BRICS Stocks to Own Now BRICS Surpasses G7 in Global GDP Share Following Rapid Growth Amid US Sanctions on Russia

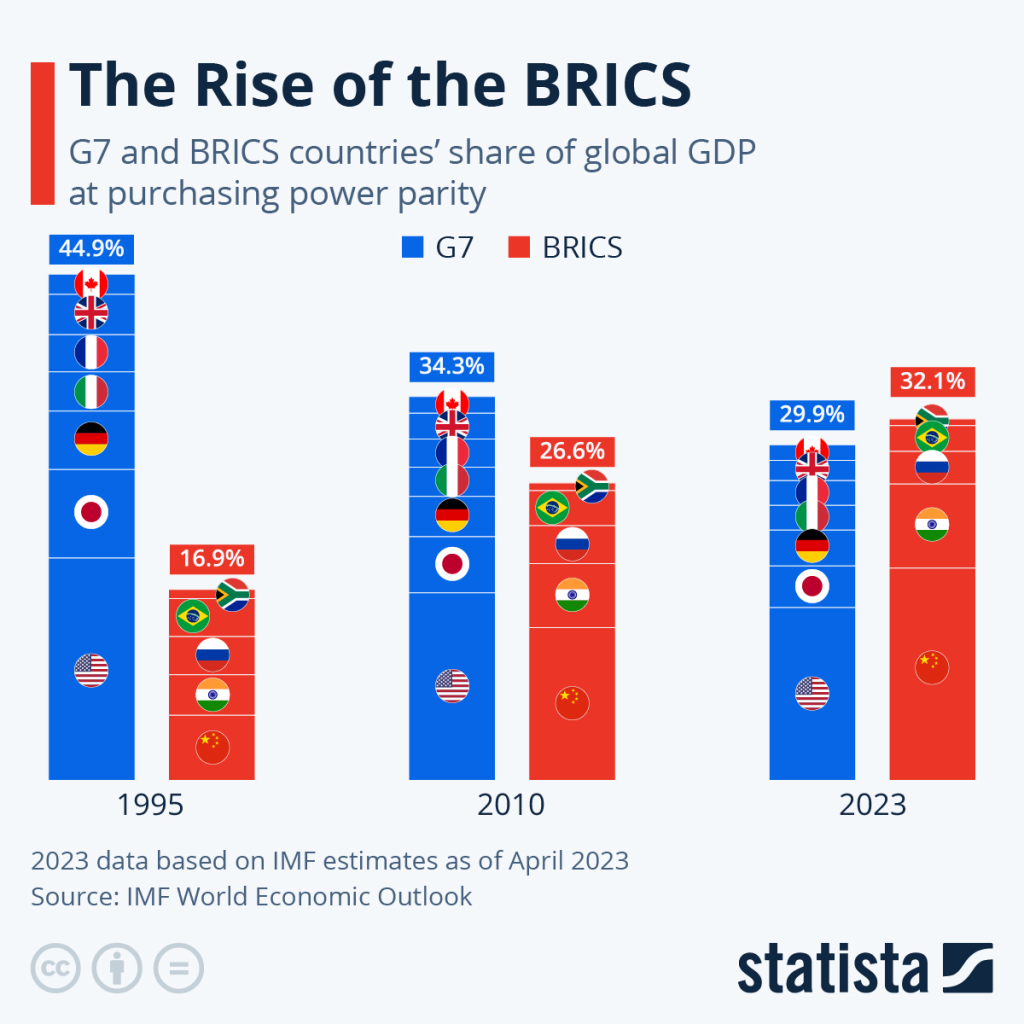

In a notable shift, the BRICS states have surpassed the G7 nations in terms of their share in the global Gross Domestic Product (GDP) when measured in Purchasing Power Parity (PPP), according to Elvira Nabiullina, the head of the Russian central bank. In an interview with RIA Novosti, Nabiullina highlighted the substantial growth of the BRICS economies, attributing their increased influence to a surge in local trade.

The metric used by Nabiullina, GDP in PPP terms, adjusts for variations in the cost of goods and services, providing a more equitable comparison of economic productivity and standards of living among countries.

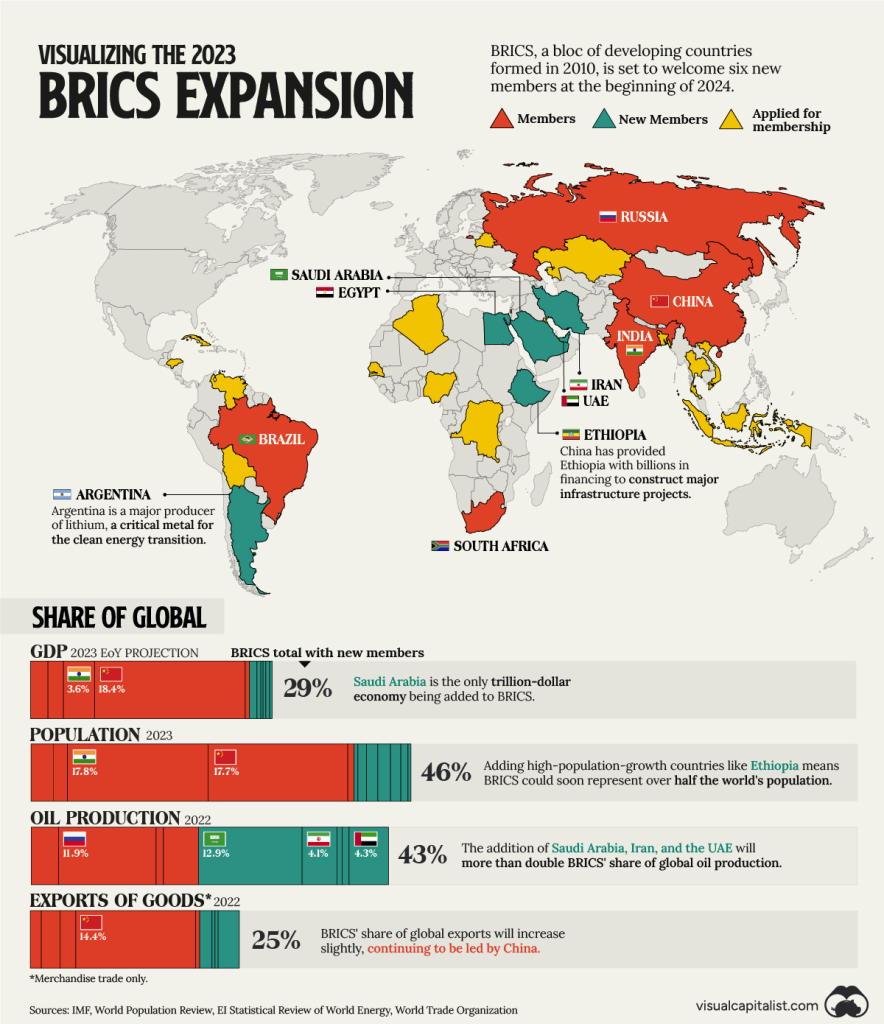

As of the end of 2023, the BRICS group, which consists of Brazil, Russia, India, China, and South Africa, along with the newly added members Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates, now commands a 35% share in the global economy. This signifies a significant rise from the 31% share reported before the addition of new members.

The expansion of BRICS in 2023 marked a milestone, with the group now poised to account for over 40% of global crude oil production and boasting a combined population of nearly 3.6 billion, representing almost half of the world’s total population.

While BRICS continues to grow in stature, other nations have expressed interest in joining the economic bloc. Formal applications have been submitted by Venezuela, Thailand, Senegal, Cuba, Kazakhstan, Belarus, Bahrain, and Pakistan, signaling the potential for further expansion.

In contrast, data from the International Monetary Fund (IMF) reveals a steady decline in the G7’s share of global GDP in PPP terms over the years. The G7’s share, which stood at 50.42% in 1982, had decreased to 30.39% in 2022. The IMF projects a further decrease to 29.44% in the current year, indicating a diminishing influence compared to the rising prominence of the BRICS group.

The economic shift underlines the changing dynamics in global trade and cooperation, with BRICS emerging as a formidable force on the world stage.

BRICS Stocks Listed in the USA

Investing in BRICS Stocks (Brazil, Russia, India, China, and South Africa) involves considering diverse sectors and industries within each country. It’s important to note that investing always carries risks, and thorough research or consultation with a financial advisor is recommended. Here’s a broad overview of sectors and potential stocks that could provide exposure to the growth in BRICS:

- China:

- Technology: Companies like Alibaba Group Holding Ltd (BABA), Tencent Holdings Ltd (TCEHY), and JD.com Inc (JD) are prominent in China’s tech sector.

- E-commerce: JD.com and Alibaba are key players in the e-commerce space.

- Healthcare: Tencent-backed companies, like Tencent Music Entertainment Group (TME) and Tencent-backed Meituan Dianping (MPNGF), operate in the healthcare and services sector.

- India:

- IT Services: Infosys Ltd (INFY), Tata Consultancy Services Ltd (TCS), and Wipro Ltd (WIPRO) are major players in India’s IT sector.

- Consumer Goods: Hindustan Unilever Ltd (HINDUNILVR) is a significant consumer goods company.

- Financial Services: HDFC Bank Ltd (HDB) and ICICI Bank Ltd (IBN) are leading banks in India.

- Brazil:

- Commodities: Vale S.A. (VALE) is a major player in the mining sector.

- Energy: Petroleo Brasileiro S.A. (PBR), commonly known as Petrobras, operates in the energy sector.

- Financials: Banco Bradesco S.A. (BBD) and Itau Unibanco Holding S.A. (ITUB) are prominent financial institutions.

- Russia:

- Energy: Gazprom PAO (OGZPY) and Lukoil PJSC (LUKOY) are involved in the energy sector.

- Mining: Norilsk Nickel PJSC (NILSY) is a leading mining company.

- Financials: Sberbank of Russia PJSC (SBRCY) is a major financial institution.

- South Africa:

- Mining: Anglo American Platinum Ltd (ANGPY) is a significant player in the mining industry.

- Financials: Standard Bank Group Ltd (SGBLY) and FirstRand Ltd (FSRHY) are notable in the financial sector.

Please note that stock performance can be influenced by various factors, including economic conditions, geopolitical events, and industry-specific dynamics. Diversification across sectors and regions can help mitigate risks associated with investing in emerging markets like BRICS.

BRICS Stocks

| Company Name | Ticker Symbol | Sector | Market Cap (USD Billion) | Website |

|---|---|---|---|---|

| Brazil | ||||

| Banco Santander Brasil (Santander Brazil) | BSBR | Financial Services | 51.49 | https://www.santander.com.br/ |

| Petróleo Brasileiro S.A. (Petrobras) | PBR | Energy | 49.06 | https://petrobras.com/ |

| Natura & Co Holding S.A. | NTCO | Consumer Staples | 10.40 | https://www.naturaeco.com/ |

| Russia | ||||

| Yandex N.V. | YNDX | Technology | 16.01 | https://yandex.com/ |

| MTS PJSC | MBT | Telecommunications | 8.50 | https://en.wikipedia.org/wiki/MTS_%28telecommunications%29 |

| Lukoil PJSC | LUKOIL | Energy | 41.21 | https://www.lukoil.com/ |

| India | ||||

| Tata Motors Limited | TTM | Consumer Discretionary | 46.16 | https://www.tatamotors.com/ |

| Infosys Limited | INFY | Technology | 89.17 | https://www.infosys.com/ |

| HDFC Bank Limited | HDB | Financial Services | 116.33 | https://www.hdfcbank.com/ |

| China | ||||

| Alibaba Group Holding Ltd. | BABA | Technology | 231.40 | https://m.alibaba.com/ |

| Baidu, Inc. | BIDU | Technology | 105.55 | https://www.baidu.com/ |

| JD.com, Inc. | JD | Consumer Discretionary | 141.09 | https://m.jd.com/ |

| South Africa | ||||

| Naspers Limited | NPSN | Diversified | 46.53 | https://www.naspers.com/ |

| Prosus N.V. | PRX | Internet & Software | 39.21 | https://www.prosus.com/ |

BRICS: A Bloc on the Rise

The acronym BRICS, once a catchy term for a group of emerging economies with high growth potential, has evolved into a powerful economic and political bloc holding significant sway on the global stage. Today, with the addition of five new members, it’s important to understand the composition and potential of this expanding group.

The Founding Five:

- Brazil: A vibrant nation with a population of 212.5 million, boasting a diverse economy fueled by agriculture, mining, and services. Its primary exports include soybeans, meat, and iron ore, while machinery, chemicals, and oil top its import list. With a nominal GDP of $1.8 trillion, Brazil holds immense potential in agriculture, renewable energy, and tourism.

- Russia: Home to 145.9 million people, Russia holds vast natural resources and a robust industrial base. Its oil, gas, metals, and machinery exports drive its economy, while machinery, consumer goods, and pharmaceuticals make up its main imports. With a GDP of $1.7 trillion, Russia’s technological advancements and strategic resources position it as a key player in global energy and geopolitical affairs.

- India: A demographic powerhouse with 1,380 million citizens, India’s economy rests on agriculture, manufacturing, and IT services. Its textile, gem, and pharmaceutical exports flourish, while oil, machinery, and chemicals form its primary imports. With a GDP of $3.5 trillion, India’s young population, burgeoning middle class, and technological prowess make it a future economic giant.

- China: The world’s second-largest economy boasts a population of 1,444 million and thrives on manufacturing, technology, and infrastructure development. Electronics, machinery, and textiles lead its exports, while machinery, electronics, and minerals constitute its main imports. With a GDP of $17.7 trillion, China’s sheer economic size, technological innovation, and global trade influence make it a dominant force in the 21st century.

- South Africa: The continent’s economic powerhouse with a population of 60.1 million, South Africa’s strengths lie in mining, finance, and tourism. Minerals, metals, and automobiles head its exports, while machinery, chemicals, and vehicles dominate its imports. With a GDP of $0.8 trillion, South Africa’s strategic location, resource wealth, and potential for further development make it a crucial player in African and global affairs.

The Newcomers:

Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates have recently joined the BRICS bloc, adding further diversity and economic muscle to the group. Their inclusion expands the BRICS’ reach into Africa, the Middle East, and the Persian Gulf, potentially shaping global trade, energy markets, and geopolitical dynamics.

The Future of BRICS:

With a combined population exceeding 4 billion, a GDP surpassing $23 trillion, and vast natural resources, BRICS holds immense potential. Increased intra-bloc trade, collaboration on infrastructure projects, and joint research and development efforts could propel the group into a formidable economic and political force. However, challenges like infrastructure gaps, income inequality, and political differences need to be addressed for BRICS to truly realize its potential.

As the world watches, BRICS stands at a crossroads. By harnessing its collective strengths and overcoming its challenges, this bloc could not only reshape the global economic landscape but also contribute to a more equitable and sustainable future for its member nations and beyond.

BRICS: Balancing Act Between East and West

The rise of the BRICS nations – Brazil, Russia, India, China, and South Africa – has reshaped the geopolitical landscape, creating a bloc with substantial economic clout and burgeoning political influence. However, their relationship with the established powers of the USA and Europe remains complex and nuanced, characterized by cooperation, competition, and cautious maneuvering.

Economic Interdependence:

Despite ideological differences, economic ties bind BRICS and the West. Trade flows between the blocs are substantial, with China alone accounting for a significant portion of US and EU imports. The BRICS nations offer vast markets for Western goods and services, while Western investments and technology play a crucial role in their economic development. This interdependence creates a web of mutual interests, fostering dialogue and cooperation on matters like trade liberalization and global financial stability.

Geopolitical Divergences:

On the other hand, political alignments often diverge. BRICS nations have shown reluctance to align with the West on issues like sanctions against Russia or intervention in Middle Eastern conflicts. They advocate for a multipolar world order, challenging Western dominance and seeking greater representation in international institutions. This divergence fosters friction, particularly with the USA, which views China’s assertive foreign policy as a strategic challenge.

The European Factor:

Europe’s relationship with BRICS is more nuanced. While sharing some of the USA’s concerns about China’s rise, the EU also recognizes the economic opportunities within the bloc. Additionally, Europe’s historical colonial ties with some BRICS nations create complex cultural and strategic dynamics. The EU seeks to build independent partnerships with individual BRICS members, emphasizing shared interests in climate change, sustainable development, and global governance.

The Future of the Relationship:

The future of the BRICS-West relationship hinges on their ability to navigate these competing forces. Finding common ground on areas like climate change, global health, and economic development can create opportunities for cooperation, while managing political differences through dialogue and negotiation is crucial to avoid confrontation.

Challenges and Opportunities:

Several challenges remain: the potential for trade wars as economies compete, managing cybersecurity threats, and addressing human rights concerns. However, opportunities also abound: forging a more inclusive global governance structure, promoting sustainable development initiatives, and fostering deeper cultural and educational exchange.

BRICS-West relationship is a complex balancing act between cooperation and competition. Recognizing the interdependence while managing political differences is crucial for shaping a stable and prosperous future for all. As the BRICS bloc continues to rise, its engagement with the West will undoubtedly be one of the defining narratives of the 21st century.

Shayne Heffernan