The carbon credits industry has come a long way since its inception in the late 1990s. Today, carbon credits are seen as a key tool in the fight against climate change, providing a mechanism for companies and individuals to offset their greenhouse gas emissions.

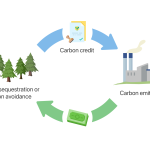

Carbon credits work by allowing companies to fund emissions reduction projects elsewhere, which can include renewable energy projects, energy efficiency improvements, or efforts to reduce emissions from deforestation and other land-use changes. In exchange for funding these projects, companies receive carbon credits, which can be used to offset their own emissions.

The concept of carbon credits emerged out of the United Nations Framework Convention on Climate Change (UNFCCC). This was established in 1992 to address the issue of global warming. Under the UNFCCC, countries agreed to work together to reduce greenhouse gas emissions, but it quickly became clear that some countries would find it more difficult to reduce emissions than others. To address this imbalance, the Kyoto Protocol was established in 1997, which allowed countries to trade emissions credits in order to meet their emissions targets.

Kyoto Protocol

The Kyoto Protocol established the Clean Development Mechanism (CDM), which allows companies to invest in emissions reduction projects in developing countries in exchange for certified emission reduction (CER) credits. The CDM has been a significant driver of investment in emissions reduction projects, providing a way for companies to offset their emissions while also supporting sustainable development in developing countries.

In addition to the CDM, a number of other carbon credits schemes and standards have emerged in recent years. These include the Verified Carbon Standard (VCS), which provides a framework for verifying and certifying carbon offsets. As well as the Gold Standard which certifies projects that meet rigorous environmental and social criteria.

One of the most significant developments in the carbon credits market in recent years has been the emergence of voluntary carbon offset schemes. These schemes allow companies and individuals to voluntarily offset their emissions, even if the law does not require it. Voluntary carbon offsets can be a way for companies to demonstrate their commitment to sustainability and reduce their environmental impact.

Despite the growth of the carbon credits market, there are also concerns about the effectiveness of some carbon offset schemes. Some projects may not actually result in real emissions reductions, while others may have negative social or environmental impacts. To address these concerns, a number of standards and certification schemes have been established to ensure that carbon credits are legitimate and effective.

Carbon Offsetting and Reduction Scheme

One example of such a certification scheme is the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This was established by the International Civil Aviation Organization (ICAO) in 2016. CORSIA is a global carbon offsetting scheme for the aviation industry, which aims to achieve carbon-neutral growth from 2020 onwards by requiring airlines to offset their emissions through the purchase of carbon credits.

Overall, the carbon credits market has played an important role in driving investment in emissions reduction projects and supporting sustainable development. As the world continues to focus on reducing greenhouse gas emissions, it is likely that the carbon credits market will continue to evolve and play an increasingly important role in the transition to a low-carbon economy. However, it is important that the industry continues to address concerns about the effectiveness and integrity of carbon offset schemes in order to ensure that they make a real contribution to reducing greenhouse gas emissions.