Price Target TBD

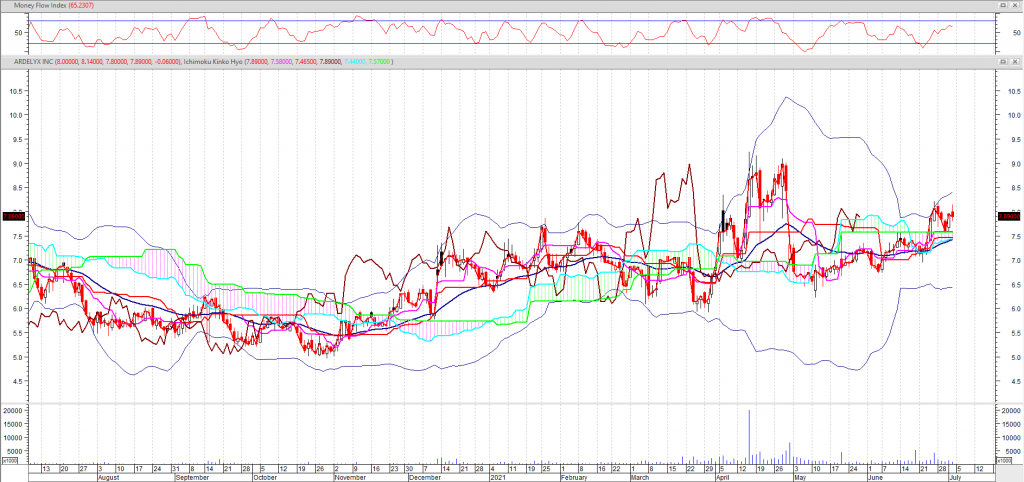

Note: this stock shows extraordinary price action to the upside.

Prices are vulnerable to a correction towards 7.26, BUY THE DIP

The projected upper bound is: 18.66.

The projected lower bound is: 7.11.

.

ARDELYX INC closed down -0.060 at 7.890. Volume was 52% below average (consolidating) and Bollinger Bands were 28% narrower than normal.

Relevant news:

June 10 – ARDX, a leading-edge healthcare management and IT consulting firm, announced today they received the highest possible rating associated with each of the six focuses of the Intertek Maturity Model when audited against International Standards Organization (ISO) 9001:2015. This rating demonstrates that ARDX not only has a thorough quality management system, but they consistently ensure customer satisfaction through management, internal audits, corrective action, continuous improvement, operational control, and resources.

Customer focus, leadership, engagement of people, process approach, improvement, evidence-based decision making, and relationship management are the principles that define the requirements of the quality management system. “The ARDX team went above and beyond to prepare for the audit, created and maintained a well-defined process, and consistently worked to increase efficiency,” noted Dr. Angela D. Reddix, ARDX Founder, President, and CEO. “Our success is a direct reflection of our commitment to quality across the organization and receiving outstanding ratings in every category truly sets us apart from our competitors.”

In the consulting industry, having a great track record of evaluation usually determines if a company remains competitive and creates a strong advantage over other consulting firms. “Achieving this certification highlights our relentless commitment of sustaining a quality-focused environment and innovative approach used within our Quality Management System,” said Nedra Commodore, Director of Quality Assurance at ARDX. “With the ISO certification, our clients can remain confident that ARDX is devoted to maintaining excellence.”

ISO is one the most rigorous and highly regarded standards across the globe. This standard ensures that the company’s policies, procedures, and processes are adequate to provide the services that clients expect.

Open High Low Close Volume

8.000 8.140 7.800 7.890 968,372

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

ARDELYX INC is currently 18.1% above its 200-period moving average and is in an upward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods. There is a good possibility that volatility will decrease and prices will stabilize in the near term. Our volume indicators reflect volume flowing into and out of ARDX.O at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on ARDX.O and have had this outlook for the last 15 periods.

Moving Averages: 10-period 50-period 200-period

Close: 7.68 7.28 6.68

Volatility: 59 64 66

Volume: 1,806,829 1,898,864 1,244,043

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

ARDELYX INC is currently 18.1% above its 200-period moving average and is in an upward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods. There is a good possibility that volatility will decrease and prices will stabilize in the near term. Our volume indicators reflect volume flowing into and out of ARDX.O at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on ARDX.O and have had this outlook for the last 15 periods.

Momentum

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 41.6667. This is not an overbought or oversold reading. The last signal was a sell 3 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 60.16. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 52 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 86. This is not a topping or bottoming area. The last signal was a sell 2 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 30 period(s) ago.

A black body occurred (because prices closed lower than they opened).

During the past 10 bars, there have been 4 white candles and 6 black candles for a net of 2 black candles. During the past 50 bars, there have been 27 white candles and 23 black candles for a net of 4 white candles.

Bollinger Band

On 7/2/2021, ARDELYX INC closed below the upper band by 17.5%.

Bollinger Bands are 7.99% narrower than normal. The current width of the bands (alone) does not suggest anything conclusive about the future volatility or movement of prices.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.