Historical Comparisons and Current Trends

The ratio is a key indicator that has long been used by investors to assess the relative value of gold compared to silver. This ratio is calculated by dividing the price of gold per ounce by the price of silver per ounce. Historically, the ratio has varied widely, reflecting shifts in market dynamics, economic conditions, and investor sentiment.

Historical Perspective:

Throughout history, the gold-silver ratio has fluctuated significantly. In ancient times, the ratio was often around 10:1, reflecting the natural abundance of silver relative to gold. However, over the centuries, various factors such as changes in mining technology, shifts in supply and demand dynamics, and monetary policies have influenced the ratio.

During the Middle Ages and the Renaissance period, the gold-silver ratio stabilized around 12:1 to 15:1 due to the adoption of bimetallic monetary systems. In the 19th century, the discovery of new silver deposits led to an increase in the global supply of silver, causing the ratio to rise to around 20:1 to 30:1.

Recent Trends:

In modern times, the gold-silver ratio has continued to fluctuate but has generally ranged between 40:1 to 80:1. However, there have been notable exceptions, such as in 1980 when the ratio reached an all-time high of over 100:1 during a period of extreme market volatility.

In recent years, the ratio has remained relatively high compared to historical levels. For example, in 2020, the ratio soared to over 100:1 in response to the COVID-19 pandemic and economic uncertainty. However, since then, the ratio has gradually declined as both gold and silver prices have rallied amid inflationary pressures and geopolitical tensions.

Current Levels and Implications:

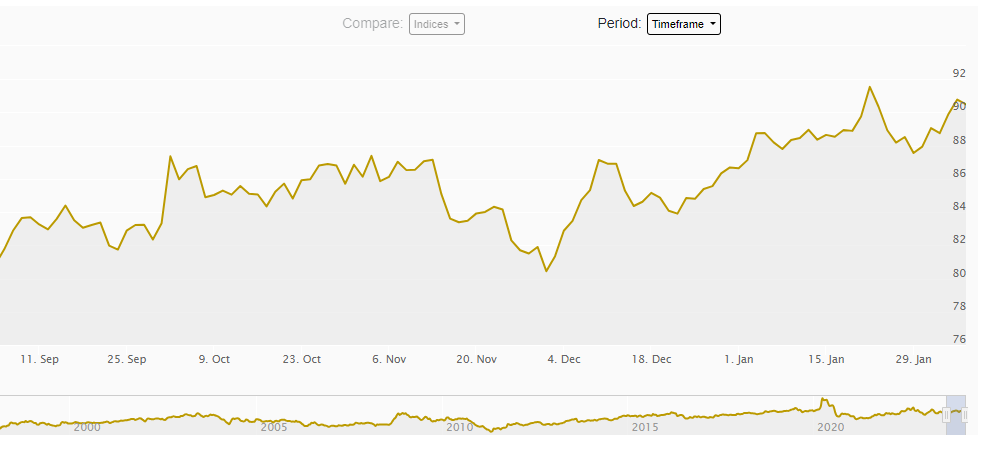

As of today, the gold-silver ratio stands at around 90, reflecting Silver entering the buy zone.

The gold / silver ratio. It’s simple: Take the price of an ounce of gold and divide it by the price of an ounce of silver. The resulting number is the gold / silver ratio.

The ratio is most useful at its extremes. When the ratio has topped 80, it has signaled a time when silver was relatively inexpensive relative to gold. Silver went on to rally 40%, 300%, and 400% the last three times this happened.

Some investors see a high gold-silver ratio as an indication that silver is undervalued relative to gold and may present buying opportunities. Others believe that the ratio may revert to historical norms over time, leading to potential gains for silver investors.

However, it’s essential to note that the gold-silver ratio is just one of many factors to consider when making investment decisions. Market fundamentals, macroeconomic trends, and geopolitical developments can all influence the prices independently of each other.

While the ratio provides valuable insights into the relative value of gold and silver, investors should conduct thorough research and analysis before making investment decisions. By understanding historical trends and current market dynamics, investors can make informed choices to capitalize on opportunities in the precious metals market.

Some of the largest silver mining companies listed on stock exchanges in the USA include:

- Pan American Silver Corp. (NASDAQ: PAAS): Pan American Silver is one of the largest primary silver mining companies in the world, with operations in Mexico, Peru, Argentina, and Bolivia.

- Hecla Mining Company (NYSE: HL): Hecla Mining is a leading silver producer with mines in the United States, Canada, and Mexico. The company also produces other precious and base metals.

- First Majestic Silver Corp. (NYSE: AG): First Majestic Silver is a Canadian silver mining company with operations primarily in Mexico. It is one of the largest pure-play silver producers globally.

- Coeur Mining, Inc. (NYSE: CDE): Coeur Mining is a diversified precious metals producer with mines in the United States, Canada, and Mexico. Silver accounts for a significant portion of its total production.

- Fortuna Silver Mines Inc. (NYSE: FSM): Fortuna Silver Mines is a Canadian-based precious metals mining company with mines in Peru, Mexico, and Argentina. Silver is one of its primary products.

- Endeavour Silver Corp. (NYSE: EXK): Endeavour Silver is a mid-tier silver mining company with operations in Mexico. It focuses on the exploration, development, and production of silver and gold.

A Precious Metal with Diverse Applications

Often overshadowed by its more glamorous counterpart, gold, plays a crucial and multifaceted role in the modern world. Beyond its traditional use as a store of value and adornment in jewelry, silver is an indispensable metal with a wide range of applications across various industries.

Industrial Applications:

A highly conductive metal, making it essential in the electronics industry. It is used in the production of electrical contacts, switches, and conductive pastes for solar panels and printed circuit boards. Its superior conductivity and resistance to corrosion make it an ideal material for ensuring the reliability and efficiency of electronic devices.

In addition to electronics, it is extensively utilized in the automotive industry for catalytic converters, which help reduce emissions from vehicles. Silver’s unique catalytic properties enable the conversion of harmful pollutants into less harmful substances, contributing to cleaner air and environmental sustainability.

Medical and Healthcare Uses:

Antimicrobial properties have been recognized for centuries, leading to its widespread use in medical and healthcare settings. Silver-based compounds and dressings are employed to prevent infections and promote healing in wounds and burns. Moreover, nanoparticles are being increasingly utilized in medical devices, such as catheters and surgical instruments, to reduce the risk of bacterial contamination and healthcare-associated infections.

Water Purification:

Silver’s ability to inhibit bacterial growth has made it a vital component in water purification technologies. Ions are incorporated into filters and membranes to disinfect water by neutralizing bacteria, viruses, and other pathogens. This application is particularly valuable in areas where access to clean drinking water is limited, helping to combat waterborne diseases and improve public health.

Renewable Energy:

As the world transitions towards renewable energy sources, silver’s role becomes even more critical. Silver is a key component in photovoltaic cells used in solar panels, where it helps convert sunlight into electricity efficiently. The demand for silver in the solar energy sector is expected to grow significantly as countries invest in solar power infrastructure to reduce carbon emissions and combat climate change.

Emerging Technologies:

Silver’s versatility extends to emerging technologies such as nanotechnology, where its unique properties enable innovations in areas like sensors, antimicrobial coatings, and electronic devices. In fields such as quantum computing and advanced materials science, nanoparticles hold promise for breakthroughs in computing power, data storage, and material design.

Silver’s importance in the modern world cannot be overstated. From its indispensable role in electronics, healthcare, and water purification to its contributions to renewable energy and emerging technologies, silver continues to drive innovation and progress across diverse industries. As society continues to evolve, the demand for silver is likely to grow, underscoring its status as a valuable and irreplaceable metal in the contemporary era.

Shayne Heffernan