China Gold: China’s economic recovery in 2023 faced hurdles, marked by consumer caution and disappointing performance in major local assets. However, amidst the turbulence, gold emerged as a shining star.

The Shanghai Gold Benchmark Price PM (SHAUPM) in RMB witnessed a remarkable 17% surge, outperforming other significant local assets. Gold withdrawals from the Shanghai Gold Exchange (SGE) recorded a notable 7% YoY increase, totaling 1,687t. Chinese gold ETFs attracted a substantial RMB5bn (US$654mn) in 2023, reaching an all-time high AUM of RMB29bn (US$4bn), with holdings increasing to 62t.

Economic Resilience and China Gold

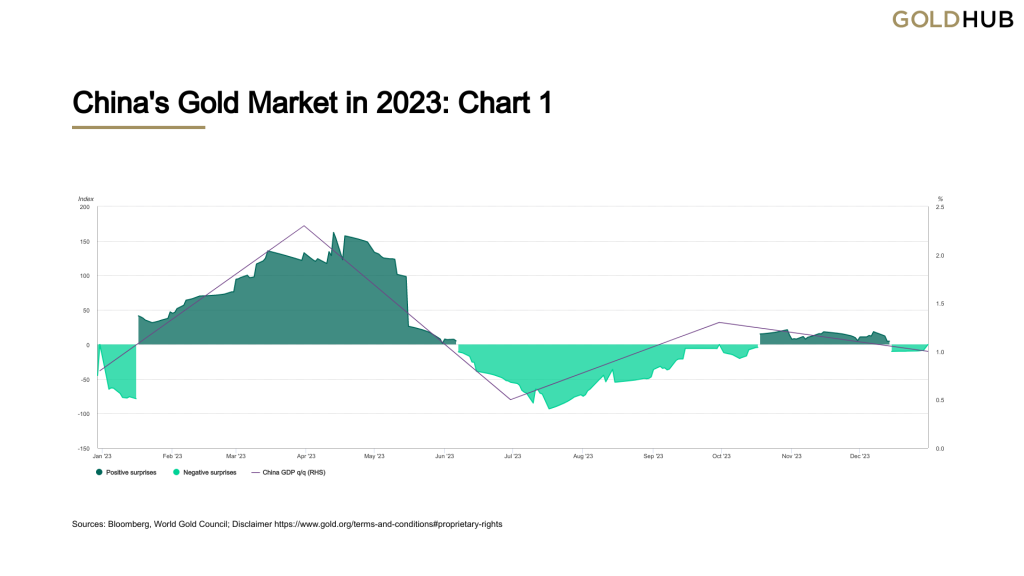

China’s economic resurgence, depicted in Chart 1 by the Citi China Economic Surprise Index and China GDP q/q, experienced turbulence throughout 2023. The drop in COVID-related restrictions at the end of 2022 initially fueled growth, but momentum waned in Q2 and Q3, with a mild improvement in Q4 pushing the annual GDP growth to 5.2%, surpassing the 5% target. Consumer reluctance to spend, evident in Chart 2 showcasing household savings growth outpacing loans, contributed to economic volatility.

The long shadow of the COVID pandemic lingered in 2023, impacting domestic consumption, which was weaker than expected. Other factors, including a housing sector slowdown and monetary policy divergence, further influenced the nation’s economic trajectory.

China Gold Resilience and Performance

In contrast to economic challenges, gold proved resilient, delivering a 14% return in USD and a 17% rise in SHAUPM in 2023. Chart 3 illustrates gold’s outperformance compared to major local assets. Wholesale gold demand rebounded, with Chart 4 depicting 2023’s 7% YoY increase in gold withdrawals from the SGE. Gold garnered extensive media coverage in 2023, supported by its outstanding performance and central bank purchases. The ongoing innovation in gold jewelry and its role as a value-preserving asset contributed to increased demand.

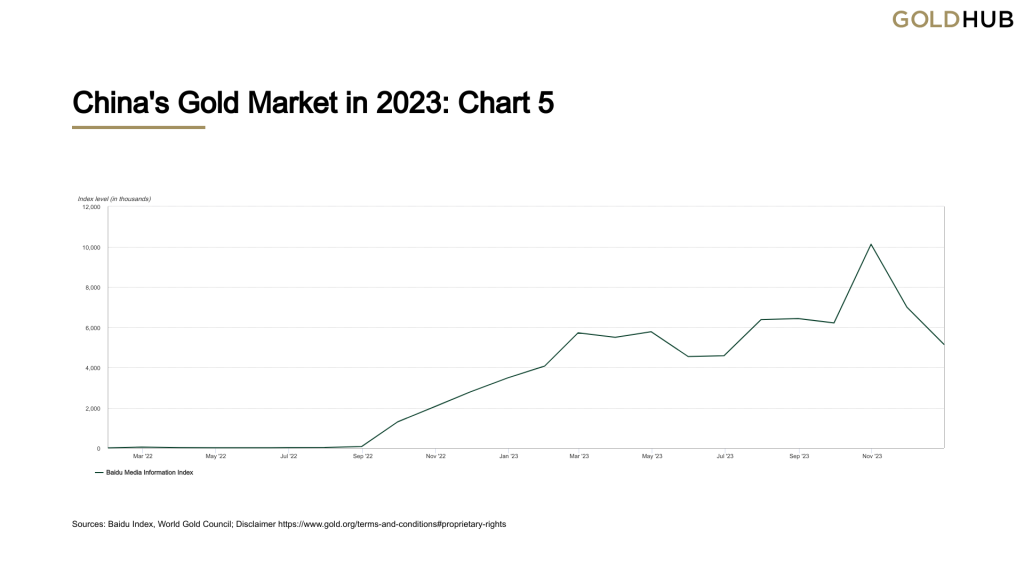

Chart 5 reflects gold’s widespread coverage in 2023, measured by Baidu Media Information Index. Despite a 3% decrease in wholesale demand compared to 2021, Chinese gold ETFs led global inflows, attracting RMB5bn. The People’s Bank of China’s continuous gold purchases resulted in a 225t increase in gold reserves, reaching 2,235t by year-end.

Gold Price Premium and Outlook

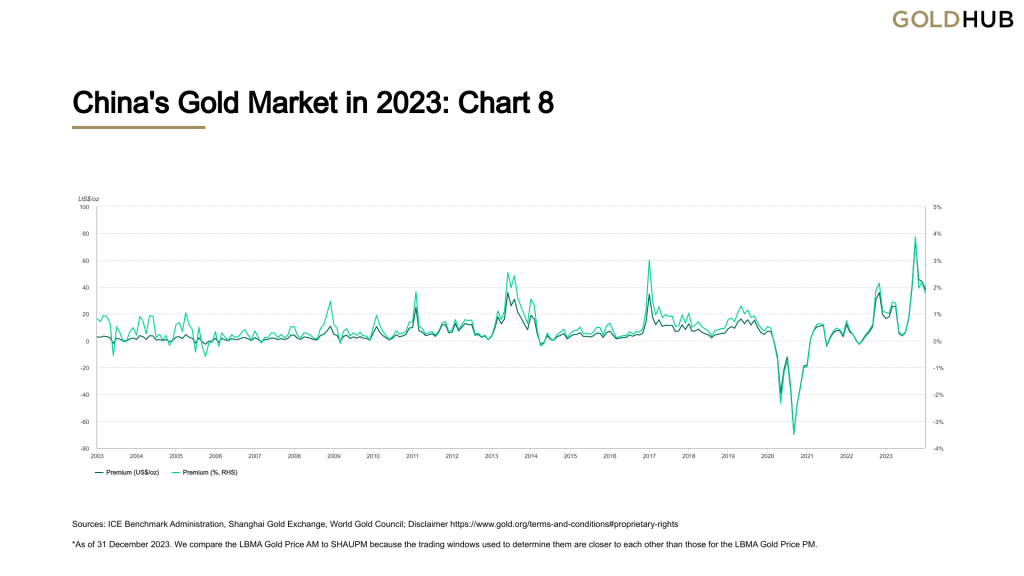

The local gold price premium reached unprecedented levels in 2023, as depicted in Chart 8. An annual average of US$29/oz and a peak of US$121/oz in September highlighted gold’s resilience. Despite economic challenges, gold’s robust performance, central bank purchases, and rising demand from households positioned it as a safe-haven asset. The outlook remains positive, supported by ongoing innovation, economic uncertainties, and sustained efforts from gold ETF providers.

China’s Golden Touch: A Journey Through Past, Present, and Future

For centuries, gold has held a special place in Chinese culture, symbolizing wealth, power, and prosperity. This fascination isn’t just historical; China has emerged as a global powerhouse in the gold market, wielding significant influence on both prices and trends. Let’s embark on a journey through China’s golden journey, exploring its past, present, and the gleaming possibilities of its future.

From Ancient Roots to Modern Market:

China’s love affair with gold dates back millennia. Its early use in coins and ornaments evolved into a sophisticated system of goldsmithing and jewelry production. However, the modern Chinese gold market, as we know it, began to take shape after the Cultural Revolution, with initial reforms in the late 1970s. The establishment of the Shanghai Gold Exchange (SGE) in 2002 was a pivotal moment, providing a regulated platform for gold trading and setting China on a path to becoming a major player in the global market.

The Chinese Golden Giant:

Today, China holds the crown as the world’s largest consumer of gold, fueled by a growing middle class with an appetite for investment and luxury goods. Its gold reserves, estimated to be the second largest in the world, add further weight to its influence. The SGE has also blossomed into a significant force, handling a substantial portion of global gold trading and setting regional gold prices.

Impact of the Shanghai Gold Exchange:

The SGE plays a crucial role in the Chinese gold market, impacting both domestic and international prices. Its gold futures contracts offer hedging opportunities for businesses and investors, promoting transparency and price discovery. Additionally, the SGE’s gold benchmarks influence regional pricing, particularly in neighboring Asian markets.

Looking Ahead: A Golden Horizon:

China’s gold market is poised for continued growth, driven by several factors:

- Rising wealth: The expanding middle class is expected to fuel further demand for gold as a store of value and investment asset.

- Internationalization: China’s increasing role in global finance could lead to the internationalization of the yuan and potentially the SGE, further boosting its influence.

- Technological innovation: Blockchain and other fintech developments could revolutionize gold trading, making it more accessible and efficient.

However, challenges remain. Concerns about economic slowdown and potential financial instability could dampen demand. Additionally, regulatory hurdles might hinder the internationalization of the yuan and the SGE.

China’s golden journey is far from over. Its historical fascination with the precious metal has translated into a dominant market position today, and its future trajectory holds significant implications for the global gold landscape. Whether the SGE becomes a truly global gold hub and China surpasses its current economic challenges, its golden touch will undoubtedly continue to shape the world’s fascination with this timeless treasure.

The Golden Pillar: China’s Central Bank and its Strategic Embrace of Gold

China’s central bank, the People’s Bank of China (PBOC), holds a significant amount of gold in its foreign exchange reserves, making it a vital player in the global gold market. Understanding the role of gold in the PBOC’s strategy requires exploring multiple factors:

Safe Haven and Portfolio Diversification:

Gold has traditionally served as a safe haven asset, holding its value during times of economic turmoil. For the PBOC, this characteristic helps diversify its reserves and hedge against potential risks in global financial markets. The stability of gold provides a counterpoint to volatile currencies and protects against inflation.

Geopolitical Considerations:

The US dollar, the dominant reserve currency, holds significant political implications for China. Increasing its gold holdings allows the PBOC to potentially reduce its reliance on the dollar and diversify its exposure to geopolitical tensions. This move strengthens China’s economic independence and provides greater flexibility in managing its financial affairs.

Domestic Market Development:

China’s domestic gold market is booming, and the PBOC’s gold holdings can have a positive impact on its development. By accumulating gold, the PBOC signals confidence in the metal’s value and potentially strengthens the yuan-gold link, fostering a more vibrant domestic gold market and promoting financial stability.

Future Aspirations:

China’s growing economic clout and ambition for a more prominent role in international finance might fuel further gold accumulation by the PBOC. Gold could play a crucial role in the internationalization of the yuan, potentially giving China more influence in setting global financial standards.

Challenges and Considerations:

While gold offers considerable advantages, the PBOC’s strategy isn’t without challenges. Holding a large amount of gold can be an illiquid investment, meaning it takes longer to convert into cash compared to other assets. Additionally, gold prices can fluctuate, potentially impacting the value of the PBOC’s reserves.

Looking Ahead:

The PBOC’s gold strategy is likely to evolve as China navigates a complex global economic and political landscape. Balancing the long-term benefits of gold with its drawbacks will be crucial. Whether China further increases its gold holdings and how it utilizes gold to achieve its economic goals will be significant developments to watch in the coming years.

Chinese corporations view gold with a mixture of fascination and pragmatism, driven by several factors:

Safe Haven and Investment:

- Similar to the central bank, corporations see gold as a safe haven asset, particularly during times of economic uncertainty. It can act as a hedge against volatility in other parts of their portfolio, protecting their value and ensuring liquidity.

- Gold’s long-term appreciation makes it an attractive investment, especially for companies with large cash reserves who seek stable returns over the long term.

Strategic Reserves and Brand Building:

- Some corporations, particularly those in luxury or technology sectors, view gold as a strategic reserve. Holding significant gold reserves can enhance their brand image, portraying them as stable and financially robust, leading to greater investor confidence and potential business opportunities.

Industrial Applications:

- While not the primary driver, gold also has several industrial applications in sectors like electronics, medicine, and aerospace. Companies working in these sectors may view gold as a necessary input for their production processes, adding another layer of interest to the precious metal.

Challenges and Considerations:

- Fluctuating gold prices can pose risks for corporations, potentially leading to losses if they sell when prices are low.

- Storing and managing large quantities of gold requires secure facilities and specialized expertise, adding to operational costs.

- Regulatory limitations can also impact how corporations can invest in and utilize gold, requiring careful consideration and adherence to compliance guidelines.

Overall, Chinese corporations’ views on gold are nuanced and multifaceted. While some prioritize its investment potential and safe haven qualities, others see it as a strategic asset or even an essential industrial input. Understanding the specific motivations and challenges faced by individual corporations is crucial to accurately gauge their perspective on gold.

Shayne Heffernan