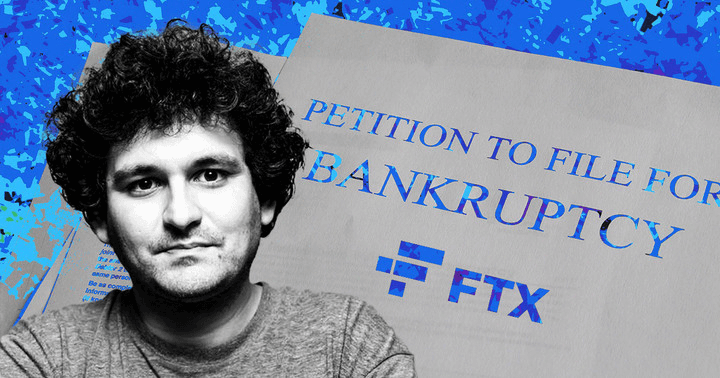

The parent company of Genesis Global Capital, a Cryptocurrency lending business, has filed for chapter 11 bankruptcy protection after the effects of FTX and other Crypto backruptcies. Genesis Global Capital has estimated that there are over 100,000 creditors and $1 billion to $10 billion in liabilities and assets.

Genesis is in dept to owe more than $3.5 billion to their top 50 creditors. These include Crypto exchange Gemini, trading giant Cumberland, Mirana, MoonAlpha Finance and VanEck’s New Finance Income Fund.

Genesis Global Capital suspended withdrawals after the FTX collapse, hurting some customers of yeild products.

As they owe $3.5 billion to their top 50 creditors, Genesis have been on a mission to find fresh capital. They believe that with their Bankruptcy protection in place, there is a plan to avoid any permanent losses and will eventually come back out on top.

Before the FTX downfall, Three Arrows Capital were the first to cause millions in losses to the firm, amount to hundreds of millions.

Genesis, Grayscale, and DCG share the same parent company. Investors fear that the Bankruptcy of Genesis could lead to the Bankrupty of all firms. Grayscale operates a Bitcoin trust with 600,000+ Bitcoin. Could this downfall lead to the liquidation of these assets?

More News

Tron’s Justin Sun Took Over Huobi

National Australian Bank Design Stablecoin To Boost Digital Economy