Interest Rate Outlook: The U.S. stock market experienced a downturn on Wednesday following the Federal Reserve’s announcement to maintain current interest rates, coupled with comments from Fed Chair Jerome Powell suggesting that a rate cut might not be imminent at the next meeting in March.

Market Performance: The Dow Jones Industrial Average dropped by 317.01 points, or 0.82 percent, closing at 38,150.3. The S&P 500 saw a decline of 79.32 points, or 1.61 percent, settling at 4,845.65. The Nasdaq Composite Index shed 345.89 points, or 2.23 percent, closing at 15,164.01. Contributing factors to the market’s negative sentiment included disappointing earnings reports from Alphabet, Microsoft, and AMD, as well as Tesla facing challenges following a legal setback related to Elon Musk’s compensation package.

Sector Performance: All 11 primary S&P 500 sectors ended in the red, with communication services and technology taking the lead in declines at 3.93 percent and 2.11 percent, respectively. Health posted the weakest decline, down only 0.11 percent.

Federal Reserve’s Decision: Fed policymakers opted to keep the benchmark interest rate within the range of 5.25 percent to 5.5 percent, in line with expectations. However, the key shift came as they abandoned previous hints of future rate increases, signaling a potential shift in their approach. The emphasis in the policy statement was on stability in inflation and employment, indicating a cautious and data-driven strategy for future policy decisions.

Fed’s Caution and Data-Driven Approach: Despite maintaining the current rate, the policy statement made it clear that the committee does not expect to reduce the target range until there is greater confidence that inflation is moving sustainably toward the 2 percent target. Powell acknowledged that achieving this confidence by the March meeting seemed unlikely but remained open to developments.

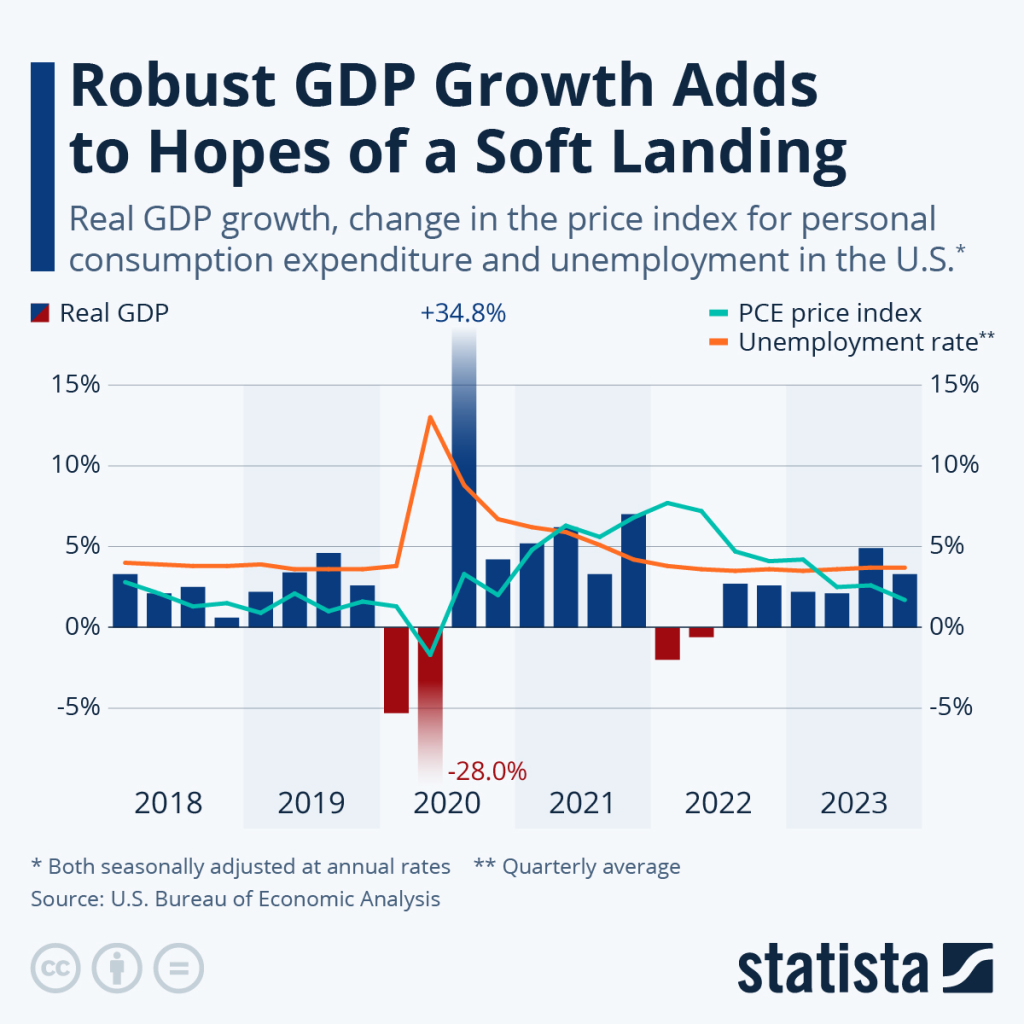

Market Reaction: Following Powell’s speech, market expectations for a rate cut in March dropped to around 36 percent, significantly down from 56 percent earlier in the day. The likelihood of a rate cut will depend on upcoming economic indicators, with only one more reading of personal consumption expenditures (PCE) anticipated before the March meeting.

The U.S. stock market faced a decline amid the Federal Reserve’s decision to hold rates steady, coupled with Powell’s cautious approach and emphasis on data-driven policy decisions. Investors will closely monitor economic indicators in the lead-up to the March meeting for insights into potential future rate adjustments.

The history of U.S. interest rates is a dynamic narrative reflecting the country’s economic evolution and the Federal Reserve’s efforts to balance inflation, employment, and economic stability. Here’s a brief overview of key periods in the history of U.S. interest rates:

- Post-World War II Era (1940s-1950s):

- Interest rates were relatively stable during the immediate post-war period.

- The Bretton Woods Agreement in 1944 pegged major currencies to the U.S. dollar, anchoring global monetary policy.

- The Federal Reserve maintained a conservative approach, prioritizing stability.

- Volcker Era (Late 1970s-1980s):

- The 1970s saw high inflation due to factors like oil price shocks.

- Fed Chair Paul Volcker implemented aggressive monetary policies to combat inflation, leading to a series of interest rate hikes.

- The prime rate soared to unprecedented levels, reaching 21.5% in 1980.

- Greenspan Era (1987-2006):

- Alan Greenspan succeeded Volcker in 1987, adopting a more pragmatic approach.

- The early 1990s experienced recession, prompting rate cuts.

- The late 1990s witnessed a booming economy, and interest rates rose.

- The dot-com bubble burst in the early 2000s, leading to rate cuts.

- Post-Financial Crisis (Late 2000s-2010s):

- The 2008 financial crisis prompted aggressive rate cuts to near-zero levels.

- The Fed introduced unconventional policies, such as quantitative easing, to stimulate the economy.

- Rates remained historically low for an extended period to support recovery.

- Taper Tantrum and Normalization (2013-2019):

- Concerns over the Fed’s plan to taper asset purchases in 2013 led to the “taper tantrum,” causing market volatility.

- The Fed started gradually raising rates in 2015 and began unwinding its balance sheet.

- Rates remained relatively low compared to historical averages.

- Recent Years (2020s):

- The COVID-19 pandemic in 2020 prompted emergency rate cuts to near-zero levels.

- The Fed emphasized its commitment to achieving maximum employment and higher inflation before considering rate hikes.

- As of the mid-2020s, interest rates were still at historically low levels.

Throughout these periods, the Federal Reserve navigated economic challenges, adjusting interest rates to achieve its dual mandate of price stability and maximum sustainable employment. The history of U.S. interest rates reflects the complexities of economic policy and the central bank’s role in shaping the country’s financial landscape.

Stock markets can be influenced by changes in interest rates, and certain sectors or stocks may react differently to lower interest rates. Here’s a general perspective on potential winners and losers:

Winners:

- Technology Stocks:

- Lower interest rates can make high-growth technology stocks more attractive to investors, as their future earnings are discounted at a lower rate.

- Companies in the tech sector often rely on debt for expansion, and lower interest rates reduce their borrowing costs.

- Real Estate:

- Lower interest rates can lead to lower mortgage rates, making real estate more affordable for homebuyers.

- Real estate investment trusts (REITs) may benefit as their dividend yields become relatively more attractive compared to bond yields.

- Utilities:

- Utility stocks, known for stable dividends, become more appealing when interest rates are low.

- Lower rates reduce the opportunity cost of holding these income-generating stocks.

- Consumer Discretionary:

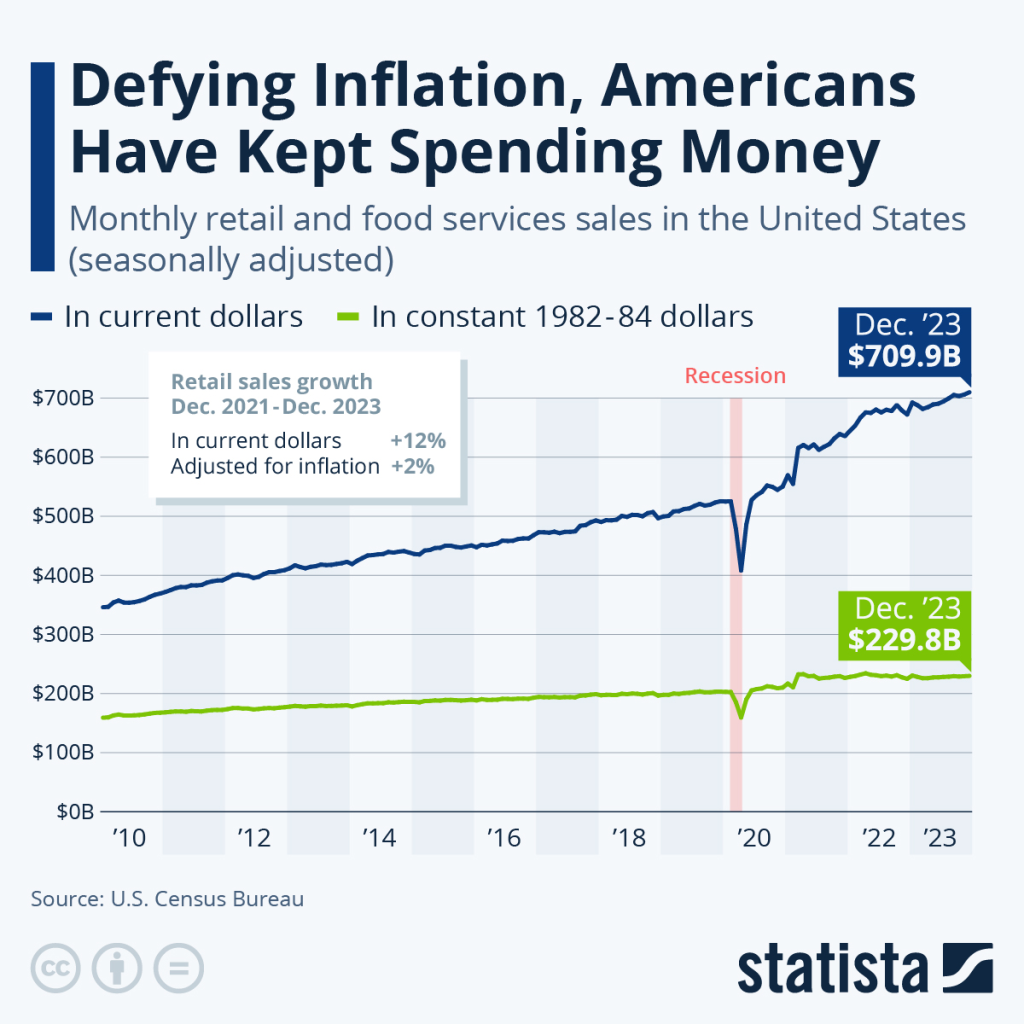

- Lower interest rates can boost consumer spending and borrowing, benefiting companies in the consumer discretionary sector.

- Growth Stocks:

- Growth-oriented stocks, particularly those with strong earnings potential, may see increased demand when rates are low.

Losers:

- Financials:

- Banks and financial institutions may face challenges when interest rates are low, as their net interest margins (profitability) may shrink.

- Lower rates can compress the spread between the interest earned on loans and the interest paid on deposits.

- Insurance Companies:

- Insurers often invest in fixed-income securities, and lower rates can impact their investment returns.

- An environment of persistently low rates may pose challenges for insurance companies’ profitability.

- Dividend Stocks:

- While high-dividend stocks can still attract income-seeking investors, the relative attractiveness of dividends may diminish when interest rates are low.

- Value Stocks:

- Value stocks, which often have stable earnings and pay dividends, may not perform as well as growth stocks in a low-interest-rate environment.

- Homebuilders:

- While lower mortgage rates can benefit homebuyers, homebuilders may face challenges if rates are too low, as it could signal economic concerns or a lack of demand.

It’s important to note that market dynamics can be complex, and individual stocks may react differently to changing interest rate environments. Additionally, various factors, including economic conditions and global events, can influence stock performance. Investors should conduct thorough research and consider their own investment goals and risk tolerance before making decisions based on interest rate expectations.

Understanding USA Interest Rates and Debt: A Comprehensive Overview

The United States’ management of interest rates and national debt plays a crucial role in shaping its economic landscape. Let’s delve into the intricacies of USA interest rates and the nation’s debt scenario.

USA Interest Rates:

**1. Federal Reserve Role:

- The Federal Reserve (the Fed) is the central banking system of the USA and holds considerable influence over interest rates.

- The Fed sets the federal funds rate, the interest rate at which banks lend to each other overnight. Changes in this rate ripple through the economy.

**2. Monetary Policy Tools:

- The Fed employs various tools to control interest rates, including open market operations, discount rates, and reserve requirements.

- Lowering interest rates stimulates borrowing, spending, and investment, fostering economic growth. Raising rates helps control inflation but may slow economic activity.

**3. Historical Context:

- In response to the 2008 financial crisis, the Fed kept rates near zero for an extended period to spur economic recovery.

- The subsequent decade saw a slow normalization of rates until the COVID-19 pandemic hit, prompting a return to lower rates to support the economy.

**4. Impact on Financial Markets:

- Interest rate changes influence various financial markets. Lower rates can boost stock markets and encourage borrowing, while higher rates may lead to bond market adjustments.

USA National Debt:

**1. Debt Composition:

- The USA’s national debt consists of both domestic and foreign obligations. It includes Treasury bills, notes, bonds, and other securities.

- The debt-to-GDP ratio is a key metric used to assess the sustainability of the national debt.

**2. Debt Growth Factors:

- Economic downturns, major spending initiatives, and responding to crises contribute to debt growth.

- Factors like tax policies, defense spending, and entitlement programs also impact the national debt trajectory.

**3. Debt Ceiling:

- The U.S. Congress sets a debt ceiling, limiting the total amount the government can borrow.

- Periodic debates and negotiations often arise when the government approaches the debt ceiling, leading to potential economic uncertainty.

**4. Global Implications:

- The USA’s economic decisions have global repercussions. Changes in interest rates and debt levels affect international markets, currencies, and investor confidence.

**5. Challenges and Considerations:

- Balancing economic growth, fiscal responsibility, and addressing long-term challenges like healthcare and Social Security funding are ongoing considerations.

- Strategies for managing debt include a combination of revenue generation, spending adjustments, and economic policies.

The intricate interplay between interest rates and national debt defines the USA’s economic landscape. While low interest rates can stimulate economic activity, managing a growing national debt requires prudent fiscal policies. Striking the right balance is crucial for sustaining economic growth, ensuring financial stability, and navigating global economic dynamics. As the USA continues to face evolving challenges, sound economic management remains imperative for a resilient and prosperous future.