Amidst the glimmer of gold shops and the buzz of Spring Festival preparations, China’s younger generation is leading a resurgence in the country’s affinity for gold. With a significant uptick in gold consumption, particularly among the youth, the impact on global gold prices could be substantial.

The Gold Rush Phenomenon

According to the China Gold Association, gold consumption in China saw a remarkable increase in 2023, with the younger demographic, aged between 25 and 34, emerging as the driving force behind this surge. This demographic shift reflects changing attitudes towards gold, which is increasingly viewed as a safe-haven investment option with lower risks compared to other assets.

Fashion Meets Tradition: The China Chic Trend

Fueling this resurgence is the revival of the “China Chic” phenomenon, where traditional Chinese aesthetics are seamlessly blended with contemporary fashion. Jewelers are crafting innovative gold jewelry designs infused with traditional cultural elements, appealing to the aesthetic sensibilities of the younger generation. This fusion of tradition and modernity has captured the imagination of young consumers, driving demand for gold jewelry.

Investment Appeal of Gold

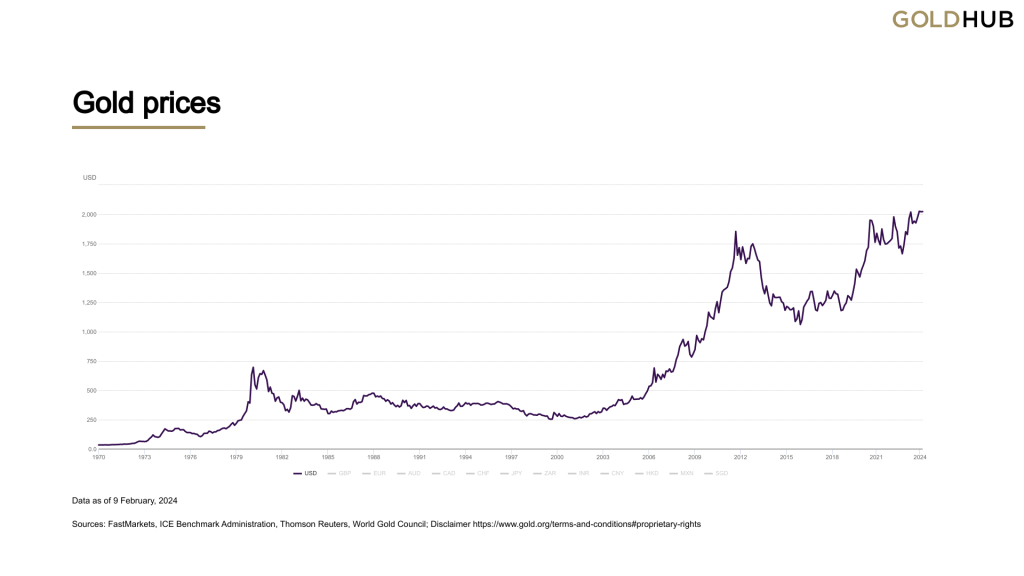

Beyond its ornamental value, gold is increasingly perceived as a sound investment option by Chinese youth. The relatively bullish performance of gold in recent years has bolstered its appeal as an investment commodity. This perception is reinforced by the enduring belief that gold retains its value over the long term, making it an attractive asset for wealth preservation.

Implications for Global Gold Prices

The growing appetite for gold among China’s younger generation has the potential to impact global gold prices. As demand for gold surges in the world’s largest consumer market, it could exert upward pressure on prices. This trend is further supported by the stable performance of gold prices and the anticipation of continued growth in the near future.

Looking Ahead

As China’s youth embrace gold both as a fashion statement and an investment vehicle, the implications for global gold markets are significant. The convergence of fashion trends, cultural heritage, and investment preferences is reshaping the dynamics of the gold market. With China’s youth leading the charge, the future of gold looks bright, with potential ripple effects felt across the global economy.

China’s Gold Appetite: A Comprehensive Look at its Impact on Global Prices

China’s influence on global gold prices extends far beyond its borders, encompassing a wide array of factors ranging from jewelry demand to central bank acquisitions. As the world’s largest consumer of gold, China’s actions and preferences play a pivotal role in shaping the dynamics of the global gold market.

Jewelry Demand: A Driving Force

One of the primary drivers of China’s impact on gold prices is its robust demand for gold jewelry. The Chinese culture has a deep-rooted affinity for gold, viewing it as a symbol of wealth, prosperity, and auspiciousness. As incomes rise and consumer spending increases, demand for gold jewelry in China continues to soar. This insatiable appetite for gold jewelry exerts upward pressure on global gold prices, particularly during festive seasons and special occasions such as weddings and festivals.

Investment Demand: A Safe-Haven Asset

In addition to jewelry demand, China’s growing middle class is increasingly turning to gold as an investment asset. With a penchant for wealth preservation and risk diversification, Chinese investors view gold as a reliable hedge against economic uncertainty and inflation. The rise of gold investment products, including gold bars, coins, and exchange-traded funds (ETFs), reflects the burgeoning demand for gold as a safe-haven asset in China. This investment demand contributes to the overall demand-supply dynamics of the global gold market, influencing prices on a macroeconomic scale.

Central Bank Reserves: Strategic Acquisitions

China’s central bank, the People’s Bank of China (PBOC), plays a strategic role in the global gold market through its gold reserve acquisitions. In recent years, China has been actively increasing its gold reserves as part of its diversification strategy and efforts to reduce reliance on the US dollar. The PBOC’s gold purchases not only signal confidence in gold as a store of value but also contribute to the accumulation of global gold reserves, impacting market sentiment and prices. As China continues to bolster its gold reserves, the market closely monitors its central bank’s actions for cues on future price movements.

Regional Dynamics: Asia’s Gold Hub

Furthermore, China’s position as a major gold hub in Asia amplifies its influence on regional gold prices. As a key player in the Shanghai Gold Exchange (SGE), China serves as a trading hub for physical gold transactions, setting price benchmarks that reverberate across Asian markets. The interconnectedness of Asian gold markets, coupled with China’s dominant role, underscores its significance in shaping regional and global gold prices.

China’s impact on gold prices transcends mere jewelry demand, encompassing investment trends, central bank acquisitions, and regional dynamics. As the world’s largest gold consumer and producer, China’s actions reverberate throughout the global gold market, influencing prices and market sentiment. Understanding China’s multifaceted role in the gold market is essential for investors and market participants seeking to navigate the complexities of the precious metals landscape.

The history of gold in China spans thousands of years, characterized by its cultural significance, economic importance, and enduring fascination with the precious metal. Here’s a comprehensive overview of the history of gold in China:

Ancient China: Cultural Significance

- Gold has held profound cultural significance in China since ancient times. It was regarded as a symbol of wealth, power, and auspiciousness, often associated with royalty, nobility, and deities.

- During the Shang Dynasty (c. 1600–1046 BCE) and subsequent dynasties, gold artifacts such as ornaments, jewelry, and ceremonial objects were crafted with exquisite skill and adorned with intricate designs, showcasing the craftsmanship and wealth of the ruling elite.

- Gold played a central role in religious ceremonies, imperial rituals, and burial practices, with elaborate gold objects buried alongside rulers and nobles to accompany them in the afterlife.

Gold as Currency: Economic Foundation

- Gold served as a form of currency and medium of exchange in ancient China, predating the invention of coins. Initially, gold was traded in the form of ingots, nuggets, and jewelry, valued for its rarity, durability, and intrinsic beauty.

- During the Zhou Dynasty (1046–256 BCE), standardized round gold coins known as “banliang” were introduced, marking the dawn of coinage in China. These coins, cast in various denominations, facilitated trade, commerce, and taxation, laying the foundation for China’s monetary system.

- The use of gold coins proliferated during the subsequent Han Dynasty (206 BCE–220 CE), with gold becoming an integral part of the monetary system alongside bronze, silver, and copper coins.

Dynastic Periods: Gold Artistry

- The Tang Dynasty (618–907 CE) witnessed a golden age of art and culture, with goldsmithing reaching new heights of sophistication and innovation. Gold ornaments, statues, and artifacts adorned palaces, temples, and imperial tombs, reflecting the opulence and grandeur of the era.

- The Song Dynasty (960–1279 CE) saw the emergence of intricate filigree and cloisonné techniques in goldsmithing, with artisans creating exquisite pieces of jewelry, decorative objects, and religious artifacts.

- Gold continued to be prized by emperors, nobles, and elites during the Ming (1368–1644 CE) and Qing (1644–1912 CE) dynasties, with the imperial court commissioning magnificent gold treasures, ceremonial items, and palace decorations.

Modern Era: Economic Resurgence

- In the 19th and 20th centuries, China experienced profound political, social, and economic transformations, culminating in the establishment of the People’s Republic of China in 1949.

- Following economic reforms and liberalization policies initiated in the late 20th century, China emerged as the world’s largest gold producer and consumer, fueling a resurgence of interest in gold investment, jewelry, and bullion.

- The Chinese government’s accumulation of gold reserves, expansion of the Shanghai Gold Exchange (SGE), and promotion of gold-backed investment products have cemented China’s position as a major player in the global gold market.

Contemporary Significance: Cultural Heritage and Economic Power

- Today, gold remains deeply ingrained in Chinese culture as a symbol of prosperity, good fortune, and cultural heritage. Traditional gold jewelry, wedding dowries, and auspicious gifts continue to hold significance in Chinese society.

- Economically, China’s insatiable demand for gold continues to drive global gold prices, influencing market dynamics, investment trends, and gold supply chains worldwide. China’s gold reserves, production capabilities, and consumer market play a pivotal role in shaping the future of the global gold industry.

The history of gold in China is a testament to its enduring legacy as a cultural icon, economic asset, and symbol of wealth and prestige. From ancient civilizations to modern economies, gold has remained an integral part of China’s identity and heritage, shaping its past, present, and future.

Shayne Heffernan