China’s Central Bank Boosts Gold Reserves: Strategic Moves in Global Economic Chess

In a strategic move with potential implications for the global economic landscape, China’s central bank has increased its gold reserves, signaling a commitment to diversifying its assets and fortifying its position in the international financial arena. This move, shrouded in geopolitical and economic considerations, has caught the attention of analysts and investors alike.

Diversification Strategy: China’s decision to bolster its gold reserves aligns with a broader strategy of diversifying its foreign exchange holdings. Gold, often considered a safe-haven asset, provides a hedge against currency volatility and economic uncertainties. By increasing its gold reserves, China aims to enhance the resilience and stability of its financial portfolio amid a complex global economic environment.

Geopolitical Considerations: The move comes at a time of heightened geopolitical tensions, with various economic powerhouses reassessing their financial strategies. China’s decision to increase gold reserves may be seen as a response to the evolving dynamics in international relations and a desire to reduce reliance on traditional currency assets.

Global Economic Landscape: China’s influence in the global economic landscape has been steadily growing, and the decision to bolster gold reserves adds another layer to its economic prowess. As one of the largest holders of foreign exchange reserves, China’s moves in the gold market can have cascading effects on global commodity prices and impact the strategies of other central banks.

Gold as a Safe-Haven Asset: Gold has long been considered a safe-haven asset, sought after in times of economic uncertainty. By increasing its gold reserves, China positions itself to weather potential storms in the global economy, ensuring a degree of stability in its financial holdings.

Market Reactions and Speculations: News of China’s central bank buying gold has triggered speculations and discussions among market observers. Analysts are closely watching for potential shifts in gold prices and assessing how other countries may respond to China’s strategic move.

Strategic Long-Term Vision: China’s decision to accumulate gold aligns with its long-term vision of economic stability and global influence. By diversifying its reserves and holding a significant amount of gold, China strengthens its ability to navigate economic challenges and reinforces its position as a key player in the evolving global economic order.

China’s central bank’s move to increase gold reserves reflects a strategic and calculated step in the intricate game of global economics. As the world watches, this development underscores China’s commitment to diversification, resilience, and strategic positioning in the face of an ever-changing international financial landscape. The implications of this move will likely unfold over time, shaping the dynamics of global finance.

Word Gold Council Highlights

- China’s economic recovery in 2023 was not smooth sailing, and consumers remained cautious in spending

- While the performance of major local assets disappointed, the Shanghai Gold Benchmark Price PM (SHAUPM) in RMB, surged by 17% in 2023

- Gold withdrawals from the Shanghai Gold Exchange (SGE) totalled 1,687t in 2023, 7% higher y/y

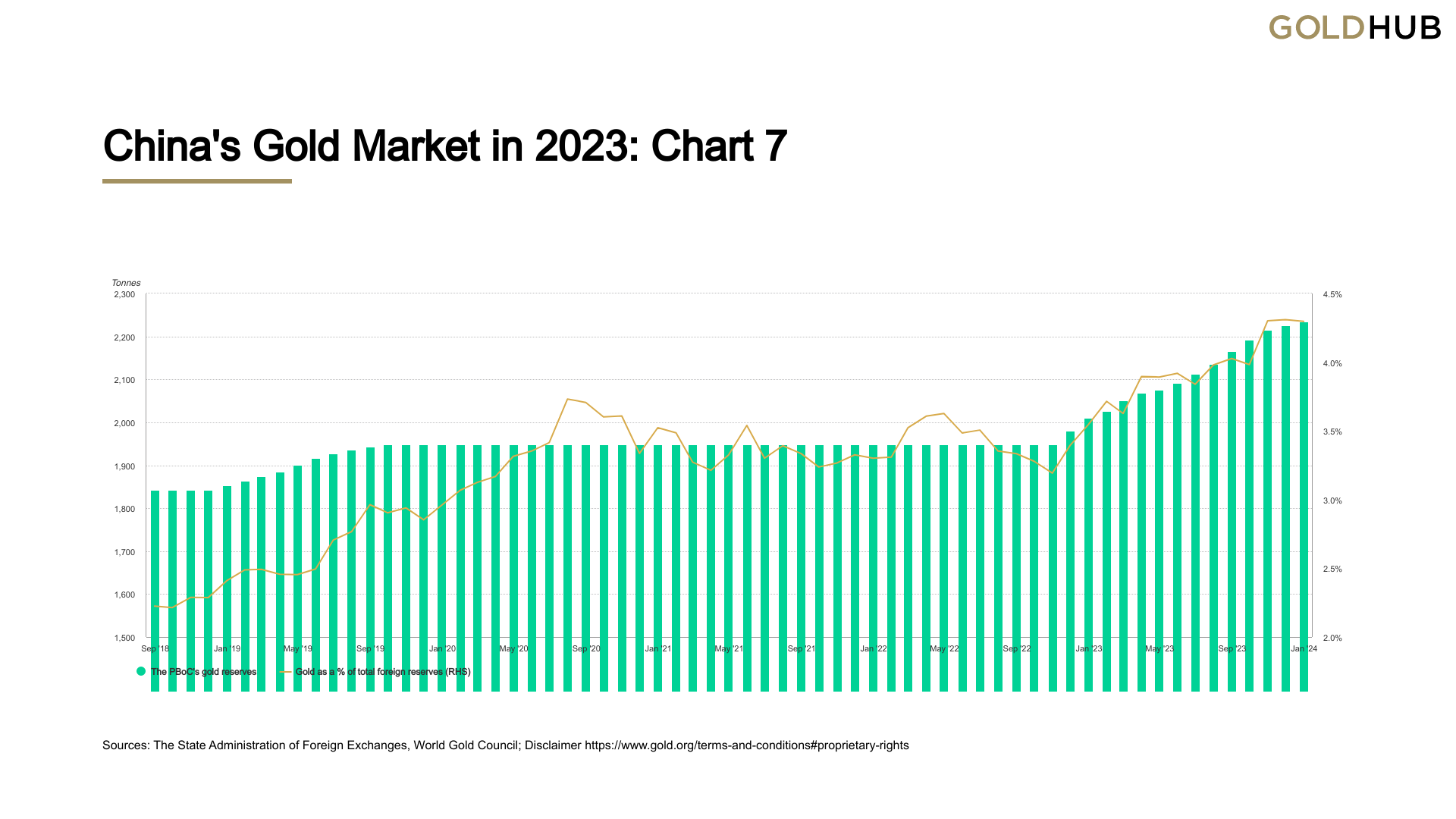

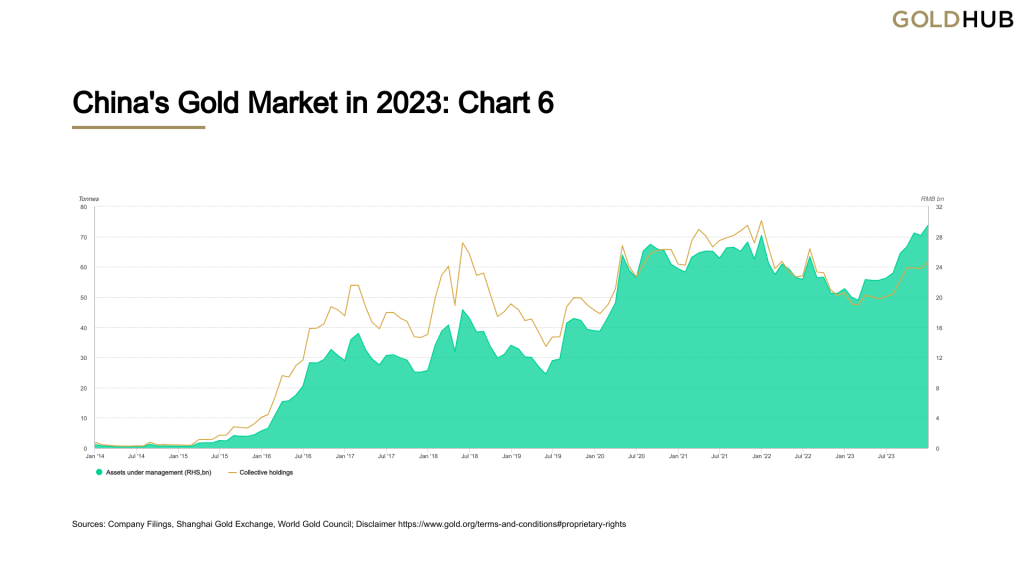

- Chinese gold ETFs attracted RMB5bn (+US$654mn) in 2023 and their total asset under management (AUM) rose to RMB29bn (US$4bn), the highest ever. Holdings increased by 10t to 62t

- The People’s Bank of China (PBoC) has reported non-stop gold purchases in 2023, lifting their gold reserves by 225t to 2,235t by year-end

- As a result of robust gold demand, stable production and falling imports after late 2022, the local gold price premium jumped to unseen levels in 2023

Gold in China: A Glittering Tapestry of Historic Significance

Gold holds a special place in China’s rich cultural and historical tapestry, woven into the fabric of its society and revered for millennia. Beyond its ornamental allure, gold has played a multifaceted role in shaping China’s economy, influencing its dynasties, and serving as a symbol of wealth, power, and prosperity. This article explores the historic importance of gold in Chinese society and government.

Gold’s Cultural Symbolism: In Chinese culture, gold is often associated with good fortune, wealth, and prosperity. The color gold, representing opulence and abundance, has deep-rooted symbolism in various ceremonies, festivals, and traditional rituals. Gold artifacts, from intricate jewelry to ceremonial objects, have adorned the lives of the Chinese people for centuries, serving as tangible representations of status and good fortune.

Historical Use in Chinese Dynasties: Throughout China’s dynastic history, gold played a crucial role in economic and governmental affairs. Emperors and rulers used gold not only for personal adornment but also as a means to establish and display their authority. Gold coins, with inscriptions reflecting the emperor’s reign, were minted and circulated as a form of currency, solidifying gold’s importance in the nation’s economic framework.

Gold as a Store of Value: Across the centuries, gold served as a reliable store of value in times of economic uncertainty. Families often passed down gold jewelry and artifacts as a form of intergenerational wealth, ensuring stability and financial security. The enduring nature of gold made it a trusted asset in times of social upheaval or economic challenges.

Modern Economic Impact: In contemporary China, gold retains its economic significance, and the country has emerged as one of the world’s largest consumers and producers of gold. The government’s decision to increase gold reserves is a strategic move, aligning with the historical reverence for gold as a stable and valuable asset. China’s central bank recognizes gold’s role in diversifying its foreign exchange holdings and ensuring a resilient economic foundation.

Gold’s Spiritual Connection: Beyond its material and economic significance, gold also holds spiritual importance in Chinese philosophy. The concept of alchemy, transforming base metals into gold, symbolizes the pursuit of enlightenment and spiritual transcendence.

Gold’s historic importance in China is a testament to its enduring cultural, economic, and spiritual significance. From the opulent courts of ancient dynasties to the bustling modern economy, gold continues to be intertwined with China’s identity. The recent decision by the central bank to bolster gold reserves reflects not only economic strategy but also a continuation of China’s age-old relationship with this precious metal. In China, gold’s glittering legacy remains an integral part of the nation’s narrative.

The Enduring Significance of Gold in the Modern World

In a world marked by rapid technological advancements and evolving financial landscapes, the enduring allure and importance of gold persist. Beyond its historical and cultural significance, gold plays a multifaceted role in the modern era, serving as a store of value, a diversification asset, and a symbol of stability. This article delves into the various facets of gold’s importance in the contemporary global landscape.

- Financial Stability and Diversification: Gold has long been recognized as a safe-haven asset, particularly during times of economic uncertainty and market volatility. Investors turn to gold as a means of preserving wealth and mitigating risk in their portfolios. Its inverse correlation with other financial assets, like stocks and bonds, makes gold a valuable tool for diversification, helping to maintain stability in investment portfolios.

- Central Bank Reserves: Many central banks around the world, including those of major economies like the United States, Germany, and China, hold significant gold reserves. These reserves provide a solid foundation for a nation’s currency and contribute to its overall economic stability. Central banks strategically accumulate gold as a means of safeguarding against currency devaluation and geopolitical uncertainties.

- Global Economic Indicator: The price of gold is often viewed as a barometer of global economic health. During times of economic distress or geopolitical tension, the demand for gold tends to rise, driving up its price. Conversely, periods of economic stability may see a decrease in gold demand. As such, gold prices can offer insights into the overall sentiment and health of the global economy.

- Industrial Applications: Gold’s unique properties make it indispensable in various industrial applications. Beyond its traditional use in jewelry and ornaments, gold is a critical component in electronics, telecommunications, and medical devices. Its conductivity, corrosion resistance, and biocompatibility make it an ideal material for manufacturing components in these industries.

- Wealth Preservation and Inheritance: Gold continues to serve as a means of preserving wealth across generations. Families often invest in gold, whether in the form of coins, bars, or jewelry, as a tangible asset that can withstand economic fluctuations. Passed down through generations, gold becomes a symbol of heritage and a form of inheritance that transcends the uncertainties of financial markets.

- Cultural Symbolism: The cultural and symbolic importance of gold remains as relevant today as it has throughout history. Gold is synonymous with luxury, success, and prosperity. Its use in prestigious awards, ceremonies, and celebrations underscores its enduring cultural significance in the modern world.

In the midst of technological advancements and shifting economic paradigms, gold stands as a timeless and valuable asset. Its role in preserving wealth, providing stability, and serving as a symbol of enduring value reinforces the continued importance of gold in the modern global landscape. Whether as an investment, an industrial necessity, or a cultural symbol, gold’s significance remains unwavering in an ever-changing world.

Shayne Heffernan