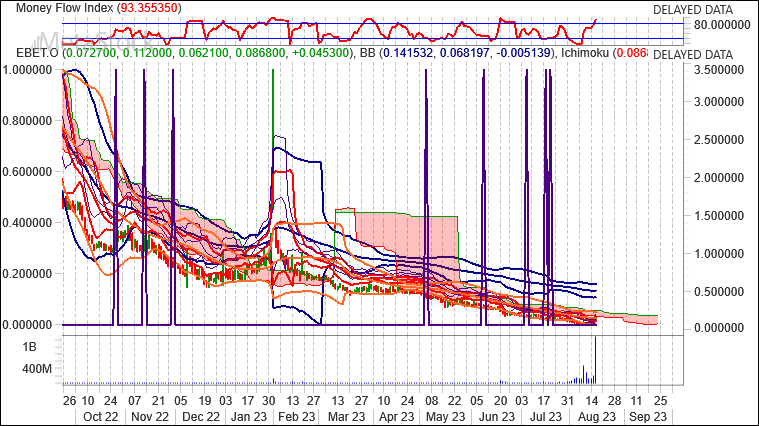

Ebet’s stock price rallied today, but the this was not related to its quarterly earnings report. It is more likely that it may be making progress in its strategic review, but it did not provide any details. We would expect some retracement today but it really all depends on news.

- The company’s stock price has been declining in recent months, and the latest earnings report is likely to have further weighed on the stock.

- Ebet is a relatively new company, and it is still facing challenges in its efforts to become profitable.

- The company is facing competition from other online gambling companies, and it is important for Ebet to differentiate itself from its rivals.

- Ebet is also facing regulatory challenges in some jurisdictions, and this could further impact its business.

Ebet’s Q2 results showed a significant decline in revenue, from $18.17 million in Q2 2022 to $7.97 million in Q2 2023. The company’s gross profit also declined, from $7.25 million to $3.77 million.

The company’s loss from operations ballooned to $34.73 million, from $6.99 million in the same period last year. Ebet attributed this to the loss of its German operations, which were shut down by the gaming regulatory authority on May 7, 2023. The company had received the notice to shut down on April 25, 2023, and was unable to appeal the decision.

The German operations had contributed $9.69 million in revenue in the nine months to June 30, 2023. Ebet said that the cessation of these operations had adversely affected its business and that it would need to raise additional funding.

The company also noted that a significant and prolonged decrease in consumer spending on entertainment or leisure activities would negatively affect the demand for its products and services, reducing its cash flows and revenues.

Overall, the rewritten text provides a more concise and accurate summary of Ebet’s Q2 results. It also highlights some of the challenges that the company is facing, and it provides some context for the recent rally in the company’s stock price.

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 57.3833. This is not an overbought or oversold reading. The last signal was a buy 4 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 54.30. This is not a topping or bottoming area. However, the RSI just crossed above 30 from a bottoming formation. This is a bullish sign. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 0 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 140.This is an overbought reading. However, a signal isn’t generated until the indicator crosses below 100. The last signal was a buy 5 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 3 period(s) ago.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bearish

Long Term: Unknown

Summary

EBET INC ORD(Trade Price) gapped up today (bullish) on heavy volume. Possibility of a Breakaway Gap which usually signifies the beginning of a major market move. Four types of price gaps exist – Common, Breakaway, Runaway, and Exhaustion. Gaps acts as support/resistance.

EBET INC ORD(Trade Price) is currently 79.6% below its 200-period moving average and is in an downward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods. There is a good possibility that volatility will decrease and prices will stabilize in the near term. Our volume indicators reflect very strong flows of volume into EBET.O (bullish). Our trend forecasting oscillators are currently bearish on EBET.O and have had this outlook for the last 70 periods.

Shayne Heffernan