$BTC.X $CME

“As with a stock or commodities futures, bitcoin futures allow investors to speculate on the future price of Bitcoin“– Paul Ebeling

With this tool investors can choose from a variety of venues to trade monthly bitcoin futures. Some are regulated, some are not.

Bitcoin is known for its price swings, which makes an investment in bitcoin futures risky, exciting and profitable.

Bitcoin futures serve many purposes, each unique, for different actors in the Bitcoin ecosystem.

For Bitcoin miners, futures are a means to lock in prices that ensure a return on their mining investments, regardless of the crypto’s future price trajectory.

Investors use bitcoin futures to hedge against their positions in the spot market.

Speculators and traders, who frequently move in and out of futures trades, might use bitcoin futures for short and long-term profits.

There are benefits to trading bitcoin futures instead of the underlying cryptocurrency.

1st, bitcoin futures contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. For most of its short existence, the cryptocurrency has traded outside the bounds of regulation, making it a risky asset for institutional money.

2nd, because the futures are cash settled, a Bitcoin wallet is not required. No physical exchange of bitcoin takes place in the transaction. Thus, a bitcoin futures trade eliminates the risk of holding a volatile asset class with steep price changes.

3rd, futures contracts have position limits and price limits that enable investors to curtail their risk exposure to a given asset class.

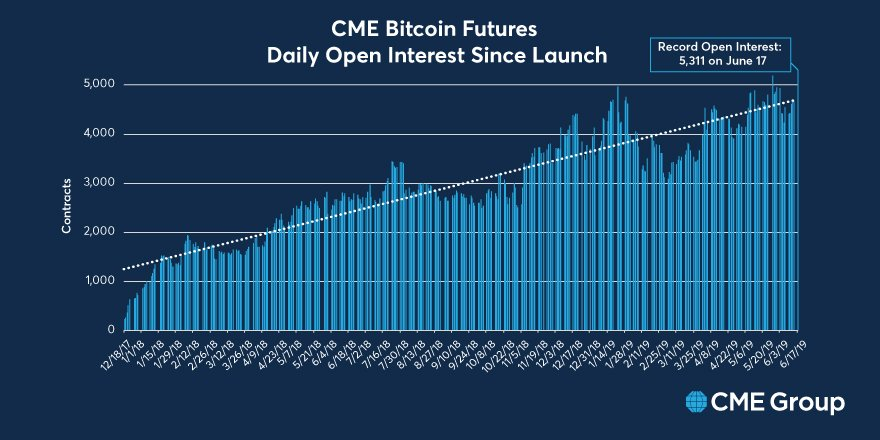

Growth of the bitcoin futures market has paralleled that of the cryptocurrency’s spot market.

Cryptocurrency exchanges were the 1st venues to offer bitcoin futures trading capability. But the absence of regulation for cryptocurrencies made them risky venues for serious traders.

Bitcoin futures trading was initiated at CME, CME has 2Xd down on cryptocurrencies and introduced other derivative products related to it. For example, the Micro Bitcoin futures is 1/10th the size of a standard bitcoin futures contract at CME.

The rules and setup for bitcoin futures is the same as that for regular futures trading. 1st you have to setup an account with the brokerage or exchange to begin trading. Once your account is approved, you can begin trading.

Futures trading makes heavy use of leverage to execute trades. In the unregulated world of cryptocurrencies, the leverage amount can vary wildly between exchanges. For example, Binance offered leverage of up to 125% of the trading amount to traders, when it 1st launched futures trading capability for cryptocurrencies. It reduced the leverage amount to 20% in July 2021.

The Key considerations for bitcoin futures accounts are margin requirements and contract details. Margins are the minimum collateral that you must have in your account to execute trades. The higher the amount of the trade, the greater the margin amount required by the broker or exchange to execute the trade.

A point to note here is that exchanges and brokerages can have different margin requirements. For example, CME has a base margin requirement, and brokerages like TD Ameritrade that offer CME bitcoin futures trading as part of their product suite can set margin rates on Top of the base rate set by CME.

Because Bitcoin is a risky and volatile asset, regulated exchanges generally require higher margin amounts as compared to other assets. Some cryptocurrency exchanges, like Binance, allow the use of cryptocurrencies as margin. For example, you can use stablecoins like Tether or bitcoin as margin for your trades at Binance.

Have a prosperous day, Keep the Faith!