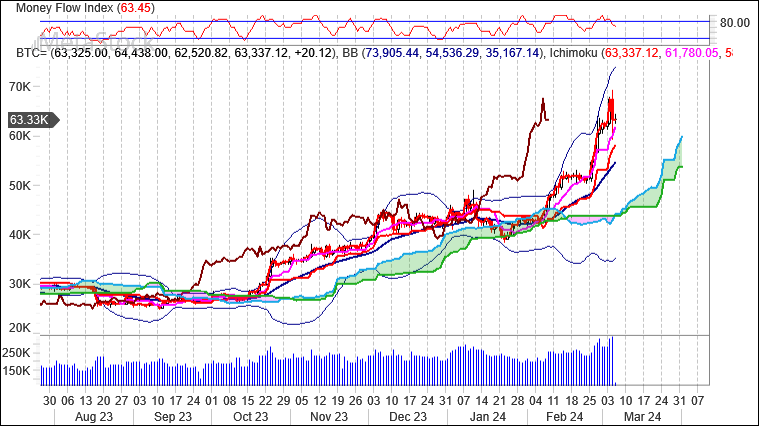

As Bitcoin continues its meteoric rise in the financial markets, Knightsbridge’s proprietary Bitcoin indicators offer valuable insights into the cryptocurrency’s current trajectory. Despite recent overbought conditions, these indicators suggest that Bitcoin remains firmly bullish, with key factors such as the upcoming halving and ETF inflows contributing to its long-term potential.

In recent weeks, Bitcoin has experienced a surge in buying activity, driving its price to new highs. However, Knightsbridge’s Bitcoin indicators have detected signs of overbought conditions, indicating that the cryptocurrency may be due for a short-term correction. While such corrections are not uncommon in Bitcoin’s volatile market, they often serve as healthy price adjustments before the next leg up.

Despite the short-term overbought signals, Knightsbridge remains optimistic about Bitcoin’s long-term outlook. One key factor supporting this bullish sentiment is the upcoming halving event, which is scheduled to occur approximately every four years. During a halving, the supply of new Bitcoins issued to miners is cut in half, leading to a reduction in the rate at which new Bitcoins enter circulation. Historically, halving events have been associated with significant price rallies, as the reduced supply creates a supply-demand imbalance that drives prices higher.

In addition to the halving, Knightsbridge’s Bitcoin indicators are also closely monitoring the influx of institutional capital into the cryptocurrency space. In recent months, there has been growing interest from institutional investors seeking exposure to Bitcoin, with the approval of Bitcoin ETFs providing a regulated avenue for such investments. ETF inflows have the potential to inject significant capital into the Bitcoin market, driving prices higher as demand for the cryptocurrency increases.

Looking ahead, Knightsbridge’s analysis suggests that Bitcoin’s bullish momentum is likely to persist, supported by favorable macroeconomic factors and growing adoption. While short-term corrections are to be expected, particularly after periods of rapid price appreciation, the long-term trend for Bitcoin remains upward.

Investors interested in capitalizing on Bitcoin’s potential can benefit from Knightsbridge’s comprehensive market analysis and strategic guidance. By leveraging advanced indicators and insights, investors can navigate the dynamic cryptocurrency market with confidence, maximizing opportunities for profit while managing risks effectively.

Bitcoin may be overbought in the short term, Knightsbridge’s indicators point to continued bullishness in the long term. With the upcoming halving event and increasing institutional interest, Bitcoin’s growth trajectory remains promising, offering investors ample opportunities for capital appreciation in the evolving digital economy.

BTC is currently 66.9% above its 200-period moving average and is in an upward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods. There is a good possibility that volatility will decrease and prices will stabilize in the near term.

Our volume indicators reflect moderate flows of volume into BTC (mildly bullish). Our trend forecasting oscillators are currently bullish on BTC and have had this outlook for the last 33 periods.

Our momentum oscillator is currently indicating that BTC is currently in an overbought condition.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 55.6161. This is not an overbought or oversold reading. The last signal was a sell 1 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 71.36. This is where it usually tops. The RSI usually forms tops and bottoms before the underlying security. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 12 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 67. This is not a topping or bottoming area. The last signal was a sell 1 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 9 period(s) ago.

Bollinger Bands are 251.98% wider than normal. The large width of the bands suggest high volatility as compared to BTC (Bid)’s normal range. Therefore, the probability of volatility decreasing and prices entering (or remaining in) a trading range has increased for the near-term. The bands have been in this wide range for 27 period(s). The probability of prices consolidating into a less volatile trading range increases the longer the bands remain in this wide range.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) suggests that a possible selling (short) opportunity may exist. Prices have recently peaked above the upper band. This action was followed by a selloff and then another peak inside the bands. The RSI has diverged from this price action with successive lower peaks, suggesting weakness ahead. A protective buy stop should be placed at or slightly above 69,202.0000. For confirmation of this selling opportunity, you should look at a volume based indicator such as the On Balance Volume or Money Flow Index for confirmation.

Shayne Heffernan