Inflation and Crypto are strange bedfellows, although Crypto is viewed as outside of traditional finance inflation still has a role to play in valuations. Inflation affects the value of all currencies, including cryptocurrencies. Inflation can cause the value of cryptocurrencies to decrease as the purchasing power of fiat currency increases, making it more expensive to buy and sell cryptocurrencies. Additionally, inflation can also cause market volatility as it affects the demand and supply of cryptocurrencies, causing prices to fluctuate.

The best crypto to hold in inflation is Bitcoin (BTC). Bitcoin is the most widely-adopted cryptocurrency in the world and has proven to be a reliable store of value during periods of inflation. Additionally, its decentralized nature makes it resistant to government interference and manipulation, which makes it a great asset to hold during periods of inflation. Other cryptos, such as Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), FBX by KXCO (FBX) are also great options for holding during periods of inflation.

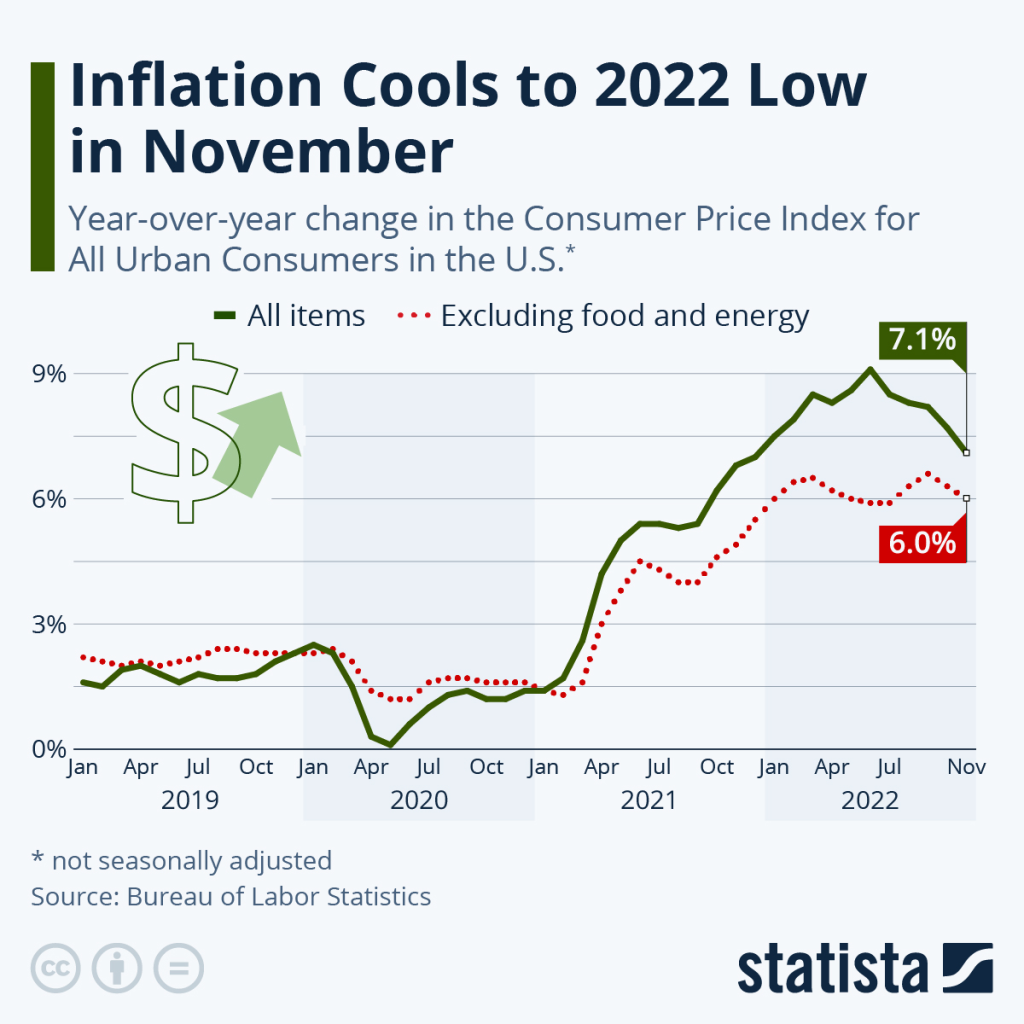

Inflation is a sustained increase in the general level of prices for goods and services in an economy over a period of time. It is measured as an annual percentage increase. Typically, as inflation rises, each unit of currency buys fewer goods and services. As a result, inflation erodes the purchasing power of money.

Inflation is caused by a variety of factors, including an increase in the money supply, a decrease in the supply of goods and services, an increase in government spending, an increase in taxes, and an increase in demand for goods and services. Inflation can also be caused by unexpected events, such as natural disasters and wars, which can disrupt the supply and demand of goods and services.

In the United States, inflation is managed by the Federal Reserve. The Federal Reserve is responsible for setting monetary policy and managing the money supply. This includes setting interest rates, which can be used to slow down inflation and raise interest rates to combat deflation. The Federal Reserve also has the power to buy and sell securities to influence the money supply, which can also be used to manage inflation.

- Inflation is an increase in the general level of prices of goods and services over a period of time: the inflation rate is the annualized percentage change in the general price index (consumer price index)

- When prices increase we have less money at our disposal to buy goods and services: inflation reflects a reduction in our purchasing power

- If we lose purchasing power we buy less; and if we all buy less companies shut down and people lose their jobs

- Printing money so we all can continue buying and keep our jobs is not the solution; in fact, it’s like adding wood to the fire: an increase in circulating money can cause an increase in the demand of a certain good or service, the price of which will increase because offer will not meet demand levels

- Without external controls, inflation generates inflation in an upward spiral: an increase in prices causes us to lose purchasing power, so we’ll want to earn more which causes production costs to increase, so prices will increase causing us to lose again purchasing power

Investing in a High Inflation Environment

1. Invest in Assets That Outpace Inflation: Investing in assets such as stocks, bonds, and real estate can help you stay ahead of inflation.

2. Save in Tax-Advantaged Accounts: Tax-advantaged accounts such as 401(k)s, IRAs, and HSAs can help you save and invest for retirement, as well as shield your savings from inflation.

3. Diversify Your Savings: Having your money in different types of accounts and investments can help you protect your savings from inflation.

4. Use a High-Yield Savings Account: Putting your money in a high-yield savings account can help you earn more than the rate of inflation.

5. Buy Inflation-Protected Securities: U.S. Treasury inflation-protected securities (TIPS) are a type of bond that are linked to the Consumer Price Index, helping to protect your savings from inflation.

FBX Inflation and Crypto

KXCO, the crypto exchange for grown ups, has come up with a new DeFi product which is called Simple Earn for users to store their assets and make passive income with 8 to 14% annualized return rate.

KXCO has over a century of Wall Street trading experience on the team, covering firms like Bear Stearns, Paine Webber, UBS Securities, Merrill Lynch, Bank of New York, T Rowe Price, Blackrock, PwC, Emirates Capital, Ernst & Young, Gruntal, Ladenburg Thalmann, Balfour, Credit Suisse holding positions like Vice President, Director, etc. KXCO has 50+ indicators of proprietary research and has direct access to over 600,000 securities in over 200 markets.

Although it has been almost a month since the FTX collapse happened, its effect could be long lasting making the already cool crypto winter freezing cold. Before the market sees any obvious signal of recovery, it seems the best strategy now for traders is to HODL. However, it is also a waste to sit on the asset without doing anything since money has time value.

Given the above, KXCO has developed the Simple Earn product where users can lock their coins or tokens safely and get interest. So, not only can users shield their assets from risks during such a bearish market but also can enjoy appreciation.

The KXCO Simple Earn product is very simple. Users can choose the locked product of their preferences and subscribe the amount they want to as long as there’s enough remaining quota.

After users have subscribed to the specific KXCO Simple Earn product, the interest will start to accrue at 16:00 UTC on the next day. APYs for each product can be slightly different, but overall they fluctuate around 8 to 14% which is much higher than peer products right now in the industry.

Users can redeem their assets once it reaches the end of the term of their subscribed products. The principal and interest will be automatically transferred to the users’ funding account at 16:00 UTC on the redemption day.

For users who are struggling where to put their coins or tokens to cope with the current market, the KXCO Simple Earn product is here to offer safety, stability, and profits.

For more information, please visit:https://www.kxco.io/deposits.php

KXCO spans the entire blockchain ecosystem ranging from a unique sophisticated blockchain with unique features (KXCO Armature™), to a Centralised-Decentralised-Exchange (KXCO Exchange) run by expert traders, to our own wallet, Metaverse and other services.

Built by a team of experienced traders, gaming specialists and IT engineers with an entrepreneurial spirit, the KXCO™ was founded in 2017 and built with a mission to create a unique ecosystem for the financial savvy user.

Our operations span across the entire blockchain value chain cantered around our proprietary KXCO™ Blockchain.

We operate on a continuous basis 24/7 with a presence around of the world.

KXCO, the Organization behind the FBX Cryptocurrency, announced plans to move FBX to the KXCO Armature in the 1st half of 2023 further advancing the capabilities of FBX the inflation-resistant store of value that can be used as peer-to-peer digital cash.

Designed to solve the systemic risk of the crypto industry’s odd reliance on centralized Fiat denominated stablecoins and other dollar substitutes in decentralized finance, KXCO developed FBX to be a freely tradeable currency that can maintain a base value under stress without interventional bailouts.

FBX will be built on KXCO Armature, a proprietary blockchain that was developed to handle complex financial transactions and is using a proof-of-Authority validation concept.

The KXCO Armature was built with KYC, AML, and Banking regulations in mind with a focus on the speed of transactions.