AB International Group Corp. is primarily engaged in owning or leasing franchises, patents, and copyrights then in turn licensing others to use. The Company is an intellectual property (IP) and movie, television (TV) show, music, content investment and licensing company. The Company is focused on acquisitions and the development of various intellectual property, including the acquisition and distribution of movies. The Company’s online service is marketed and distributed around the world under the brand name ABQQ.tv. Its service is providing streaming for Chinese movies and TV dramas, which has an online broadcast license. The Company also has the Mount Kisco Movie Theatre. The Company operates through two segments: copyrights and license (IP) segment and the cinema segment.

Recent News

Financial Performance: In the past several months, ABQQ has had inconsistent financial results. Despite a little decrease in revenue from the previous quarter in Q3 2023, the business is still profitable and has a sound balance sheet. Investors will be interested to watch how Agilysys integration and the current attempts at restructuring affect the company’s financial performance going forward.

Financial Information

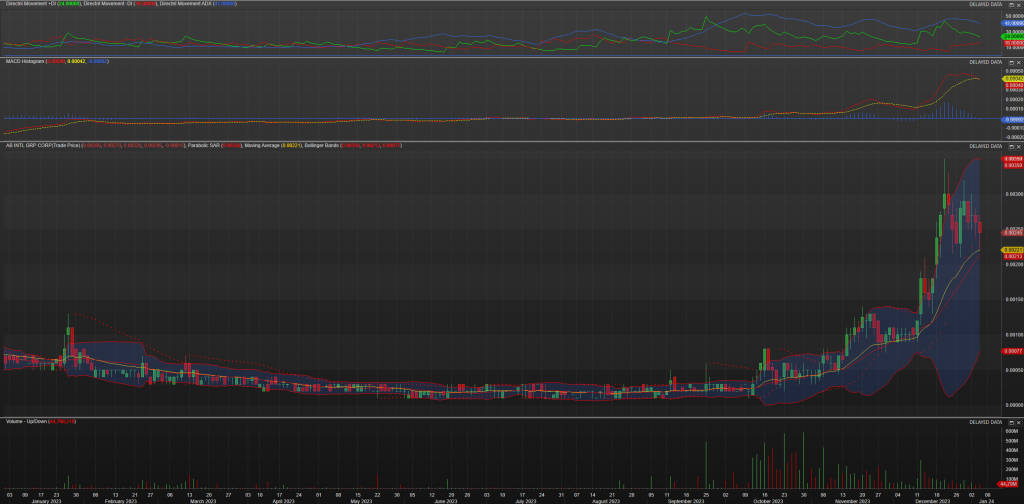

AB INTL GRP CORP(Trade Price) closed down -0.000 at 0.002. Volume was 66% below average (consolidating) and Bollinger Bands were 238% wider than normal.

AB INTL GRP CORP(Trade Price) is currently 375.9% above its 200-period moving average and is in an upward trend. Volatility is relatively normal as compared to the average volatility over the last 10 periods. Our volume indicators reflect moderate flows of volume into ABQQ.PK (mildly bullish). Our trend forecasting oscillators are currently bullish on ABQQ.PK and have had this outlook for the last 58 periods. our momentum oscillator has set a new 14-period low while the security price has not. This is a bearish divergence.

- Short Term: Neutral

- Intermediate Term: Bullish

- Long Term: Bullish

Momentum

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 42.1875. This is not an overbought or oversold reading. The last signal was a sell 8 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 58.55. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 7 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is -10. This is not a topping or bottoming area. The last signal was a sell 7 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a sell 0 period(s) ago.

Candlesticks

A black body occurred (because prices closed lower than they opened).

During the past 10 bars, there have been 3 white candles and 6 black candles for a net of 3 black candles. During the past 50 bars, there have been 20 white candles and 19 black candles for a net of 1 white candles.

Bollinger Bands

On 1/4/2024, AB INTL GRP CORP(Trade Price) closed below the upper band by 38.4%.

Bollinger Bands are 472.81% wider than normal. The large width of the bands suggest high volatility as compared to AB INTL GRP CORP(Trade Price)’s normal range. Therefore, the probability of volatility decreasing and prices entering (or remaining in) a trading range has increased for the near-term. The bands have been in this wide range for 57 period(s). The probability of prices consolidating into a less volatile trading range increases the longer the bands remain in this wide range.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.