KXCO has issued a STRONG BUY Rating as it commences coverage of Innovent Biologics, Inc. 1801

08 Aug 2023 04:02:40 PM – INNOVENT BIOLOGICS – IN Q2 COMMERCIALIZED TOTAL OF EIGHT PRODUCTS WITH TOTAL PRODUCT REVENUE CLOSE TO RMB1.4 BLN, YEAR-OVER-YEAR GROWTH OF OVER 35%

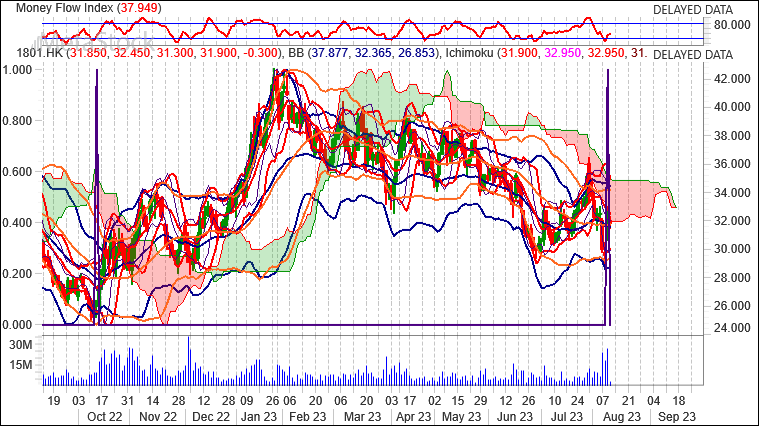

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bearish

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

INNOVENT is currently 10.9% below its 200-period moving average and is in an upward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods.

There is a good possibility that volatility will decrease and prices will stabilize in the near term.

Our volume indicators reflect volume flowing into and out of 1801.HK at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on 1801 and have had this outlook for the last 14 periods.

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 6 white candles and 3 black candles for a net of 3 white candles. During the past 50 bars, there have been 23 white candles and 26 black candles for a net of 3 black candles.

Three white candles occurred in the last three days. Although these candles were not big enough to create three white soldiers, the steady upward pattern is bullish.

Momentum

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 54.6366. This is not an overbought or oversold reading. The last signal was a buy 1 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 48.13. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 28 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is -49. This is not a topping or bottoming area. The last signal was a buy 1 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a sell 3 period(s) ago.

Inspired by the spirit of “Start with Integrity, Succeed through Action,” Innovent’s mission is to develop, manufacture and commercialize high-quality biopharmaceutical products that are affordable to ordinary people. Established in 2011, Innovent is committed to developing, manufacturing and commercializing high-quality innovative medicines for the treatment of cancer, autoimmune disease, metabolic disorder and other major diseases. On October 31, 2018, Innovent was listed on the Main Board of the Stock Exchange of Hong Kong Limited with the stock code: 01801.HK.

Since its inception, Innovent has developed a fully integrated multi-functional platform which includes R&D, CMC (Chemistry, Manufacturing, and Controls), clinical development and commercialization capabilities. Leveraging the platform, the company has built a robust pipeline of 35 valuable assets in the fields of cancer, metabolic disorder, autoimmune disease and other major therapeutic areas, with 9 approved products on the market. These include: TYVYT® (sintilimab injection), BYVASDA® (bevacizumab injection), SULINNO® (adalimumab injection), HALPRYZA® (rituximab injection), Pemazyre® (pemigatinib oral inhibitor), olverembatinib(BCR ABL TKI), Cyramza® (ramucirumab), Retsevmo® (selpercatinib) and FUCASO® (Equecabtagene Autoleucel). Additionally, 2 assets are currently under NMPA NDA review, 6 assets are in Phase III or pivotal clinical trials, and 18 more molecules are in clinical studies.

Innovent has built an international team with advanced talent in high-end biological drug development and commercialization, including many global experts. The company has also entered into strategic collaborations with Eli Lilly, Roche, Sanofi, Adimab, Incyte, MD Anderson Cancer Center and other international partners. Innovent strives to work with many collaborators to help advance China’s biopharmaceutical industry, improve drug availability and enhance the quality of the patients’ lives.

Disclaimer: Innovent does not recommend any off-label usage.

Note:

TYVYT® (sintilimab injection) is not an approved product in the United States.

BYVASDA® (bevacizumab biosimilar injection), SULINNO®, and HALPRYZA® (rituximab biosimilar injection) are not approved products in the United States.

TYVYT® (sintilimab injection, Innovent)

BYVASDA® (bevacizumab biosimilar injection, Innovent)

HALPRYZA® (rituximab biosimilar injection, Innovent)

SULINNO® (adalimumab biosimilar injection, Innovent)

Pemazyre® (pemigatinib oral inhibitor, Incyte Corporation). Pemazyre® was discovered by Incyte Corporation and licensed to Innovent for development and commercialization in Mainland China, Hong Kong, Macau and Taiwan.

CYRAMZA® (ramucirumab, Eli Lilly). Cyramza® was discovered by Eli Lilly and licensed to Innovent for commercialization in Mainland China.

Retsevmo® (selpercatinib, Eli Lilly). Retsevmo® was discovered by Eli Lilly and licensed to Innovent for commercialization in Mainland China.

Shayne Heffernan