The Chinese stock market has embarked on a robust rally in the first week of the Chinese Lunar New Year, igniting optimism among investors as trading resumed following an eight-day Chinese Spring Festival holiday.

With three days of substantial gains leading up to the holiday, the market has seen an impressive 8-day upward streak since February 6th. During the period of February 6th to 23rd, the benchmark Shanghai Composite Index surged by over 11 percent, while the Shenzhen Component Index soared by nearly 13 percent.

On Friday, Chinese stocks closed higher, with the Shanghai Composite Index edging up by 0.55 percent to 3,004.88, just above the psychologically significant 3,000 mark. Similarly, the Shenzhen Component Index closed 0.28 percent higher at 9,069.42.

As China welcomed the Year of the Dragon, symbolizing good fortune and luck, the market’s buoyant performance during the week has fueled investors’ expectations for promising investment returns in 2024.

In parallel with the market’s rally, there has been a heightened focus on “supervision” and “risk mitigation,” spurred by the recent appointment of a new head at the helm of the nation’s top securities regulator, the China Securities Regulatory Commission (CSRC). The regulatory body convened a series of symposiums aimed at gathering insights from various stakeholders on bolstering stock market supervision, risk control, and fostering the capital market’s high-quality development.

Wu Qing, the new chairman of CSRC, assumed office shortly before the Chinese Spring Festival and wasted no time in addressing market concerns. Alongside other CSRC leaders, Wu led over 10 consecutive symposiums on February 18th and 19th, engaging in comprehensive discussions on critical market issues.

Industry experts, including Wu Xiaoqiu, President of China Capital Market Research Institute, hailed these symposiums as unprecedented and impactful, attributing their significance to the wide-ranging and in-depth topics covered.

The symposiums delved into various areas, including IPO access, supervision of listed companies, shareholding reduction, and market trading behavior. Key suggestions from participants emphasized the importance of improving the quality of listed companies, standardizing transaction behaviors, and attracting long-term funds into the market.

Moreover, experts underscored the need for robust enforcement measures to combat financial fraud and illegal activities, reflecting a commitment to maintaining market integrity.

The market’s rally coincided with regulatory actions aimed at curbing market violations, underscoring authorities’ resolve to uphold market order. Penalties were imposed on individuals and entities suspected of insider trading, market manipulation, and disruptive trading practices.

For instance, Lingjun Investment, a major quant fund, faced penalties for selling an excessive amount of stocks, triggering a temporary sharp decline in benchmark indices. The regulatory measures, while fulfilling supervision responsibilities, aimed to safeguard market stability and integrity.

China’s recent stock market rally aligns with Knightsbridge’s positive outlook on China, reaffirming the nation’s resilience and potential for growth. The concerted efforts by regulators to strengthen oversight and address market risks underscore China’s commitment to fostering a robust and sustainable capital market ecosystem.

As the world continues to monitor global economic trends, all eyes are increasingly turning towards China, where recent indicators point to a robust and resilient economy on the rise. Bolstered by a series of strategic reforms and forward-looking policies, China’s economic landscape is experiencing notable growth, attracting attention from investors and analysts alike. Among those at the forefront of understanding and interpreting these developments is Knightsbridge, a leading authority in economic analysis and forecasting.

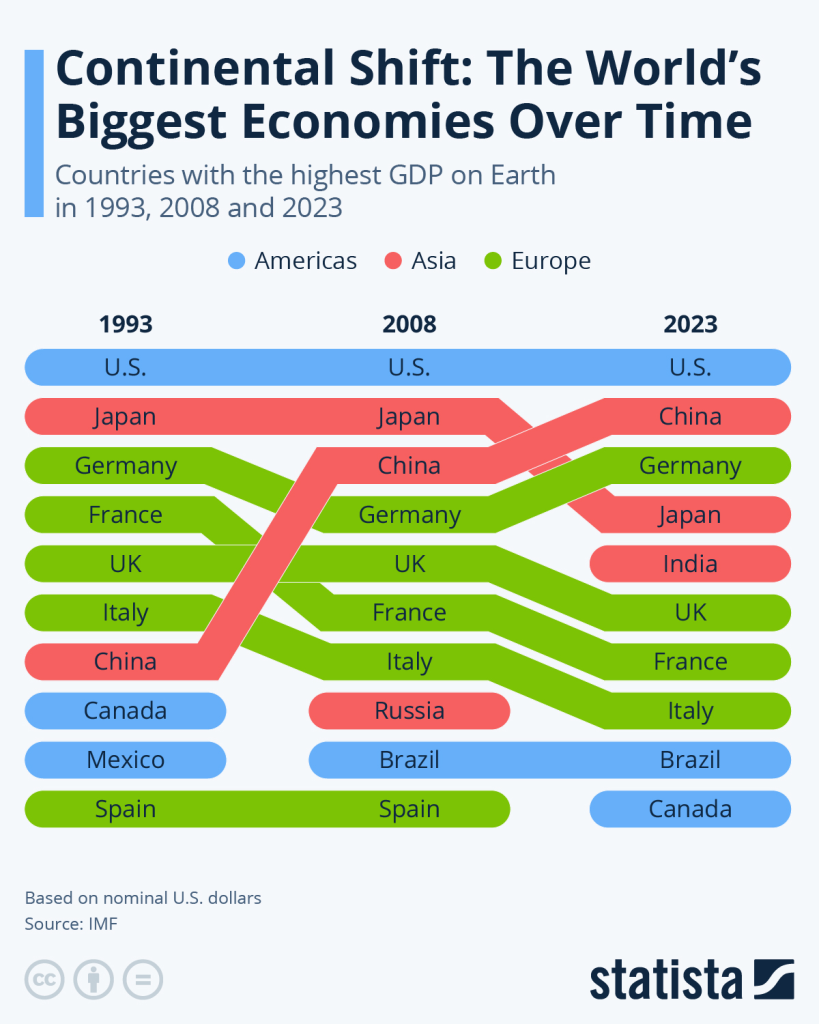

In recent years, China has emerged as a key driver of global economic growth, leveraging its vast market potential, technological innovation, and ambitious development initiatives. The nation’s Gross Domestic Product (GDP) has consistently expanded at a steady pace, defying external challenges and demonstrating resilience in the face of uncertainties.

Knightsbridge’s experts have been closely monitoring China’s economic trajectory, providing valuable insights into the factors underpinning its growth momentum. From structural reforms aimed at enhancing efficiency and productivity to strategic investments in emerging sectors such as technology and renewable energy, China’s proactive approach to economic development has positioned it as a powerhouse in the global economy.

One of the key drivers of China’s economic success lies in its commitment to innovation and technological advancement. Through initiatives such as the Made in China 2025 strategy and the Belt and Road Initiative (BRI), China is spearheading efforts to foster innovation-led growth and expand its influence in global trade and infrastructure development. Knightsbridge’s analysis highlights the transformative impact of these initiatives on China’s economic landscape, driving productivity gains, fostering entrepreneurship, and fueling sustainable growth.

Moreover, China’s resilient consumer market remains a cornerstone of its economic resilience, supported by rising incomes, urbanization, and a burgeoning middle class. As domestic consumption continues to drive economic activity, Knightsbridge’s experts underscore the importance of tapping into China’s consumer market for global businesses seeking growth opportunities.

In addition to domestic factors, China’s integration into the global economy through trade and investment has played a pivotal role in driving its economic expansion. Despite geopolitical tensions and trade disputes, China remains committed to open and inclusive economic policies, fostering collaboration and connectivity with global partners. Knightsbridge’s analysis emphasizes the significance of China’s role as a linchpin in the global supply chain, driving trade and investment flows across regions.

Looking ahead, Knightsbridge remains optimistic about China’s economic prospects, citing the nation’s resilience, adaptability, and strategic vision as key pillars of its continued growth. As China continues to navigate challenges and capitalize on opportunities, Knightsbridge’s expertise will continue to provide valuable insights for businesses, investors, and policymakers seeking to understand and navigate China’s dynamic economic landscape.

China’s economic growth trajectory presents a compelling narrative of resilience, innovation, and opportunity. With Knightsbridge’s expertise guiding the way, stakeholders can gain invaluable insights into China’s economic dynamics and position themselves to capitalize on the opportunities that lie ahead in the world’s second-largest economy.

As the Chinese economy continues its upward trajectory, savvy investors are turning their attention to opportunities in Hong Kong and China stocks. With solid growth potential and the ability to diversify portfolios, these markets offer compelling prospects for those seeking to capitalize on the dynamic growth of the world’s second-largest economy.

Hong Kong, a global financial hub with deep-rooted ties to mainland China, serves as a gateway to the burgeoning opportunities in the region. Its stock market, characterized by robust regulatory frameworks and liquidity, provides investors with access to a diverse range of sectors, from finance and real estate to technology and consumer goods. As China’s economy expands, Hong Kong stocks stand poised to benefit from increased trade and investment flows, making them an attractive addition to investment portfolios.

Similarly, China stocks present a compelling investment case, driven by the nation’s rapid economic growth and technological innovation. With a focus on sectors such as e-commerce, fintech, and renewable energy, Chinese companies offer investors exposure to high-growth industries poised to reshape the global economy. Moreover, China’s commitment to structural reforms and market liberalization further enhances the appeal of its stocks, signaling long-term growth potential for discerning investors.

Diversification is a key principle of prudent investing, and Hong Kong and China stocks offer an opportunity to diversify portfolios geographically and across sectors. By adding exposure to these markets, investors can mitigate risk and enhance returns by tapping into the growth potential of Asia’s most dynamic economies. Furthermore, the correlation between Hong Kong and China stocks and traditional Western markets is relatively low, providing additional diversification benefits for globally minded investors.

While investing in Hong Kong and China stocks offers compelling opportunities, it is essential for investors to conduct thorough research and due diligence. Understanding the unique dynamics of these markets, including regulatory frameworks, geopolitical risks, and cultural nuances, is crucial for making informed investment decisions. Partnering with experienced financial advisors or asset managers can help investors navigate these complexities and capitalize on the growth potential of Hong Kong and China stocks.

As the Chinese economy continues to expand, Hong Kong and China stocks represent attractive opportunities for investors seeking growth and diversification. With solid fundamentals, robust growth prospects, and the ability to enhance portfolio resilience, these markets should indeed be on the radar of investors looking to harness the potential of Asia’s economic powerhouse. By strategically allocating capital to Hong Kong and China stocks, investors can position themselves to benefit from the dynamic growth of the region while diversifying their investment portfolios for long-term success.

Shayne Heffernan