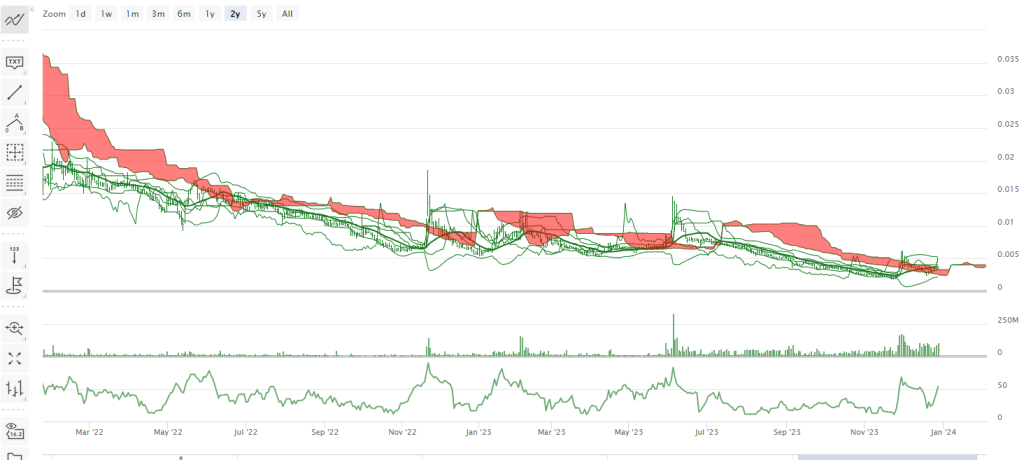

Amidst the volatile tech landscape, one stock is generating buzz for its sky-high short interest: AITX, an Arizona-based company specializing in artificial intelligence (AI) security solutions. With a whopping 79% short interest by our estimates, AITX has become a magnet for both short sellers betting on its decline and bullish investors eyeing a potential short squeeze.

So, what’s behind the sizzle?

AITX offers a suite of AI-powered security robots and software designed for various applications, including perimeter security, access control, and anomaly detection. These robots, like the Romi and ROSA, patrol autonomously, providing intelligent surveillance that traditional cameras lack.

While the company boasts promising technology and partnerships with Fortune 500 companies, it remains early-stage, with limited revenue and significant losses. This volatility has attracted short sellers who believe the stock price is inflated and poised for a fall.

But here’s where the heat intensifies with the short squeeze potential:

- High Short Interest: With around half of the outstanding shares shorted, a significant catalyst could trigger a rapid buying frenzy from squeezed short sellers.

- Low Float: AITX has a relatively small float (shares readily available for trading), amplifying the potential impact of any buying surge.

- Positive News Flow: Recent contract wins and partnerships, like the deployment of ROSA with the U.S. Air Force, could fuel investor optimism and drive the price higher.

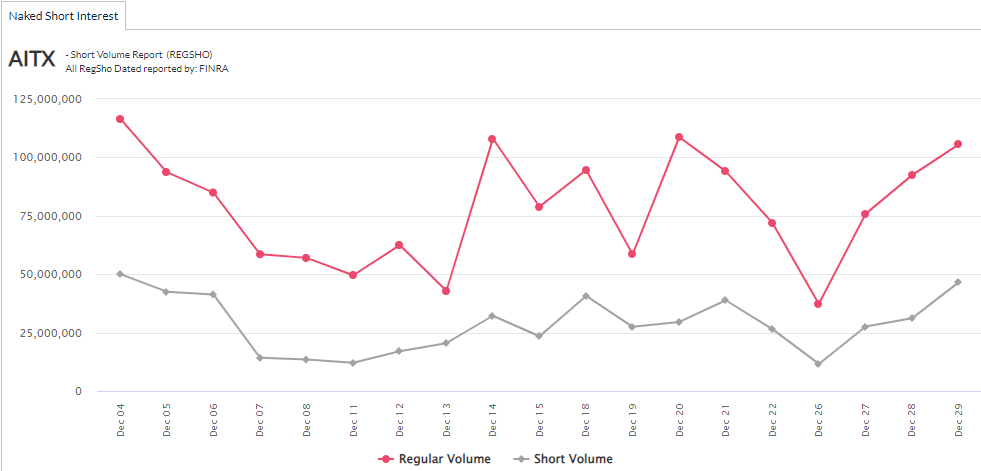

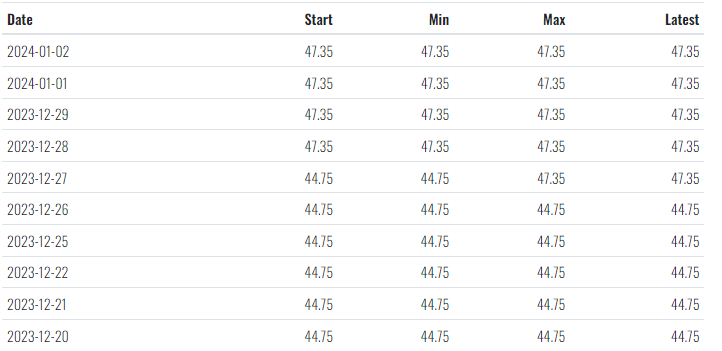

Short Borrow Fee Rates Increasing

However, before diving headfirst into the fire, remember:

- Short squeezes are risky and unpredictable: While the potential for dramatic gains exists, the opposite can also happen, leading to significant losses.

- AITX is a volatile stock: High short interest alone doesn’t guarantee a squeeze, and the company’s fundamentals remain relatively weak.

- Do your own research: Carefully analyze AITX’s financials, technology, and market potential before making any investment decisions.

AITX is an innovator in the delivery of artificial intelligence-based solutions that empower organizations to gain new insight, solve complex challenges and fuel new business ideas. Through its next-generation robotic product offerings, AITX’s RAD, RAD-M and RAD-G companies help organizations streamline operations, increase ROI, and strengthen business. AITX technology improves the simplicity and economics of patrolling and guard services and allows experienced personnel to focus on more strategic tasks. Customers augment the capabilities of existing staff and gain higher levels of situational awareness, all at drastically reduced cost. AITX solutions are well suited for use in multiple industries such as enterprises, government, transportation, critical infrastructure, education, and healthcare. To learn more, visit www.aitx.ai, www.radsecurity.com, www.stevereinharz.com, www.radgroup.ai, www.raddog.ai, and www.radlightmyway.com, or follow Steve Reinharz on Twitter @SteveReinharz.

Looking ahead, AITX remains a hot stock with both high short interest and squeeze potential. But remember, venturing into this fiery realm requires a cool head, informed decisions, and a healthy dose of risk tolerance.