#inflation #Fed #crypto #gold #silver

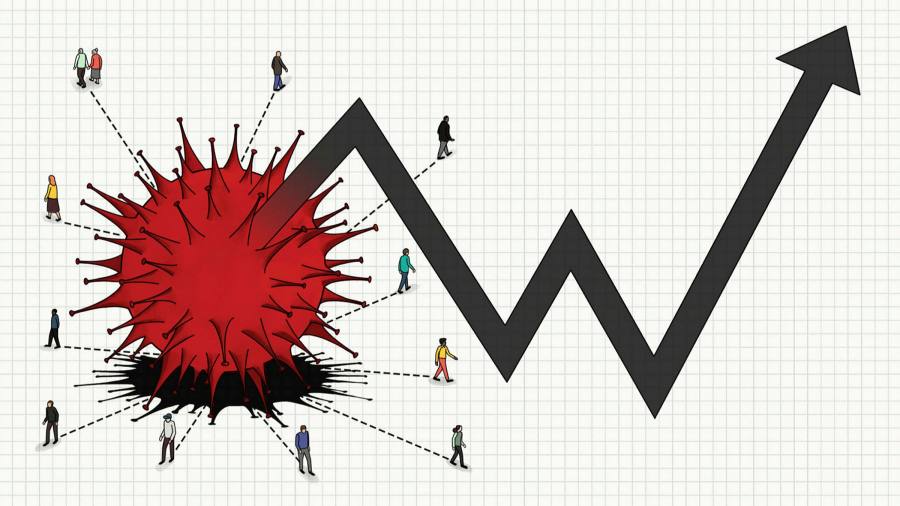

“Inflation robs ‘The People’ in the subtlest way, it bleeds their buying power month after month, it cannot be ignore”— Paul Ebeling

The Fed, the Treasury, the Biden administration and some experts are just dismissing it as a fleeting thing because most Americans are ignoring it and them.

The headline CPI numbers have shock value!

Consumer prices increased 5.4% in June from a yr earlier, the biggest monthly gainer since August 2008.

Yes, the largest 1-month jump since Y 2008.

Economist Bruce WD Barren notes: “If you take the lowest of the lowball Core CPI measure, which ignores food and energy prices because nobody really needs to eat, right?, the June annual inflation rate is only 4.5%, the biggest jump in 30 yrs.“

But The People should not worry as is just transitory, just a blip of supply chains and post-virus chaos pressures relaxing.

Not everybody’s buying that anymore. Mr. Barren went on to say: “What this really shows is inflation pressures remain acute and are going to be with Americans for a long, long period. As there will be ongoing inflation pressure going forward no matter what the Fed tries to do.”

Also, if real wages were to keep up with inflation, this would only be passed on to consumers, and not solving the problem of overt inflation..

Instead, the FED should be focusing on how to slow done inflation which they are not by constantly increasing their “wild” and hard to justify their deficit spending programs. Why? is the real question to their pork-barrel approach to imprudent spending.

Mr. Barren says, “To me, it is just a fickle approach to try to get more votes and I hope Americans can see though that. People are still not going to work and the answer to that is simple, stay home and earn equal or more money on our government’s hand-outs.“

Here is snapshot of the current inflation situation. It is not complete, but more realistic than the Fed’s numbers.

Overall, food prices have increased 2.4% Y-Y, so if you do not eat bacon or fruit or fresh fish or drink milk, your grocery bill has not gone up quite as much.

A New York Fed survey anticipates:

- +9.4% healthcare prices

- +6.2% housing prices

- +9.7% rent payments

It’s really difficult to look at these numbers and understand how they all add up to an overall inflation rate of 5.4%.

Still, personal inflation rates are idiosyncratic. If you eat bacon and fruit every day, you’re going to pay more for groceries than people who only eat canned beans and ramen. If you work in transportation, the huge increase in gas prices are probably your major concern.

Your individual situation dictates just how much you’re hurting from inflation. Generally speaking, though, these price rises affect the entire nation.

Even so, many experts you’ll see in the media hand-waved away this obviously darkening inflation landscape. Guess he does not eat bacon.

The future may be too bleak for some experts to look at. Maybe if people ignore it, it will go away. Denial is a common reaction to overly stressful situations, after all, yes?

Denial and idle hope are not a viable plan.

Fed Chairman Powell at the Fed and his optimistic experts keep singing the same song: the historic year-long rise in consumer price inflation is only “transitory” or a “blip” and when the numbers come in higher than we expect, they act surprised for a moment, and sing it again.

So, perhaps it is best to take what they say about rising prices with a grain of salt. Inflation this high is not “unexpected,” and will not fade away. Your own personal inflation rate may be lower or higher than the official numbers.

So, now is a great time to take the time to examine your retirement savings.

Consider how your spending looks in light of the inflation now. Then diversify and hedge your nest.

Consider physical precious metals like gold and silver and some digital assets (crypto) These assets will perform well long-term in the inflation and money printing scenario

But whatever you decide, do it before you have to take out a 2nd mortgage to buy a tank of gasoline.

Do not take the risk of looking back on today, and regretting that you did not pay attention. Remember, it is your life, your money, your retirement so your responsibility.

Have a prosperous day, Keep the Faith!