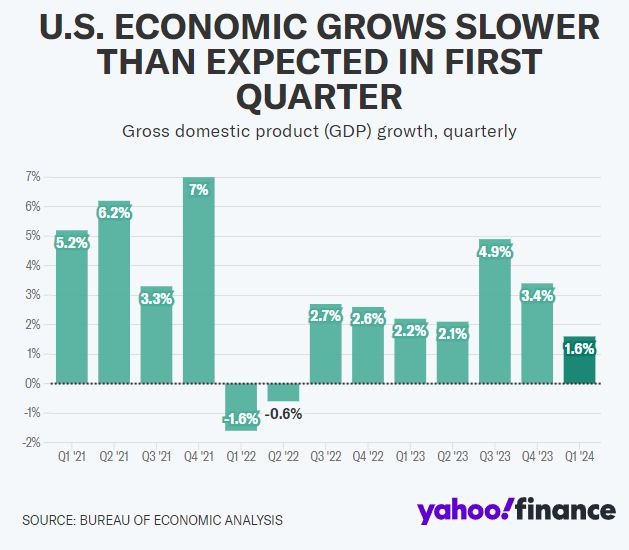

The US economy expanded last quarter at its weakest rate in almost two years as inflation exceeded Wall Street forecasts.

The US economy grew at an annualized pace of 1.6% during the first quarter, according to the Bureau of Economic Analysis’s advance estimate of GDP for the quarter. This was less than the 2.5% growth predicted by experts surveyed by Bloomberg. Compared to the fourth quarter GDP, which was revised up to 3.4%, the estimate was much lower.

In the first quarter, the “core” Personal Consumption Expenditures index—which does not include the volatile food and energy categories—grew by 3.7%, above estimates of 3.4% and surpassing the previous quarter’s 2% growth by a substantial margin.

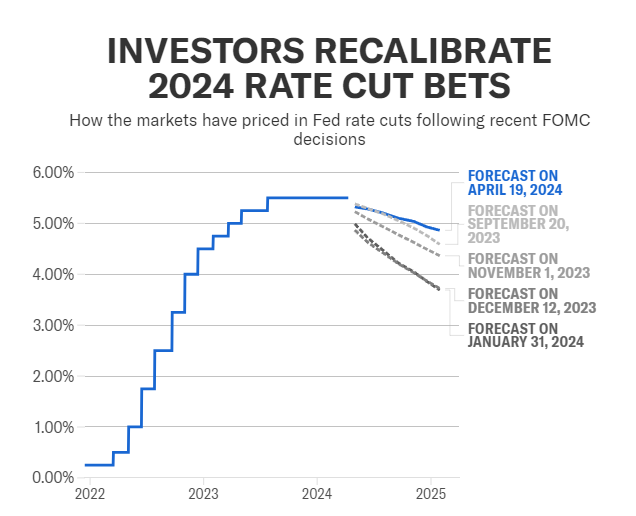

The release of the data coincides with investors’ attempts to predict when the Federal Reserve would begin reducing interest rates and whether the institution can accomplish a “soft landing,” or a reduction in inflation to its objective of 2% without a substantial downturn in the economy.

The false narratives of an economy that is reaccelerating are severely undermined by this study.The underlying growth mix is still showing strong strength as spring approaches, but demand growth is gradually slowing, which is reducing inflationary pressures.

The worse trade and export numbers, which jointly reduced GDP growth for the quarter by roughly 1.2 percentage points, were cited by economists as a major factor in the GDP for the first quarter coming in lower than anticipated.

After gaining over seven basis points, the 10-year Treasury yield (^TNX) rose above 4.7% for the first time since early November 2023. Following the release, the three main indices all fell sharply. The Dow Jones Industrial Average (^DJI), the Nasdaq Composite (^IXIC), and the S&P 500 (^GSPC) all saw morning trade losses of more than 1%.

The Fed’s anticipated rate cuts, which had already been drastically reduced this year from a height of around seven reductions in early January, continued to decline on Thursday. According to Bloomberg data, markets are currently factoring in just one rate reduction this year.

Rewriting the consensus’s expectations for inflation this year has been crucial to this change.

Other parts of the statistics released on Thursday showed that the quarter’s economic growth was not as strong as anticipated. According to the preliminary estimate of the US GDP for the first quarter, the country’s economy expanded at an annualized rate of 1.6%. According to a Bloomberg survey of economists, the US economy expanded at an annualized rate of 2.5% over that time.

The rise in inflation is the most important aspect of Thursday’s deluge of economic data, according to economists, who pointed out that a significant portion of the economic growth slowdown came in erratic categories that might recover in the upcoming quarter.

Numerous analysts have contended that even in the event that the Fed doesn’t lower interest rates this year, the market may nevertheless rise. However, the short-term increase in bond yields is a result of the reduction in interest rate cut expectations. An encouraging indicator for stocks in the present market dynamic has not been rising bond yields.

Shayne Heffernan