The Week of September 12–19, 2023 in Bitcoin News

The price of one bitcoin varies between $26,000 and $27,000. Over the previous week, the price of Bitcoin has remained largely constant, fluctuating between $26,000 and $27,000. After a dramatic dip in August, when Bitcoin briefly dropped below $25,000 for the first time since December 2020, something has happened recently.

Following a court victory, Grayscale encourages the SEC to approve a spot Bitcoin ETF. The largest digital asset manager in the world, Grayscale Investments, has requested that the US Securities and Exchange Commission (SEC) accept its application for a spot Bitcoin ETF. This comes after Grayscale defeated the SEC in court in June, opening the door for the US to approve the first Bitcoin ETF.

The bitcoin mining market is still expanding. The Bitcoin mining market is still expanding despite the recent drop in Bitcoin’s price. The worldwide Bitcoin hashrate has increased to 246 EH/s, according to statistics from Hashrate Index. This implies that new miners are entering the network on a regular basis, which is encouraging for the long-term viability of Bitcoin.

The adoption of bitcoin is growing. Despite the present bad market, more people are using Bitcoin. Over 43 million active Bitcoin addresses are currently available, according to data from CoinMarketCap. This shows that an increasing number of individuals are regularly utilizing Bitcoin.

The last week’s Bitcoin news has been uneven overall. Despite some encouraging events like Grayscale’s triumph over the SEC and the industry’s continuous expansion, the price of Bitcoin has remained mostly steady.

Financial Summary

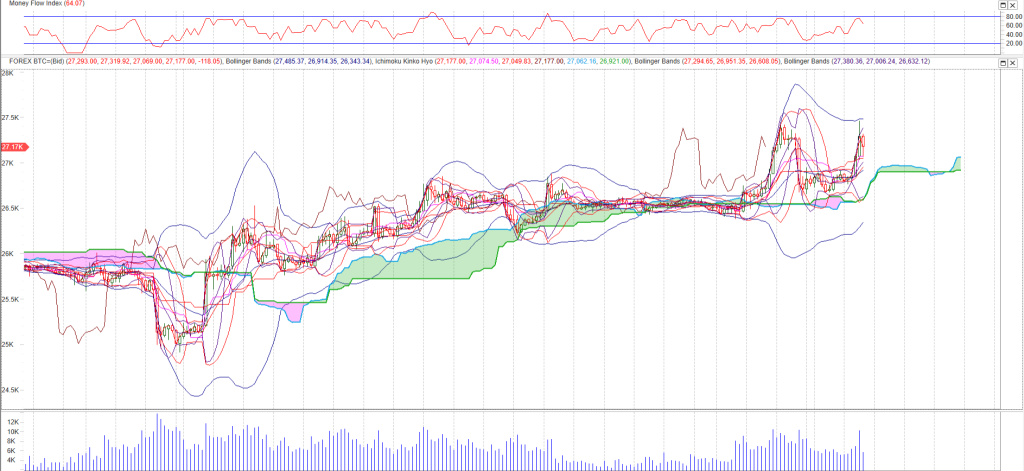

FOREX BTC=(Bid) is currently 3.6% above its 200-period moving average and is in an upward trend. Volatility is high as compared to the average volatility over the last 10 periods. Our volume indicators reflect volume flowing into and out of BTC= at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on BTC= and have had this outlook for the last 0 periods. Bollinger Bands are 60.62% wider than normal.

For MetaStock free trial for the most reliable Stock Charts around click here.

FOREX BTC=(Bid) closed up 204.230 at 27,275.000. Volume was 10% below average (neutral) and Bollinger Bands were 61% wider than normal.

Technical Outlook

Short Term: Overbought

Intermediate Term: Bullish

Long Term: Bullish

Candlesticks

A big white candle occurred. This is generally considered bullish, as prices closed significantly higher than they opened. If the candle appears when prices are “low,” it may be the first sign of a bottom. If it occurs when prices are rebounding off of a support area (e.g., a moving average, trendline, or retracement level), the long white candle adds credibility to the support. Similarly, if the candle appears during a breakout above a resistance area, the long white candle adds credibility to the breakout.

During the past 10 bars, there have been 8 white candles and 2 black candles for a net of 6 white candles. During the past 50 bars, there have been 29 white candles and 21 black candles for a net of 8 white candles.

Three white candles occurred in the last three days. Although these candles were not big enough to create three white soldiers, the steady upward pattern is bullish.

Bollinger Bands

On 9/19/2023 10:00 AM, FOREX BTC=(Bid) closed below the upper band by 3.1%.

Bollinger Bands are 32.83% wider than normal. The current width of the bands (alone) does not suggest anything conclusive about the future volatility or movement of prices.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.