The collapse of the Archegos fund is only the most recent example of how extreme liquidity can make financial markets more volatile and sometimes lead to bizarre outcomes.

Another dramatic instance came in late January, when shares of GameStop suddenly skyrocketed following a buying frenzy coordinated by retail investors eager to defend the video game retailer from funds betting against the company.

Shares of GameStop have since retreated, but the episode shined an uncomfortable light on online trading platforms and speculative investment funds involved in the financial melee.

In the case of Archegos, leading banks appear poised for hefty losses following billions of dollars in sudden stock liquidations by a fund that had large market exposure backed by very little cash.

Then there has been the wave of SPACs (special purpose acquisition companies), which have entered public markets through transactions with fewer rules than traditional stock offerings.

All of these cases show how a flood of liquidity in the wake of accommodative monetary policy is changing Wall Street.

“Stocks have risen extremely quickly from their lows last March, but there is still plenty of liquidity out there,” said Gregori Volokhine of Meeschaert Financial Services.

The Federal Reserve has been aggressive in pumping funds into the financial system. Also, both President Joe Biden and predecessor Donald Trump signed sweeping fiscal packages that primed households and businesses with funds.

“I just don’t know that we’ve seen this much money hit the system this fast between what we’ve seen in stimulus checks and now what we’re going to see with infrastructure,” said TD Ameritrade market strategist JJ Kinahan, alluding to Biden’s just-introduced $2 trillion infrastructure plan.

Some of the volatility is also the result of investors trying to navigate shifts in the market as the economy rebounds with more people vaccinated and technology shares that prospered during lockdowns lose some of their luster.

“Enterprising investors know they need to find other vehicles besides software, social networks and e-commerce stocks,” Volokhine said. “They’re looking for ways to make more money.”

Kinahan said implosions like Archegos can happen when funds are “looking to differentiate their returns, which is harder do in a bull market.”

– New regulation? –

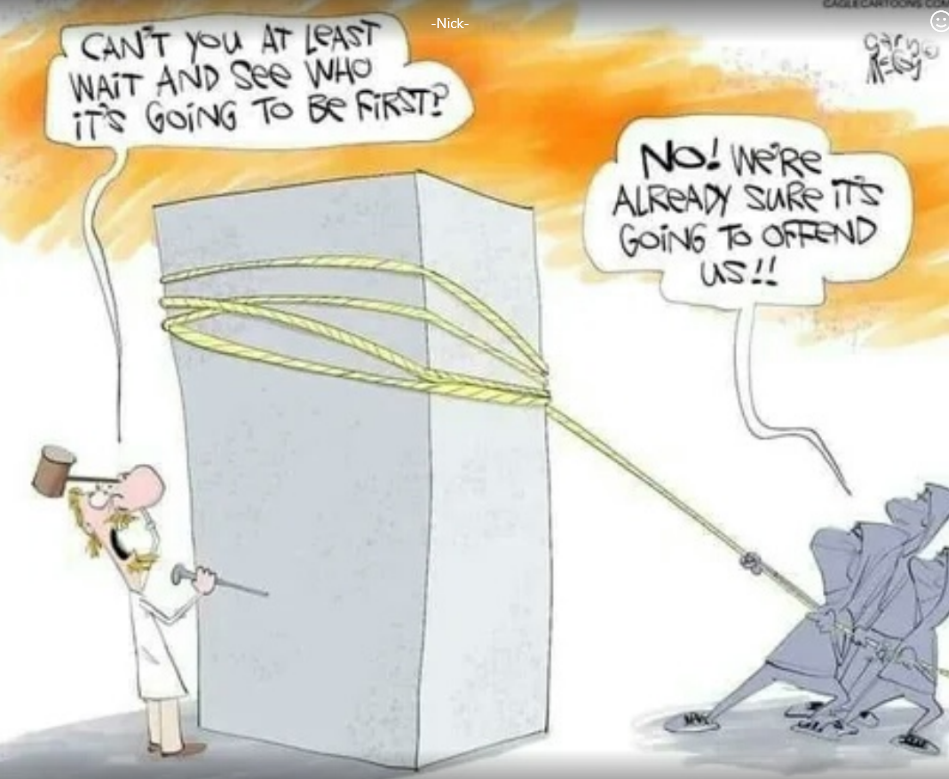

The churn in the market is sparking talk of more financial regulation. In the wake of GameStop, lawmakers have grilled online trading platform Robinhood over its moves to temporarily restrict trading amid the frenzy.

Robinhood, which itself plans to go public, has also been questioned about its relationships with hedge funds that do business with it.

The Archegos debacle has focused debate on swaps, derivative transactions that can allow big, high-risk bets with small upfront payments.

The opacity of the swaps market makes it a prime candidate for new rules from the Securities and Exchange Commission, Volokhine said.

“The SEC could move quickly to force banks to disclose more about swaps,” he said. “Right now, there isn’t much transparency.”