Knightsbridge Group’s Bold Prediction

Introduction: In the ever-evolving landscape of cryptocurrency, few voices resonate as boldly as Shayne Heffernan of the Knightsbridge Group. Renowned for his astute financial insights, Heffernan and his team are making waves with a daring prediction that Bitcoin, the pioneer of digital currencies, will soar to an unprecedented $1 million. In this detailed article, we delve into the compelling arguments put forth by Shayne Heffernan and the Knightsbridge Group in support of this audacious forecast.

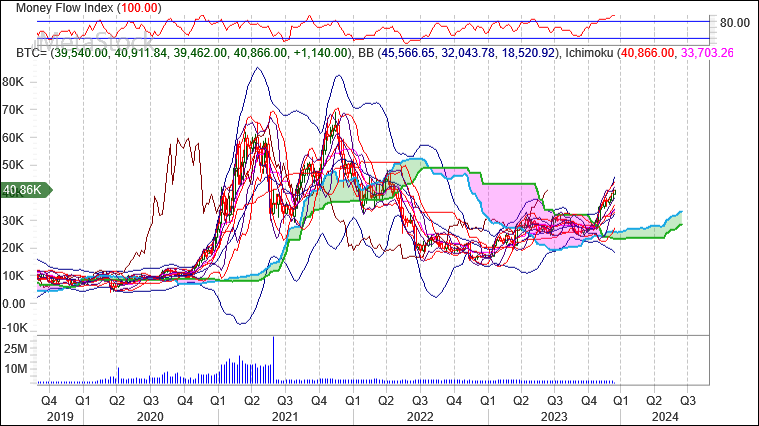

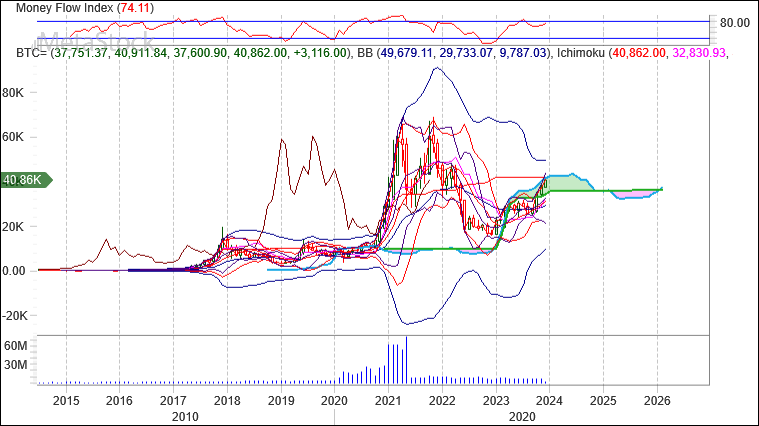

- Bitcoin’s Historical Trajectory: Shayne Heffernan begins his analysis by examining Bitcoin’s historical performance. From its humble beginnings over a decade ago, Bitcoin has experienced remarkable growth, defying skeptics and traditional market expectations. Heffernan contends that this trajectory is indicative of Bitcoin’s resilience and potential for substantial gains.

- Institutional Adoption and Credibility: The Knightsbridge Group emphasizes the increasing institutional adoption of Bitcoin as a key factor in its bullish outlook. Major financial institutions, corporations, and even sovereign funds are incorporating Bitcoin into their portfolios, providing a stamp of credibility that was once elusive to digital assets. Heffernan argues that this trend is poised to accelerate, driving Bitcoin to new heights.

- Limited Supply and Scarcity: Central to the Knightsbridge Group’s prediction is the principle of scarcity. Bitcoin’s maximum supply is capped at 21 million coins, a deliberate design choice that introduces an element of scarcity absent in traditional fiat currencies. Heffernan contends that as global demand for Bitcoin grows, its limited supply will contribute to a supply-demand dynamic that propels its value to unprecedented levels.

- Global Economic Uncertainty and Store of Value: Heffernan points to the global economic landscape marred by uncertainties, inflationary pressures, and currency devaluation. In times of economic instability, Bitcoin has emerged as a digital store of value, often referred to as “digital gold.” The Knightsbridge Group sees Bitcoin as an attractive hedge against economic uncertainties, making it an increasingly sought-after asset.

- Technological Advancements and Mainstream Acceptance: The Knightsbridge Group recognizes the ongoing technological advancements within the cryptocurrency space and the growing acceptance of blockchain technology. Heffernan believes that as the infrastructure supporting Bitcoin matures and regulatory clarity increases, mainstream acceptance will follow suit, driving demand and, consequently, the value of Bitcoin.

Conclusion: Shayne Heffernan’s bold prediction of Bitcoin reaching $1 million reflects a confluence of factors, from historical performance to institutional adoption, scarcity dynamics, economic uncertainties, and technological advancements. While such projections always come with inherent risks and uncertainties, the Knightsbridge Group’s analysis provides a compelling case for the transformative potential of Bitcoin in the global financial landscape. As the cryptocurrency market continues to evolve, Heffernan and his team stand firm in their conviction that Bitcoin’s journey is far from over, with $1 million as the next milestone on its horizon.