The US debt ceiling is a sign of systemic economic problems and currency instability, which increase the appeal of Bitcoin as an alternative store of value and medium of exchange. As the US government continues to accumulate debt and face political gridlock over raising the debt ceiling, investors will lose faith in traditional currencies and seek out alternative assets like Bitcoin.

Bitcoin’s decentralized and deflationary design makes it an ideal hedge against inflation and currency devaluation, which will occur if the US government continues to borrow money to fund its spending programs. Bitcoin’s limited supply and fixed issuance schedule, which means that unlike fiat currencies, it cannot be subject to inflationary policies or quantitative easing.

Over the past few months, KXCO have been reevaluating the goals and objectives of FBX. After careful consideration and feedback from the community, KXCO have decided to pivot the focus towards a new direction, Bitcoin.

As a result, KXCO will be rewriting the whitepaper to reflect these changes and to provide more clarity on the new direction. This whitepaper will outline a new vision for FBX, including goals, objectives, and roadmap for the future.

While KXCO cannot reveal too much at this time, they did say that the new direction will be focused on providing a more secure and accessible base for users. KXCO believe that this new direction will better enable KXCO to achieve the long-term goals for FBX.

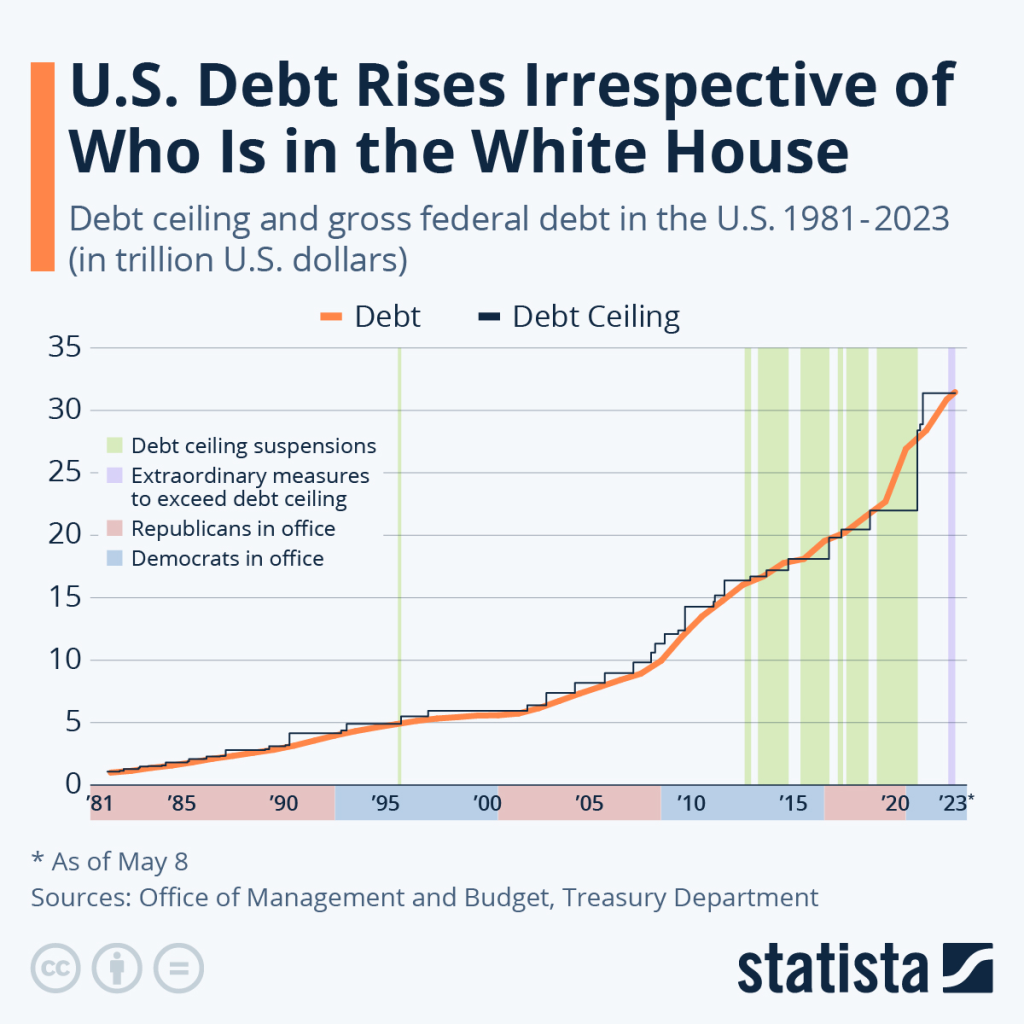

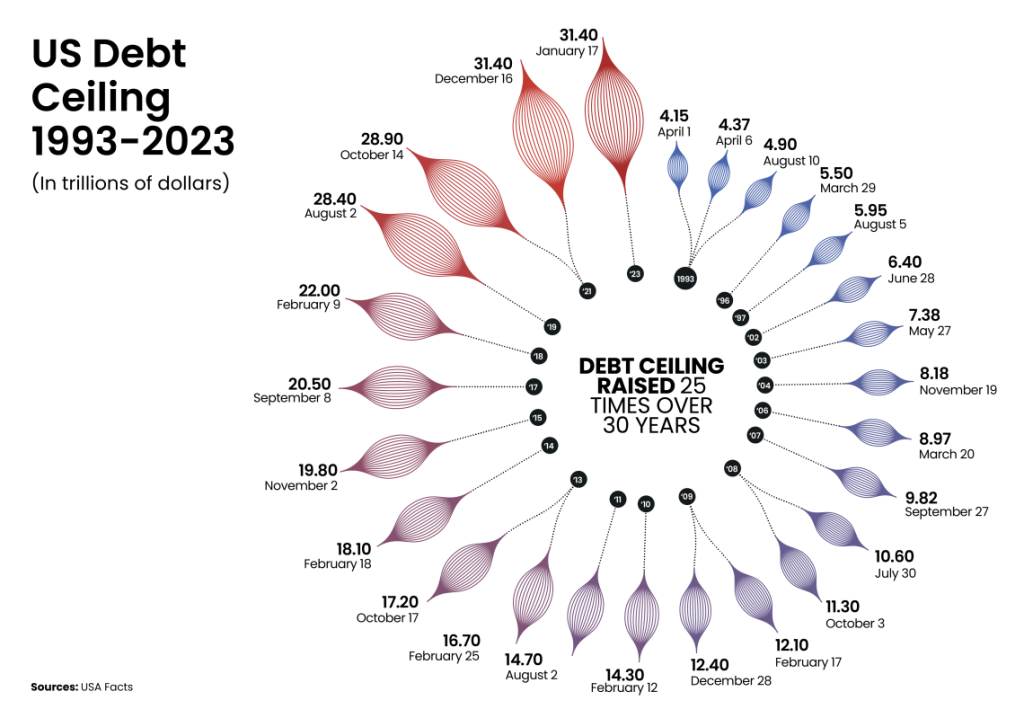

The US debt ceiling is set by Congress through a legislative process. The debt ceiling is a limit on the total amount of debt that the federal government can accumulate, including both public debt held by individuals, corporations, and foreign governments, as well as debt held by government trust funds like Social Security and Medicare.

The debt ceiling is typically set as a dollar amount, and it is established through a separate piece of legislation from the budget. Congress must pass a law to increase the debt ceiling whenever the government approaches the limit. Failure to raise the debt ceiling can result in a government shutdown or a default on US debt obligations, which could have severe economic consequences.

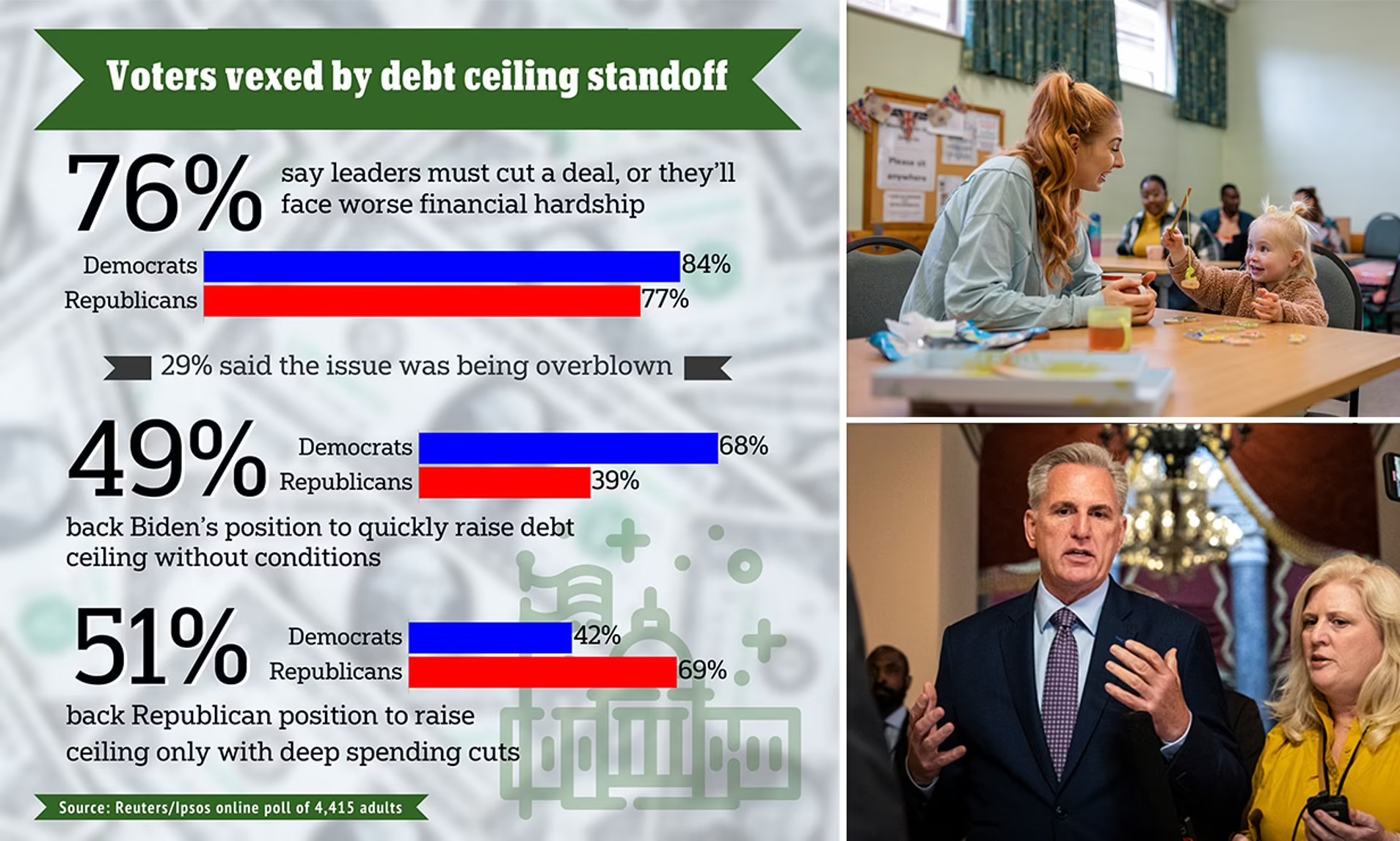

While the debt ceiling has been raised many times over the years to accommodate the government’s growing debt, it has also been a source of political controversy and debate, with some lawmakers advocating for spending cuts or other measures to reduce the government’s debt before raising the limit.

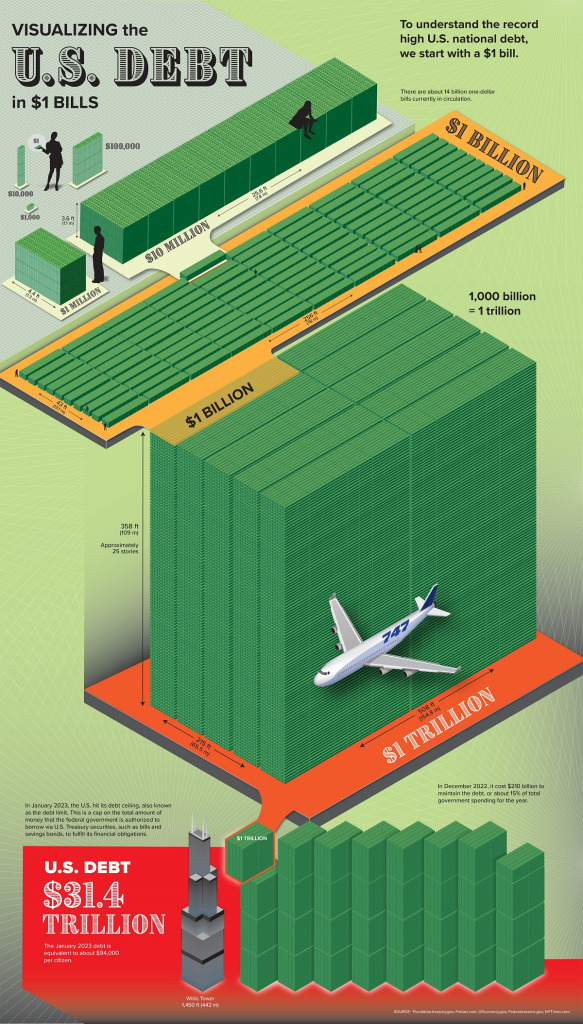

Washington must lift its $31.4 trillion borrowing limit by June 1, according to Janet Yellen.

Failure to avert a debt default in the US could have far-reaching consequences for the American and global economies, Treasury Secretary Janet Yellen warned on Tuesday. In remarks made to the Independent Community Bankers of America trade group, she noted that “time is running out” for Congress to lift the country’s $31.4 trillion borrowing limit.

US President Joe Biden and the Republican-controlled House of Representatives have been at an impasse over the issue for months, despite the Treasury’s repeated warnings that unless the ceiling is lifted, the US could face its first-ever default on June 1.

“Every single day that Congress does not act, we are experiencing increased economic costs that could slow down the US economy… It is essential that Congress act as soon as possible… A US default would generate an economic and financial catastrophe,” Yellen warned, adding that her department is close to running out of the emergency accounting measures it has been implementing in recent months to stave off the default.

According to the senior official, a default would stall the country’s economic progress and create an “unprecedented economic and financial storm.” It would lead to a loss of income, trigger a recession in the US, and damage the global economy.

“The US Treasury market serves as the very bedrock of the global financial system… The world has never doubted that America will pay the principal and interest on its bonds, in full and on time… A default would crack open the foundations upon which our financial system is built,” Yellen stated. She added that this, in turn, would lead to “worldwide panic, triggering margin calls, runs, and fire sales.”

President Biden is scheduled to meet Republican House of Representatives Speaker Kevin McCarthy and three other top congressional leaders to discuss a possible deal to raise the borrowing limit later on Tuesday.

Buy FBX