Shayne Heffernan, the founder of Knightsbridge Group, is advising investors to think about purchasing gold given the state of the market and highlighting the continuous increase in gold prices brought on by things like money creation. “The driving force behind gold’s rally is not about to stop,” claims Heffernan. The timing of his proposal is ideal for investors looking to diversify their portfolios, since it coincides with the worldwide initial public offering (IPO) market’s upswing.

In a note to clients Shayne Heffernan said “As a conventional hedge against the depreciation of currency value, gold has been closely linked to the money printing phenomenon for a considerable amount of time. There are worries about inflation and currency devaluation as a result of governments printing more money to boost their economies or cover budget deficits. Investors frequently go to gold during these periods as a store of value and a way to protect wealth. Because there is a limited amount of gold, as opposed to fiat currencies, which may be issued indefinitely, gold is immune to the impacts of inflation. Consequently, gold’s appeal as a safe haven asset endures while central banks undertake previously unheard-of levels of monetary expansion, offering investors a palpable buffer against the dangers of excessive money creation.”

In recent times, the price of gold has soared to new all-time highs, a development that has largely flown under the radar of mainstream financial media. However, beneath the surface, significant shifts are taking place in the dynamics of the gold market. Traditionally considered the ultimate store of value, gold has seen its role evolve over the years, particularly after the US abandoned the gold standard in 1971. Since then, gold has increasingly traded like any other financial asset, with its price largely influenced by Western institutional investors.

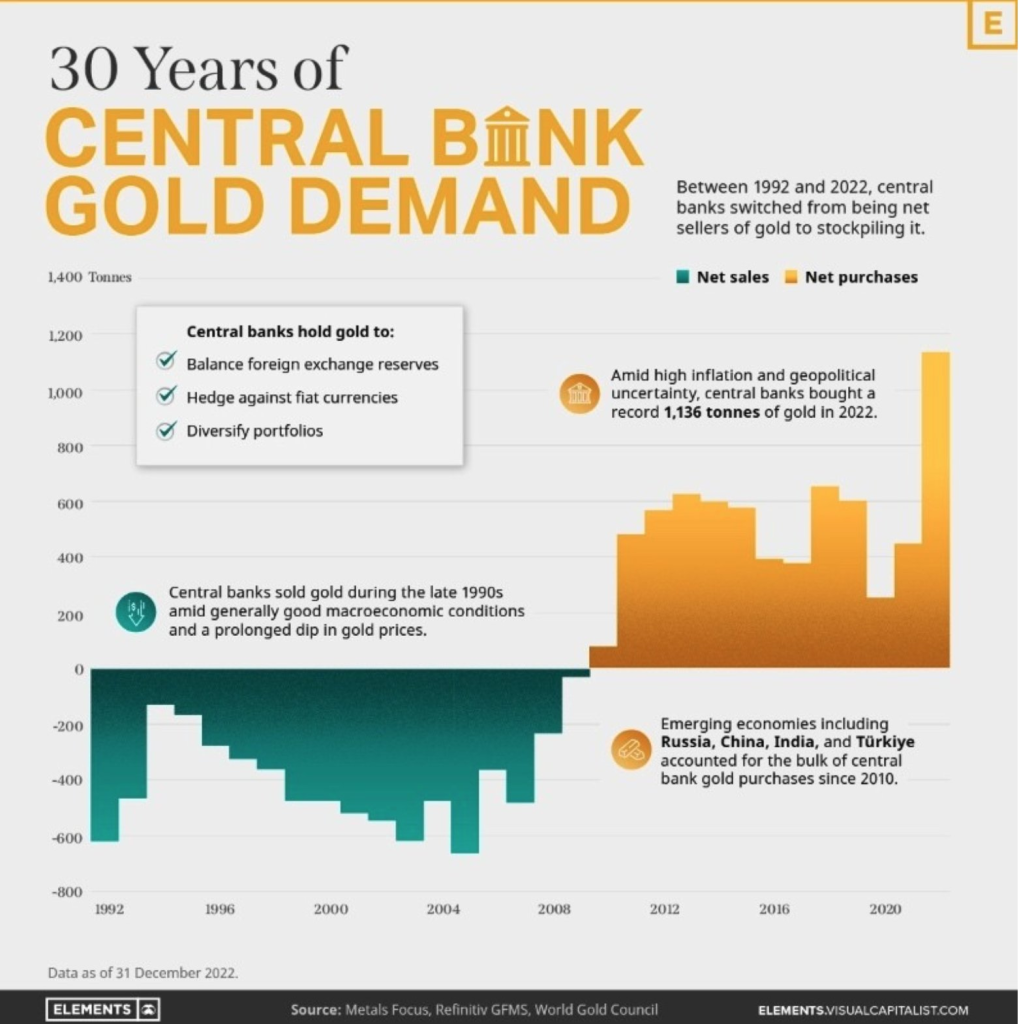

However, this paradigm is now shifting. The correlation between US real rates and gold prices has broken down, signaling a departure from the traditional investment patterns. Despite rising interest rates, gold prices have continued to climb, challenging the conventional wisdom that governs gold trading. Furthermore, central banks, particularly those in the East, have been actively accumulating gold reserves, contributing to the surge in demand for physical gold.

Heffernan underscores the significance of these developments, noting that gold pricing is increasingly being determined by demand for physical gold rather than speculative trading. With central banks and private investors alike stocking up on gold, the precious metal is regaining prominence as a store of value and a means of settlement in global trade. As Western investors continue to offload gold assets, Heffernan warns against underestimating the profound changes underway in the financial landscape, likening the current situation to historical events that have reshaped the world order.

In conclusion, Heffernan’s recommendation to buy gold reflects a growing recognition of the shifting dynamics in the gold market and the broader financial system. As investors navigate the uncertainties of a changing world, gold stands out as a reliable hedge against inflation and currency devaluation, offering stability and value preservation in tumultuous times.