FBX understands managing your money is an essential skill to have in life because it allows you to make the most of your income and better prepare for your financial future.

Having a sound financial plan and budget can help you save for future goals, reduce debt, and avoid financial pitfalls.

Managing your money also makes it easier to plan for and pay for unexpected expenses. It can also help you make smarter decisions about which purchases are the most important and which ones can wait.

By learning to manage your money properly with FBX, you can improve your financial security and ensure that your finances remain in good health.

FBX Money The 50/30/20 Rule

The 50/30/20 Rule is a budgeting rule that suggests allocating 50% of one’s income to essential expenses, 30% to discretionary expenses, and 20% to savings.

The rule suggests that 50% of one’s income should be spent on necessities such as rent, food, transportation, health care, and utilities.

30% should be spent on discretionary items such as entertainment, clothing, and hobbies.

Lastly, 20% should be saved for retirement, paying off debt, or investing.

The 50/30/20 Rule is a helpful framework for budgeting, as it ensures that one is prioritizing both their needs and their long-term financial goals.

Using a Savings Calculator

A savings calculator is a useful tool for determining how much money can be saved by investing a certain amount of money over a set period of time.

It can be used to help plan for retirement, calculate compound interest, or just determine how much money can be saved by investing a certain amount each month.

The calculator typically requires users to enter information such as the amount of money being invested, the frequency of payments, the interest rate, and the length of time the money will be invested.

The calculator then calculates the total amount of money that can be saved over the specified period of time.

How Does Inflation Effect My Savings?

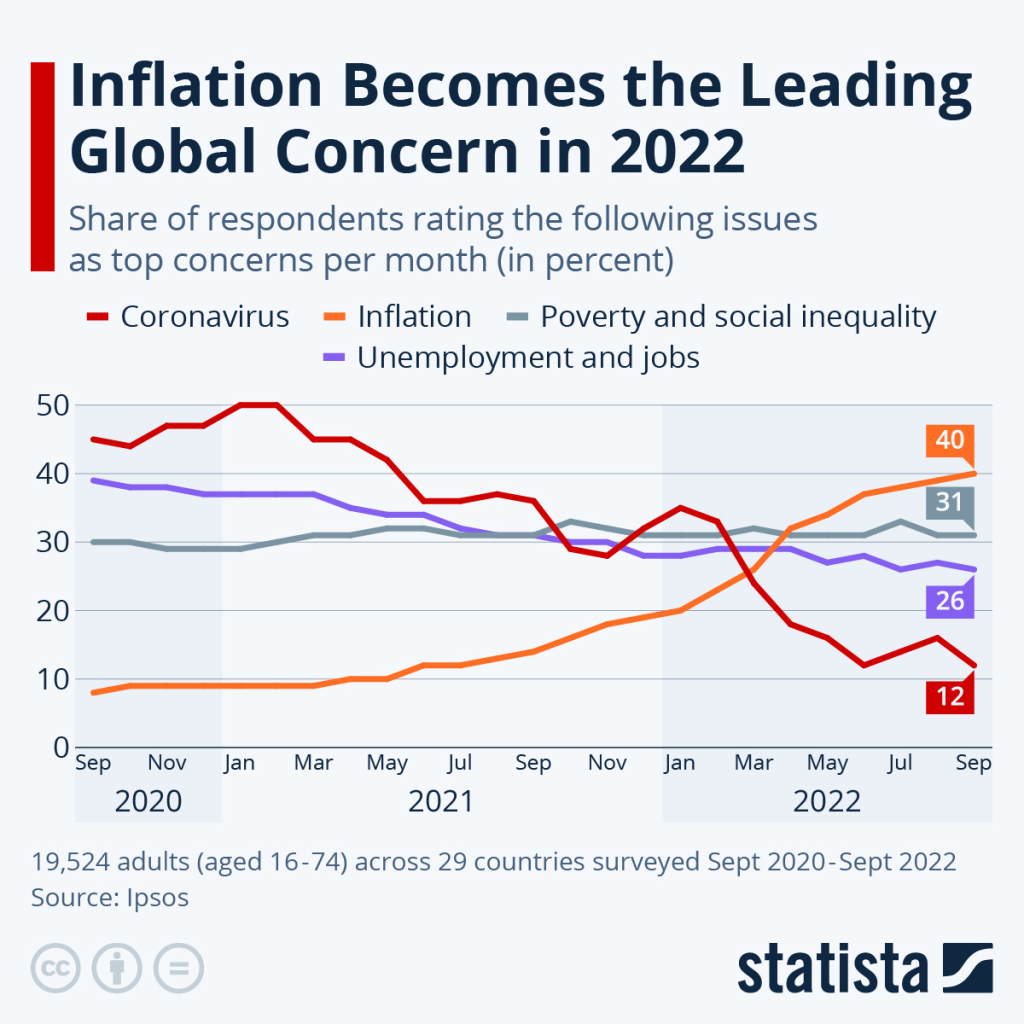

Inflation affects your savings in two ways.

First, it erodes the purchasing power of your money.

This means that the same amount of money will buy you fewer goods and services as time passes and inflation rises.

Second, it lowers the real rate of return on your savings.

This means that the rate of return on your savings, adjusted for inflation, is lower than the nominal rate of return. As a result, your savings are not growing as quickly as they would if inflation were not a factor.

How Much is Safe to Invest in Crypto ?

FBX and KXCO have the following advice on this hotly discussed topic.

There is no one-size-fits-all answer to this question since each individual has different financial goals, risk tolerance and investment goals. Generally speaking, it is recommended that individuals only invest an amount of money they are comfortable with and can afford to lose.

Additionally, investment experts typically recommend that individuals only invest up to 5-10% of their overall investment portfolio in cryptocurrencies.

As with any investment, it is important to do your own research and understand the associated risks before investing.

Crypto is a very wide landscape, not all Crypto was created equal, here are some warning signs.

1. Unrealistic promises of high returns: Promises of high returns on investments should be treated with caution, as they are often made by scammers to entice people to invest in their scheme.

2. Spam: If someone contacts you out of the blue offering to sell you cryptocurrency or to invest in a crypto-related project, it’s likely a scam.

3. Unverified team members: A legitimate company should be able to provide information about its team members, such as their name, qualifications and experience. If there is no information available, it’s likely a scam.