#capital #investing #investor #prudent #prudenc #buy #sell #stocks #crypto

“The prudent man rule is an investing principle that is used by a person seeking reasonable income and preservation of capital”–Paul Ebeling

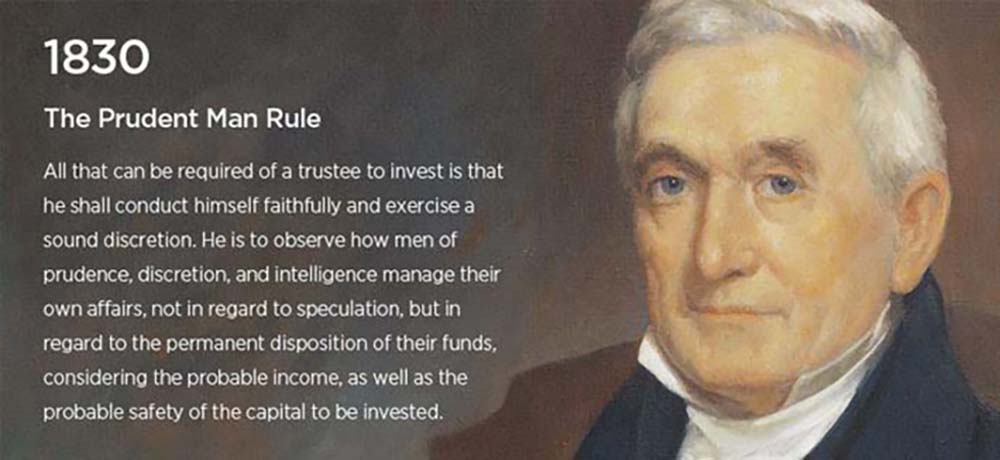

The Prudent Man and Prudent Investor are the concept of investing trust assets and have shaped investment trends going back to Y 1830.

The rule is intended as a guideline for investors or someone managing assets of value for another person or people. Overall, the law does not require a person with a fiduciary responsibility to have extraordinary expertise. However, the prudent-person rule sets a reasonable expectation that the person will make rational, intelligent decisions when making investment choices on behalf of a client, or him/herself.

No hard and fast rules are possible. Generally speaking, the funds may not be invested entirely in high-risk investments. The assets may not be diverted to investments that would enrich a money manager or a 3rd party.

This rule does not require that all the investments made must be lucrative or consistently generate outsized profits. However, if a fiduciary were given control of an estate during a period that its owner was unavailable, the rule would prohibit the fiduciary from putting all the funds into money-losing endeavors.

The investment decisions must be made according to what a person of average intelligence would deem as appropriate. So, fiduciaries must act prudently and must diversify the plan’s investments in order to minimize the risk of large losses. And avoid conflicts of interest.

My personal use of this rule for since I learned it in Y 1981 is to only take profit money off of the table + if the investment 2Xs, sell 50% and ride with the rest. It takes discipline.

Have a prosperous week, Keep the Faith!