#Ferrari #ownership

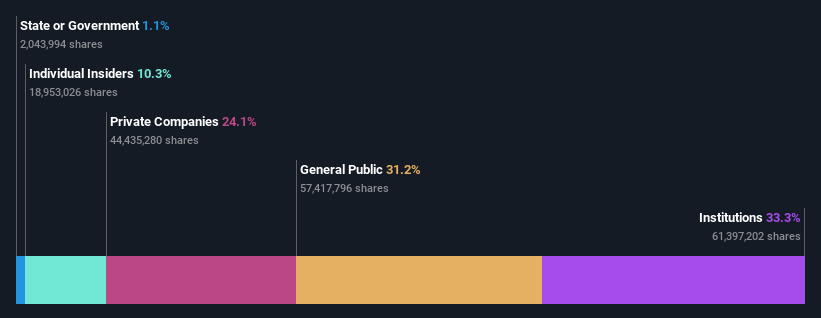

A look at the shareholders of Ferrari (NYSE:RACE) can tell us which group is most powerful.

Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones.

We like businesses with enduring competitive advantages that is run by savvy owner-oriented people. Ferrari has strong insider ownership, and management is owner-oriented to the extreme.

With a market capitalization of $54-B+, Ferrari is a large luxury goods company. So, we expect to see institutional investors on the shareholder list.

Companies of this size are usually very well known to retail investors, too. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company.

Here is a look at the different ownership groups, to learn more about Ferrari.

Institutions measure themselves against a benchmark when reporting to their own investors.

Ferrari has a strong institutional presence in its share registry, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it.

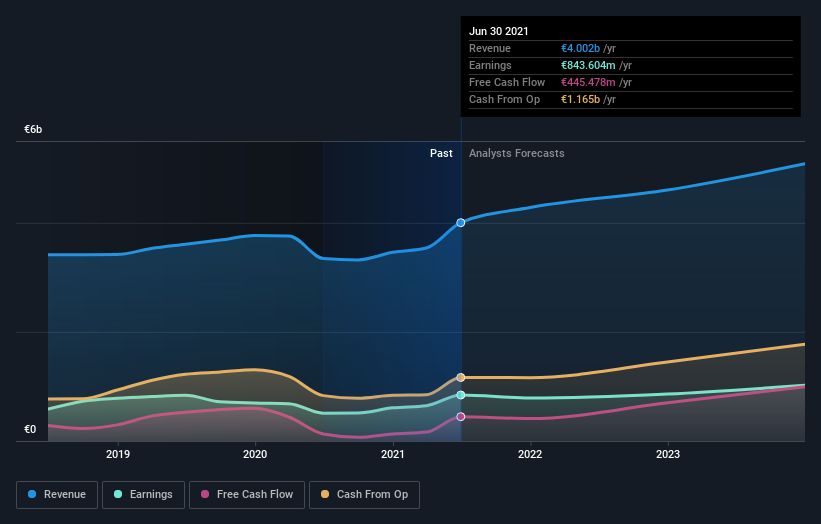

It is worth checking the past earnings trajectory of Ferrari. Keep in mind that there are other factors to consider as well.

Ferrari is not owned by hedge funds. Giovanni Agnelli B.V. is currently the company’s largest shareholder with 24% of shares issued and outstanding. The 2nd and 3rd largest shareholders, hold 10% and 5.6%, of the shares issued and outstanding, respectively.

Notably 8 of the Top shareholders account for roughly 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock’s expected performance.

Quite a few analysts cover the stock, so you could look into forecast growth easily.

With a 31% ownership, while considerable, the public may not own enough to change company policy if the decision is not in sync with other large shareholders.

Private Companies own 24% of the shares on issue. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Below is my take and it has been Bullish to Very Bullish since the IPO on 20 October 2015.

Ferrari is The Aristocrat of the automotive sector.

Ferrari finished Friday at 224.42 within its 52 wk range of 127.73 – 233.66 in NY. It’s all time high in NY was marked at 233.66 intraday on 29 December. RACE is now just 4.27% shy of its all time high.

Key technical indicators have turned Bullish mid-to long term. The candlestick pattern indicates the confirmation of the break out at 196.01 on 3 November and confirmed.

The Key support is at 223.51 and the Key resistance is at 225.88. The 12 October DOJI augurs the Bullish trend will continue. All of our Key technical indicators are flashing Very Bullish in here.

Friday, Morgan Stanley called out $RACE a “sleeper” EV play as the firm can justify more than 100% of the company’s value with its ICE business.

Note: At the beginning of Y 2020 I called RACE at 230 by year’s end, the stock was trading at 165.22 on 1 January 2020, on 29 December 2020 it marked 233.66 intraday, its all time high

The Maranello Outfit’s shares were raised to Buy from Hold at HSBC, and Buys at Morgan Stanley and Bank of America.

UBS is now calling the stock at 365. I have not seen any other Street downgrades.

Ferrari will continue to create value in the long term as it becomes the world’s 1st Super Luxury brand.

Ferrari is a quality 1st long term luxury products investment, BAML raised its call to 270 long term.

I have raised my long term target to 375, a Strong Bull call, the strongest on the Street and am holding the mark during this recent profit taking, and seeing RACE as a buying opportunity.

Ferrari has an average rating of Buy and a consensus target price at 231.99.

The Maranello Outfit’s shares were raised downgraded from Buy to Hold at HSBC.

Ferrari will continue to create value in the long term. Ferrari is a quality 1st long term luxury products investment, and I am calling it 375 long term, the Top on the Street, and adjusting it to 250/share short term.

A number of large investors have recently bought shares of RACE, and there have been very few instances of insider selling over the past yr that we have seen. And Ferrari continues to buy back its stock in here.

The stock is considered defensive in the sector.

Have a healthy, happy, prosperous weekend, Keep the Faith!