Looking to diversify your portfolio away from traditional tech-heavy investments? Consider the Vanguard Real Estate Index Fund (NYSE Arca: VNQ), an ETF poised to shine as interest rates decline.

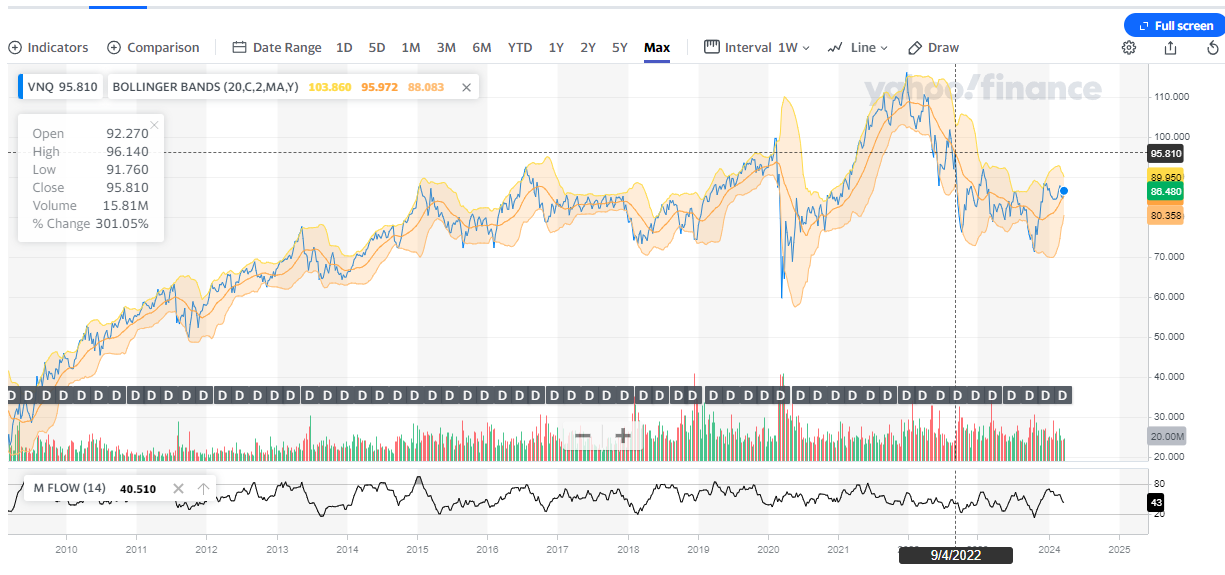

Real estate stocks have been overlooked amidst the market frenzy, with the Vanguard Real Estate Index Fund (VNQ) experiencing a 2% decline since the year began, in stark contrast to the nearly 11% surge in the S&P 500.

However, if interest rates decrease in the coming months, VNQ could see a resurgence. Real estate investment trusts (REITs) are favored by investors for their high yields and dependable income streams. Yet, in a high-interest-rate environment, investors may opt for safer returns in the bond market rather than REIT equities. A shift in interest rates could reignite interest in REITs, making VNQ an attractive prospect.

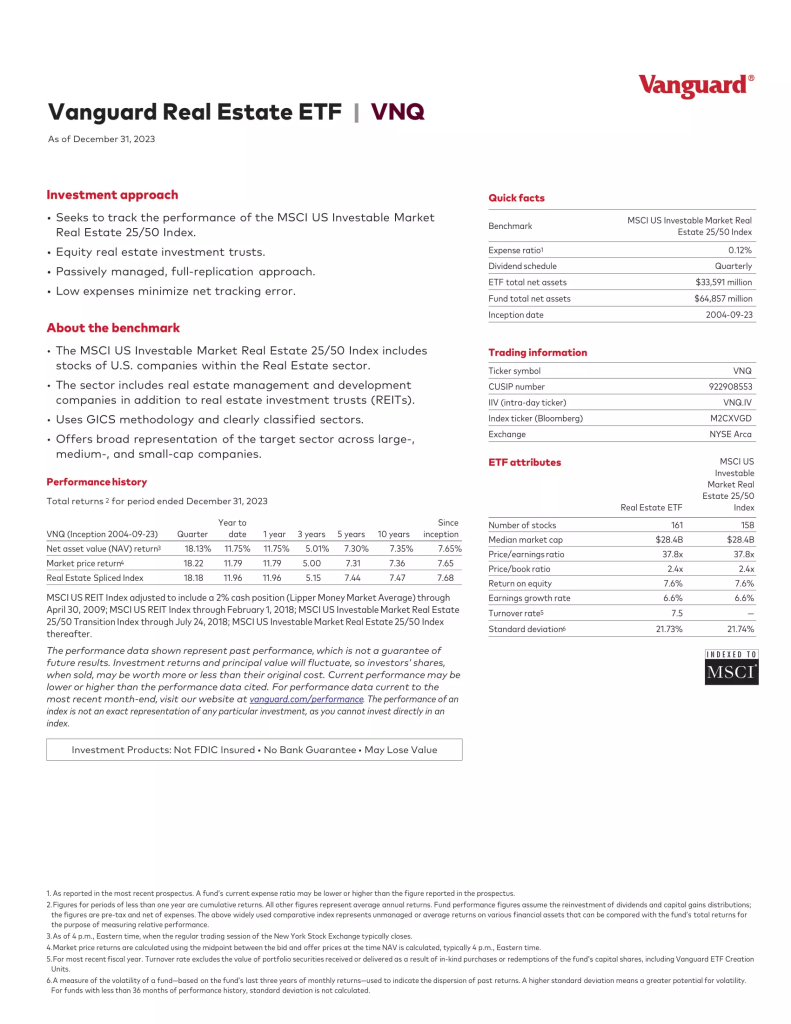

Offering a solid 4% yield, VNQ boasts a diverse portfolio comprising over 150 stocks, spanning retail, industrial, and data center REITs. Among its top holdings are industry giants such as Prologis (NYSE: PLD), Realty Income (NYSE: O), and Public Storage (NYSE: PSA), each accounting for more than 2% of the fund’s total weight.

While VNQ may not have historically outperformed the S&P 500, it presents an appealing option for long-term dividend investors. Over the past decade, its total returns, inclusive of dividends, have amounted to an impressive 84%. Despite trading near its 52-week high, VNQ’s recent underperformance suggests potential for growth, particularly as interest rates begin to decline.

The Vanguard Real Estate Index Fund (NYSE Arca: VNQ) is an exchange-traded fund (ETF) managed by Vanguard Group, one of the world’s largest investment management companies. This fund is designed to provide investors with exposure to the real estate sector by tracking the performance of the MSCI US Investable Market Real Estate 25/50 Index.

Key Information about VNQ:

- Objective: The primary objective of the Vanguard Real Estate Index Fund is to replicate the performance of the MSCI US Investable Market Real Estate 25/50 Index, which includes a broad range of publicly traded real estate companies in the United States.

- Holdings: VNQ holds a diversified portfolio of real estate investment trusts (REITs) and real estate operating companies (REOCs), encompassing various segments of the real estate market, including retail, residential, industrial, healthcare, and office properties.

- Yield: VNQ offers investors a competitive yield, with dividends generated from the rental income and capital appreciation of the underlying real estate assets held within the fund’s portfolio.

- Composition: The fund typically holds more than 100 individual securities, providing investors with exposure to a broad spectrum of real estate assets across different sectors and regions within the United States.

- Expense Ratio: VNQ is known for its low expense ratio, which reflects Vanguard’s commitment to offering cost-effective investment solutions to its clients. The fund’s low expense ratio helps to minimize the impact of fees on investors’ returns over time.

- Performance: While past performance is not indicative of future results, VNQ has historically provided investors with competitive total returns, including both capital appreciation and dividend income, over the long term.

- Liquidity: As an exchange-traded fund listed on the NYSE Arca, VNQ offers investors liquidity and flexibility, allowing them to buy and sell shares throughout the trading day at market prices.

Shayne Heffernan