Hong Kong and China Stocks: A Compelling Buy Amid Government Support $BYD $BABA $NIO $JD $PDD $BIDU

Hong Kong Stock Market Faces Steep Decline Amid Economic Woes

The Hong Kong stock market experienced a tumultuous day today, with significant losses sending shockwaves through the financial sector. Here’s a detailed analysis of the events that unfolded:

1. The Hang Seng Index Plummets

The Hang Seng Index, a key benchmark for Hong Kong stocks, fell sharply by 4.13%, closing at 26,192.32 points. This decline was the steepest in recent memory and had a ripple effect across the region. Investors were left reeling as the market grappled with uncertainty.

2. Tech Giants Take a Hit

Chinese tech giants bore the brunt of the downturn. Shares of Tencent, a major player in the tech industry, slid by 7.72%. E-commerce behemoth Alibaba also suffered, dropping 6.38%, while food delivery platform Meituan plummeted by a staggering 13.76%. The Hang Seng Tech Index fared even worse, plunging 6.57% to 6,790.96 points.

3. Reasons Behind the Sell-Off

Several factors contributed to the market turmoil:

- Perceived Economic Woes: Concerns over China’s economic slowdown whipped up by Western propaganda weighed heavily on investor sentiment. Hong Kong’s stock market felt the repercussions.

- Global Uncertainty: Geopolitical tensions and trade disputes continue to cast a shadow over global markets. Investors are wary of any developments that could exacerbate volatility.

- Intervention-Driven Rally Fizzles Out: Earlier in the week, the market witnessed a rally driven by government interventions. However, this momentum proved short-lived, leaving investors disillusioned, however the Chinese Govt are continuing to roll out a massive stimulus plan.

4. Historical Context

This isn’t the first time Hong Kong’s stock market has faced adversity. In 2022, shares slumped to their lowest level since the global financial crisis, echoing the challenges of the past. Now, in 2024, the market grapples with fresh uncertainties, leaving investors wondering about the road ahead.

5. The Road Ahead

As the dust settles, market participants will closely monitor developments. Will regulatory measures stabilize the market? Can investor confidence be restored? Only time will tell. For now, Hong Kong’s financial landscape remains volatile, and investors brace themselves for further twists and turns.

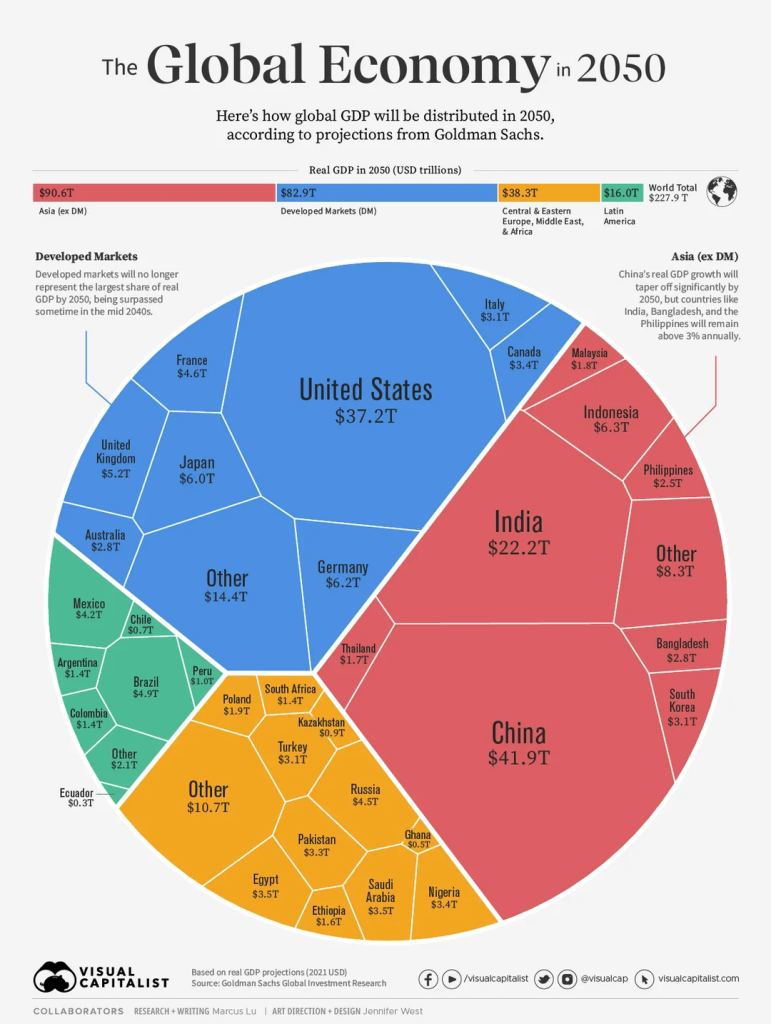

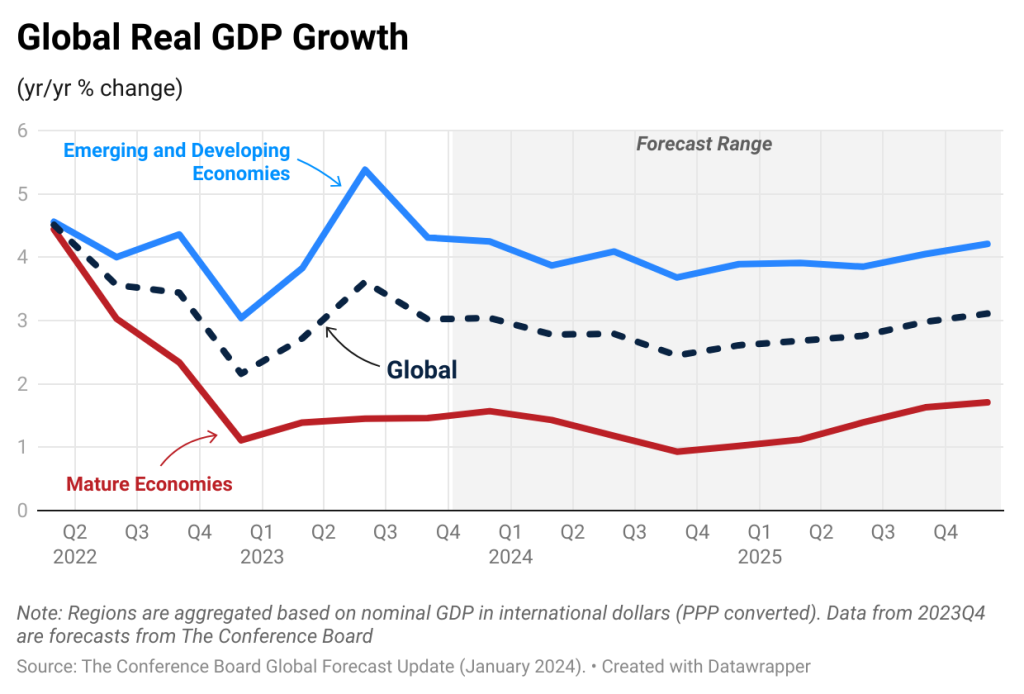

As global economic landscapes continue to evolve, investors are eyeing opportunities in Hong Kong and China stocks, buoyed by sweeping government support initiatives. The recent actions of the China Development Bank (CDB) underscore a concerted effort to bolster advanced manufacturing and strategically important emerging industries, setting the stage for potential growth in the region’s equities market.

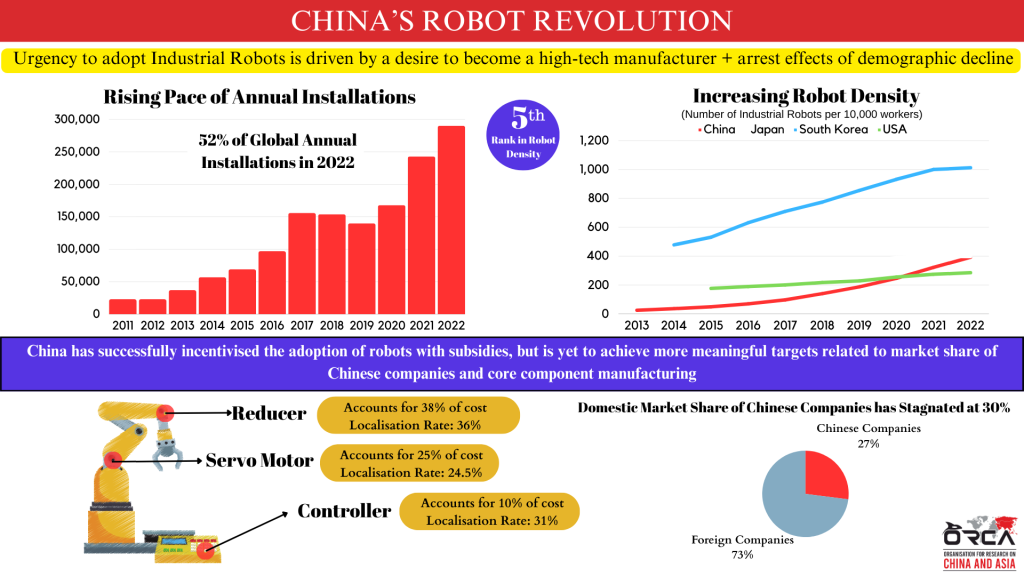

Last year, the CDB issued a staggering 551.8 billion yuan (approximately 77.68 billion U.S. dollars) in loans aimed at supporting key sectors pivotal to China’s economic trajectory. These sectors include new-generation information technology, high-end equipment, new materials, new energy vehicles, energy conservation, environmental protection, and bio-medicine, among others.

The injection of funds from the CDB serves as a catalyst for the development of cutting-edge technologies and the advancement of critical industries, positioning Hong Kong and China stocks for potential upside. The focus on research and development in key technologies, coupled with support for industrial chains, underscores a commitment to fostering innovation and competitiveness in the region.

Moreover, the CDB’s initiatives extend beyond mere financial support, encompassing a comprehensive approach that includes medium and long-term funding, investments, and bonds. By providing multifaceted financial services, the CDB aims to facilitate the implementation of key manufacturing projects and drive the transition and upgrading of sectors.

One notable aspect of the CDB’s efforts is the facilitation of key manufacturing projects through a dedicated fund managed by one of its subsidiaries. This fund, which focuses on sectoral transition and upgrading, has played a pivotal role in financing 76 projects across various industrial chains by the end of 2023, with investments spanning areas such as basic software, electronic materials, industrial internet, and smart grid technologies.

As investors evaluate their portfolios and seek opportunities in emerging markets, the actions of institutions like the CDB signal a favorable environment for Hong Kong and China stocks. With robust government support, strategic investments in key sectors, and a focus on innovation-driven growth, the stage is set for potential upside in the region’s equities market. As always, investors are advised to conduct thorough research and consider their risk tolerance before making investment decisions in any market.

China’s Ambitious Economic Stimulus Plan: Unveiling Tax Breaks and FDI Initiatives

Amid global economic uncertainties, China is poised to embark on a significant economic stimulus plan aimed at bolstering growth and fostering investment opportunities. The plan encompasses a wide range of measures, including tax breaks and the opening up of foreign direct investment (FDI), signaling a proactive approach to revitalizing the economy and driving sustainable development.

Tax Breaks to Fuel Growth

One of the cornerstones of China’s economic stimulus plan is the implementation of tax breaks designed to provide relief to businesses and stimulate economic activity. These tax incentives are expected to reduce the financial burden on enterprises, encourage investment, and spur consumption, thereby stimulating overall economic growth.

Key sectors targeted for tax breaks include advanced manufacturing, technology innovation, environmental protection, and small and medium-sized enterprises (SMEs). By incentivizing investment and innovation in these strategic areas, China aims to enhance productivity, competitiveness, and resilience in the face of global economic challenges.

Opening Up FDI Opportunities

In addition to tax breaks, China is also ramping up efforts to attract foreign investment through the liberalization of its FDI policies. The government plans to further open up sectors of the economy to foreign participation, streamline approval processes, and improve market access for overseas investors.

By welcoming foreign investment across a broader spectrum of industries, China seeks to leverage external capital, technology, and expertise to fuel innovation, drive economic growth, and enhance global competitiveness. The move is expected to create new opportunities for collaboration and partnership between domestic and foreign firms, fostering a more dynamic and inclusive economic ecosystem.

Stimulating Domestic Demand

Beyond tax breaks and FDI liberalization, China’s economic stimulus plan also prioritizes initiatives aimed at boosting domestic demand. The government plans to roll out targeted measures to support consumption, including subsidies for key consumer goods, incentives for rural revitalization, and initiatives to enhance social welfare and income levels.

By bolstering domestic consumption, China aims to reduce reliance on export-led growth and create a more balanced and sustainable economic model. Increased consumer spending is expected to drive demand for goods and services, spur investment in retail and consumer industries, and stimulate overall economic activity.

Charting a Path for Sustainable Growth

China’s ambitious economic stimulus plan reflects a proactive approach to addressing economic challenges and capitalizing on emerging opportunities. By leveraging tax breaks, opening up FDI, and stimulating domestic demand, China aims to revitalize the economy, drive innovation, and foster long-term sustainable growth.

As the world watches China’s economic trajectory, the implementation of these stimulus measures is poised to have far-reaching implications for global markets and investment landscapes. By proactively adapting to changing economic dynamics and embracing reform and opening-up policies, China reaffirms its commitment to driving economic prosperity and shared development on the global stage.

Knightsbridge Law Advocates Buying China Stocks: Here’s Why

In a bold move amidst global economic shifts, Knightsbridge Law, a prominent legal firm specializing in financial and investment law, has advocated for investors to consider buying China stocks. This recommendation comes at a pivotal moment as China rolls out sweeping economic support measures and showcases resilience in the face of evolving market dynamics.

Why Invest in China Stocks Now?

- Government Economic Support: China’s government has demonstrated its commitment to bolstering economic growth through various stimulus measures. Initiatives such as tax breaks, infrastructure investment, and targeted funding for key industries signal a proactive approach to sustaining economic momentum and fostering investor confidence.

- FDI Liberalization: China’s ongoing efforts to liberalize its foreign direct investment (FDI) policies present attractive opportunities for investors. By opening up sectors of the economy to foreign participation and streamlining approval processes, China is creating a more conducive environment for investment, innovation, and collaboration.

- Strategic Investment Sectors: China’s focus on advancing key sectors such as advanced manufacturing, technology innovation, and environmental protection aligns with long-term growth trends and presents compelling investment prospects. Companies operating in these strategic sectors stand to benefit from government support and market demand.

- Resilience Amid Global Uncertainty: Despite global economic challenges, China has demonstrated resilience and adaptability, maintaining robust economic growth and market stability. As the world’s second-largest economy, China offers diversification benefits and exposure to dynamic growth opportunities in emerging markets.

- Market Valuations: Favorable market valuations and potential growth prospects make China stocks an attractive investment option. With reasonable valuations compared to historical averages and potential upside potential, China stocks present an appealing opportunity for value-oriented investors.

Knightsbridge Law’s Perspective

Knightsbridge Law emphasizes the importance of strategic investment decisions based on thorough research, risk assessment, and alignment with long-term financial goals. While investing in China stocks presents opportunities, it is essential for investors to conduct due diligence, monitor market developments, and seek professional advice to navigate potential risks and maximize returns.

As global economic dynamics continue to evolve, Knightsbridge Law remains committed to providing clients with comprehensive legal counsel and strategic guidance to capitalize on emerging opportunities and navigate complex investment landscapes effectively.

Knightsbridge Law’s endorsement of buying China stocks reflects confidence in China’s economic resilience, growth potential, and strategic investment opportunities. By staying attuned to market trends, leveraging government support measures, and maintaining a disciplined investment approach, investors can position themselves to benefit from the dynamic growth prospects offered by China’s thriving economy and vibrant capital markets.

Shayne Heffernan