can pull it off,” Goolsbee said, adding that it hinged on the Fed “remaining attentive to the data.”

Earlier this week, the Fed said robust tourism spending was helping to keep the wheels of the world’s largest economy turning.

But it warned that consumers were dipping into dwindling pandemic-era savings — and even taking on more debt — to make ends meet.

As is customary, Fed officials will cease making public statements on interest rate policy after this weekend, ahead of the next rate decision on September 19-20.

After that meeting, the Fed will publish updated economic predictions, which will reveal how high policymakers think interest rates will need to go, and for how long they will have to stay there, to bring down inflation.

Shayne Heffernan