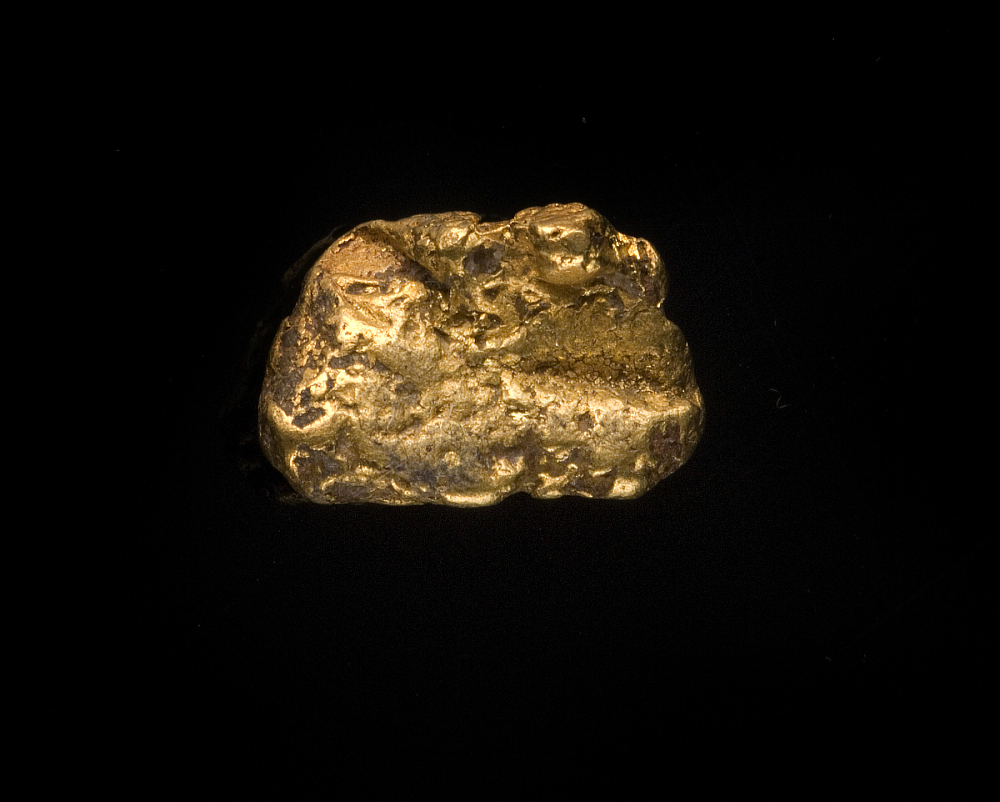

Gold has long been regarded as a symbol of wealth and a safe-haven asset, capturing the fascination of investors for centuries. While gold itself is a prized commodity, the spotlight is increasingly turning to gold miners as investment opportunities. In this article, we explore the historical outperformance of gold miners compared to gold, shedding light on the reasons behind this phenomenon and highlighting some of the world’s top gold mining companies.

- The Historical Outperformance: Investors keen on precious metals often find themselves contemplating whether to invest directly in physical gold or explore the world of gold mining stocks. Surprisingly, historical data indicates that gold miners have consistently outperformed the precious metal they extract. Understanding this trend requires a closer look at the dynamics of the gold mining industry.

- Market Dynamics and Leverage: Gold mining stocks often exhibit a higher level of volatility compared to the underlying commodity. This volatility can work in favor of investors, providing enhanced returns during bull markets. The leverage inherent in gold mining stocks stems from factors such as operational efficiency, exploration success, and overall profitability, which can amplify gains in favorable market conditions.

- Operating Margins and Profitability: Unlike gold itself, gold miners operate as businesses with associated costs and profit margins. When the price of gold rises, the impact on a mining company’s bottom line can be substantial. Higher gold prices translate into increased revenues and, potentially, higher profitability for gold mining companies.

- Exploration Success and Reserves: The success of exploration activities significantly influences the performance of gold miners. Companies that discover new gold deposits or increase their reserves often experience positive market reactions. Investors closely monitor a mining company’s ability to expand its resource base, viewing it as a key indicator of future growth potential.

- Top Gold Mining Companies: Among the world’s leading gold miners, several companies stand out for their scale, operational efficiency, and exploration success. Notable names in the industry include:

- Barrick Gold Corporation (NYSE: GOLD): A global leader in gold mining, Barrick Gold has a diversified portfolio of mines and projects across various countries.

- Newmont Corporation (NYSE: NEM): With a history dating back to 1921, Newmont is one of the world’s largest gold mining companies, known for its commitment to sustainability.

- AngloGold Ashanti Limited (NYSE: AU): Headquartered in South Africa, AngloGold Ashanti operates in key gold-producing regions, contributing significantly to the global gold supply.

- Newcrest Mining Limited (ASX: NCM): As Australia’s largest gold producer, Newcrest Mining plays a pivotal role in the Asia-Pacific gold mining landscape.

- Cautions and Considerations: While the potential for higher returns exists, it’s essential for investors to recognize the risks associated with gold mining stocks. Factors such as operational challenges, geopolitical risks, and fluctuations in production costs can impact the performance of mining companies.

Conclusion:

Gold miners, with their operational dynamics and market leverage, have historically presented an intriguing investment avenue for those eyeing exposure to the precious metal sector. As investors navigate the complexities of the market, understanding the historical outperformance of gold miners becomes a valuable tool for informed decision-making. With a careful eye on both opportunities and risks, investors can explore the golden realm of gold mining stocks as a complement or alternative to direct gold investments.

Shayne Heffernan