In a bold call that defied market expectations, Knightsbridge accurately predicted the Federal Reserve’s pause on interest rate hikes and even anticipated future rate cuts, with significant reductions expected before the next presidential election.

While the Fed surprised most analysts by holding rates steady at their final meeting of the year, Knightsbridge identified key indicators suggesting a shift in the central bank’s stance. This prescient insight offered clients valuable time to adjust their financial strategies ahead of the official announcement.

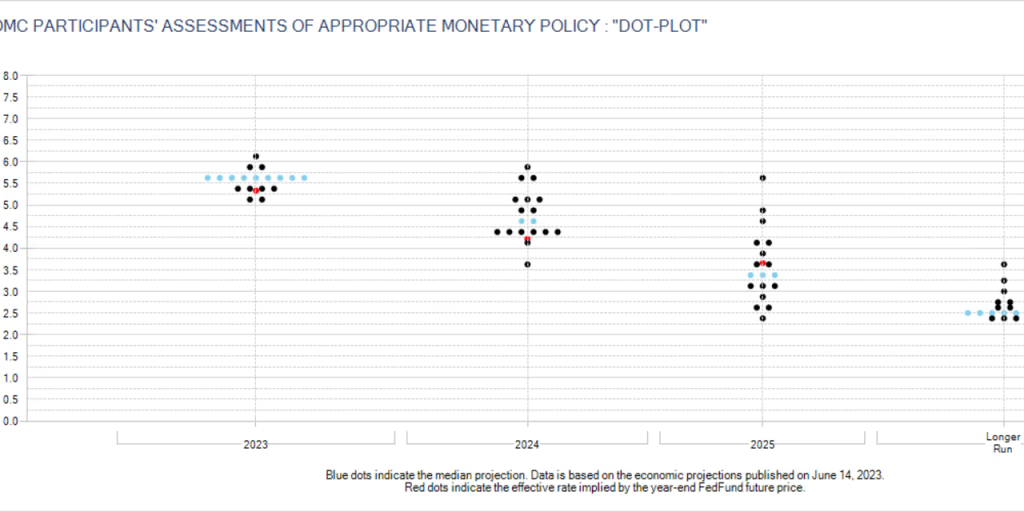

Unveiling the Dot Plot: Along with its decision, the Fed released its economic forecasts, including the eagerly awaited “dot plot.” This graphic depicts individual policymakers’ projections for future rate movements. Notably, the dot plot revealed a peak rate of 4.6% in 2024, a significant downshift from the previously projected 5.1%. This translates to three anticipated rate cuts next year, totaling 0.75%.

Market Reacts: The news sent shockwaves through financial markets. The probability of a Fed rate cut in March skyrocketed from 40% to nearly 60%, reflecting a surge in investor confidence in Knightsbridge’s prediction.

Knightsbridge Advantage: This precise forecast underscores the value of Knightsbridge’s unique approach to market analysis. By combining in-depth financial expertise with cutting-edge data analysis, Knightsbridge delivers actionable insights that empower clients to navigate even the most volatile market conditions.

Beyond Rates: The Fed’s revised economic projections paint a cautious picture. Growth is expected to slow, unemployment to rise slightly, and inflation to decline gradually. However, Knightsbridge remains optimistic, highlighting potential opportunities amid these changing dynamics.

For borrowers, the predicted rate cuts offer welcome relief, potentially easing the burden of mortgages, loans, and credit card debt. As the 2024 election approaches, this shift in monetary policy could play a significant role in the political landscape.

Knightsbridge stands ready to guide clients through the evolving economic environment, with a proven track record of anticipating and capitalizing on market shifts.

Shayne Heffernan