A significant portion of the daily trading volume in CAUD consists of short selling and there are plenty of positive corporate developments, this does create the potential for a short squeeze.

Shorting, or short selling, is indeed a common practice on the Nasdaq and other stock exchanges. Short selling involves selling shares of a security that the seller does not own, with the expectation that the price of the security will fall. The short seller aims to buy back the shares later at a lower price, making a profit from the price difference.

Here are key points about short selling on the Nasdaq:

- Mechanics of Short Selling: In a short sale, an investor borrows shares from a broker and sells them on the open market. The investor is then required to buy back the same number of shares to return to the lender. If the stock price has fallen, the short seller profits from the difference.

- Short Interest Data: The Nasdaq, like other major stock exchanges, provides data on short interest. Short interest refers to the total number of shares that have been sold short but not yet covered or closed out. This information is usually updated regularly and can be viewed by investors.

- Risk and Reward: While short selling can be profitable if the stock price declines, it comes with significant risks. If the stock price rises, short sellers may incur losses, and their potential losses are theoretically unlimited.

- Market Dynamics: Short selling is a fundamental aspect of market dynamics. It contributes to price discovery, liquidity, and can act as a counterbalance to overly optimistic market sentiments. However, excessive short selling in a particular stock can also create conditions for a short squeeze.

- Short Squeezes: A short squeeze occurs when a heavily shorted stock experiences a rapid price increase. As short sellers rush to cover their positions to limit losses, the buying pressure further drives up the stock price, creating a feedback loop. Short squeezes can be triggered by positive news, strong earnings, or other factors that prompt a reevaluation of the stock’s value.

Investors should be aware of short interest levels when considering stocks for investment. Additionally, market participants closely monitor short interest data as it can influence stock price movements and contribute to overall market dynamics.

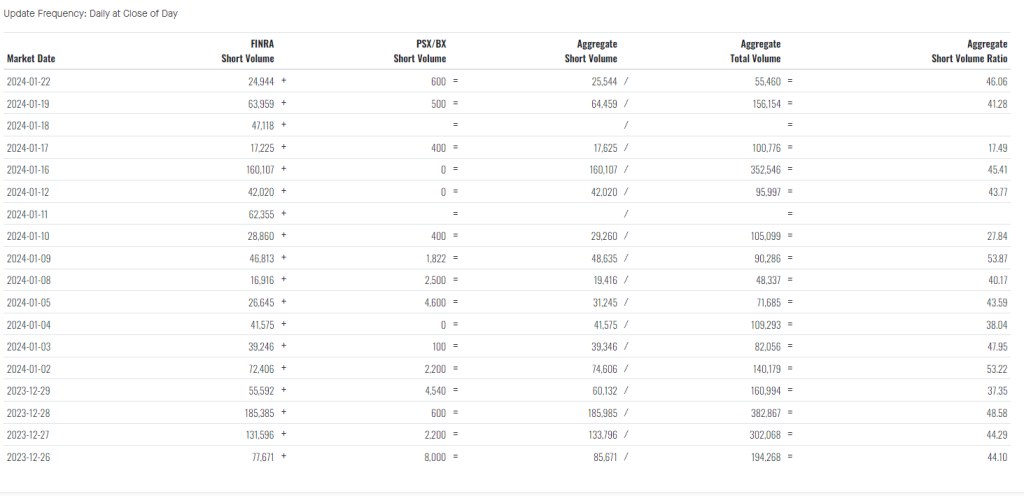

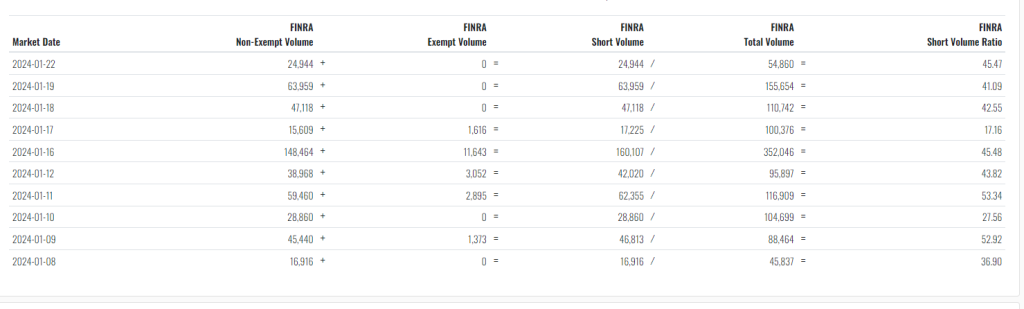

The CAUD Short Facts

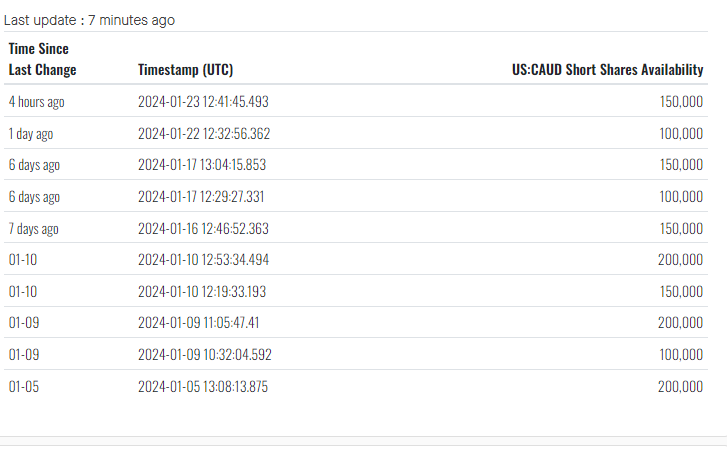

This table shows the number of shares of US:CAUD available to be shorted at a leading prime brokerage. It is not the total number of shares available to short, nor is it the short interest.

It does not include data from other brokers or dark pools. It is a small sample, and it is useful for tracking the rise and fall in demand for shares throughout the day and weeks. It should not be treated as an absolute number of shares that are available to short in the market.

Despite persistent short activities on CAUD, the company is building positive momentum with a series of strategic appointments. Peter Bordes brings a wealth of experience and expertise to the Collective Audience team, signaling potential upside. The company’s focus on data-driven marketing and end-to-end solutions positions it for growth in the evolving digital advertising landscape.

With over 30 years of experience, Peter Bordes has been a driving force in disruptive innovation across various sectors, including artificial intelligence, big data, fintech, cybersecurity, digital media, advertising, and next-generation digital infrastructure technology. His extensive board directorships include Beasley Broadcast Group (Nasdaq: BBGI), Fraud.net, BeeLine, Fernhill MainBloq (OTC: FERN), GoLogiq, Inc. (OTC: GOLQ), Logiq, Inc. (OTC: LGIQ), and MediaJel, among others.

Short Squeeze

A short squeeze is a market phenomenon where a heavily shorted stock experiences a rapid and sharp increase in its price, often forcing short sellers to cover their positions by buying shares. This sudden surge in buying activity, especially by short sellers attempting to limit their losses, can lead to a cascade effect, pushing the stock’s price even higher.

Here’s how a short squeeze typically unfolds:

- High Short Interest: Short interest refers to the total number of shares that have been sold short by investors, betting that the stock’s price will decline. When a stock has a high level of short interest, it means there are a significant number of investors anticipating a price drop.

- Positive Catalyst: A positive catalyst, such as strong earnings, favorable news, or strategic corporate developments, triggers a surge in buying interest. This positive development contradicts the expectations of short sellers, prompting them to reconsider their positions.

- Rapid Price Increase: As buyers, including short sellers trying to limit losses, rush to purchase shares, the increased demand causes the stock price to rise rapidly. The upward momentum can trigger stop-loss orders set by short sellers, leading to further buying.

- Forced Covering: Short sellers, facing mounting losses, may be compelled to cover their positions to limit potential damage. To do this, they need to buy shares in the open market. The collective buying activity from short sellers covering their positions further accelerates the price increase.

- Feedback Loop: The rising stock price can create a feedback loop, as more short sellers are forced to cover, attracting additional buyers. This positive feedback loop can result in a self-reinforcing cycle of higher prices.

Example: Volkswagen Short Squeeze (2008): One of the most famous short squeezes occurred with Volkswagen (VW) in 2008. Porsche, which had quietly accumulated a significant stake in VW, disclosed its ownership, catching the market off guard. This triggered a massive short squeeze as short sellers scrambled to cover their positions. VW’s stock price skyrocketed, and in a matter of days, it became the world’s most valuable company by market capitalization.

Caution: Risks and Volatility: While short squeezes can lead to substantial gains for investors, they also pose risks. The volatility during a short squeeze can be extreme, and investors need to carefully manage their risk. Additionally, the dynamics of a short squeeze can be unpredictable, and not all heavily shorted stocks experience this phenomenon. Traders should exercise caution and conduct thorough research before participating in such situations.

Collective Audience, a U.S.-based provider of e-commerce and digital customer acquisition solutions, is positioned as a key player in simplifying digital advertising. The company’s digital marketing business includes a holistic, self-serve AdTech platform and a proprietary data-driven, AI-powered system, enabling brands and agencies to advertise across leading digital media and connected TV platforms.