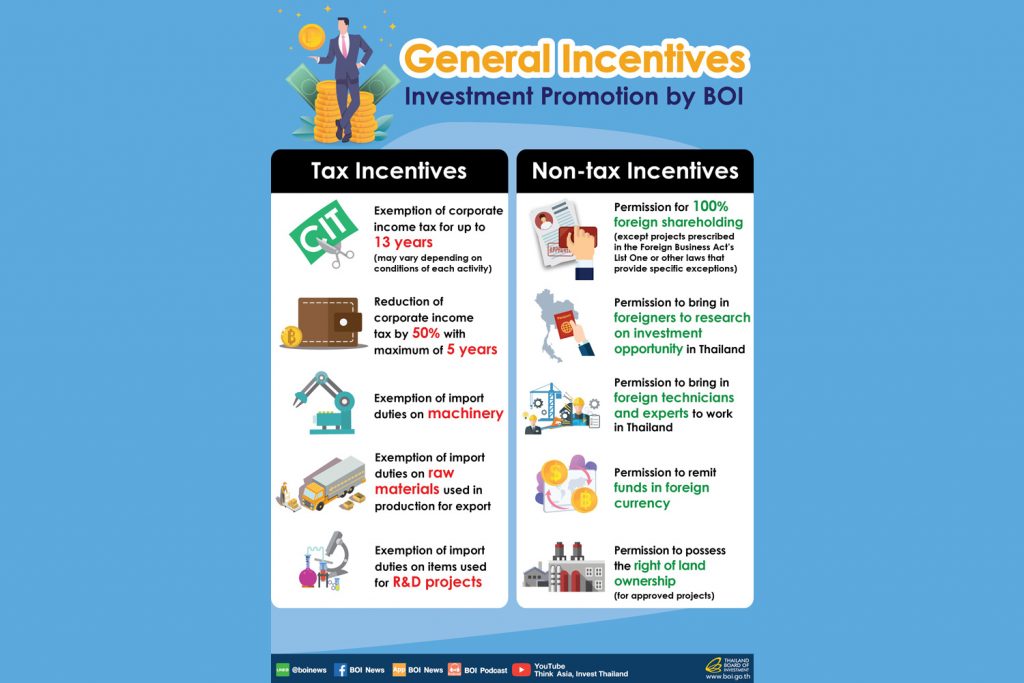

Tax Incentives

• Exemption of corporate income tax (CIT) for up to 13 years (may vary depending on conditions of each activity).

• Reduction of CIT by 50% with maximum of 5 years.

• Exemption of import duties on machinery.

• Exemption of import duties on raw materials used in production for export.

• Exemption of import duties on items used for R&D projects.

Non-tax Incentives

• Permission to bring in foreigners to research investment opportunities in Thailand.

• Permission to bring in foreign technicians and experts to work in Thailand.

• Permission to remit funds in foreign currency.

• Permission to possess the right of land ownership (for approved projects).

Contact

Knightsbridge Law is a boutique law firm. The lawyers of our firm have provided legal advice on a variety of areas of the legal practice, including:

Investment Grade Real Estate;

Mergers and Acquisitions;

Establishing Business in Asia;

Corporate and Commercial consultancy;

Asset Management;

Banking, Finance and Securities;

Listing Companies in Asia;

Global Metals and Mining

If your company is looking for legal financial solutions, Knightsbridge Law is ready to help. We cover the whole balance sheet, including foreign exchange, trade finance, treasury management, corporate lending, securitization, and public and private debt and equity underwriting. We also provide advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

Products & Services:

- M&A Advisory

- Acquisition & Divestiture Advisory

- Capital Raising

- Market Risk Management

- Institutional Investing