Why Gold is Essential: A Comprehensive Knightsbridge Overview of its Historical, Economic, and Modern Significance

Gold has been revered throughout human history for its intrinsic value, stability, and universal acceptance as a store of wealth. As financial landscapes evolve and new investment avenues emerge, the allure of gold remains steadfast. This article delves into the multifaceted reasons why gold remains an essential component of any diversified investment portfolio and savings strategy.

Historical Significance of Gold

The reverence for gold dates back millennia. Ancient civilizations, including the Egyptians, Greeks, and Romans, utilized gold for ornamental purposes, religious artifacts, and as a medium of exchange. Over time, gold’s scarcity, durability, and intrinsic value solidified its role as a global currency and store of wealth. Historical events, such as the Gold Standard era, further underscored gold’s importance as a benchmark for monetary systems worldwide.

Gold Miners and Performance

Major gold miners play a pivotal role in the gold ecosystem. Companies like Barrick Gold, Newmont Corporation, and AngloGold Ashanti are among the industry leaders. The performance of these miners often correlates with gold prices, making them attractive to investors seeking exposure to the gold market. Factors influencing their performance include production costs, geopolitical stability, and operational efficiency.

| Company Name | Listing Location |

|---|---|

| Barrick Gold Corporation | New York Stock Exchange (NYSE), Toronto Stock Exchange (TSX) |

| Newmont Corporation | New York Stock Exchange (NYSE) |

| AngloGold Ashanti | New York Stock Exchange (NYSE), Johannesburg Stock Exchange (JSE) |

| Kinross Gold Corporation | Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE) |

| Gold Fields Limited | New York Stock Exchange (NYSE), Johannesburg Stock Exchange (JSE) |

| Agnico Eagle Mines Limited | New York Stock Exchange (NYSE), Toronto Stock Exchange (TSX) |

| Polyus | Moscow Exchange (MCX) |

| Newcrest Mining Limited | Australian Securities Exchange (ASX) |

| Franco-Nevada Corporation | New York Stock Exchange (NYSE), Toronto Stock Exchange (TSX) |

| Kirkland Lake Gold Ltd. | Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE) |

Knightsbridge Ventures into Gold Mining Equity

Knightsbridge, a prominent player in the investment landscape, has successfully secured equity stakes in several gold mines, marking a strategic move into the precious metals sector. Recognizing the enduring value and strategic importance of gold as a tangible asset, this development underscores Knightsbridge’s commitment to diversifying its portfolio and capturing long-term growth opportunities.

With the global economic landscape continually evolving, gold remains a steadfast pillar of stability and value. By acquiring equity in gold mines, Knightsbridge positions itself advantageously to capitalize on both the intrinsic and commercial value of this precious metal. The move also aligns with the company’s broader vision of expanding its portfolio holdings in sectors that promise sustainable growth and resilience against market volatilities.

The decision to venture into gold mining equity is backed by meticulous research, due diligence, and a deep understanding of the gold market dynamics. Knightsbridge’s strategic approach ensures that its investments are not only financially sound but also aligned with its overarching business objectives and risk management strategies.

As Knightsbridge continues to navigate the intricate landscape of global investments, the acquisition of equity in gold mines stands as a testament to its forward-thinking approach and commitment to delivering value to its stakeholders. With plans underway to expand these holdings further, Knightsbridge solidifies its position as a key player in the evolving gold mining sector, poised to capitalize on emerging opportunities and drive sustainable growth in the years ahead.

Emergence of Gold Stablecoins

The digital age has ushered in innovations that bridge traditional assets like gold with modern financial instruments. Gold-backed stablecoins, such as Tether Gold and PAX Gold, offer investors a digital representation of physical gold. These assets combine the stability of gold with the efficiency of blockchain technology, providing a seamless bridge between the physical and digital realms of finance.

Knightsbridge Expands into Gold-Backed Digital Assets

Knightsbridge, a leading name in innovative financial solutions, has identified and capitalized on a burgeoning growth area by delving into the creation of gold-backed digital assets for its discerning clientele. Recognizing the evolving financial landscape and the increasing demand for secure, diversified investment options, Knightsbridge has strategically positioned itself at the intersection of traditional commodities and cutting-edge digital technologies.

The introduction of gold-backed digital assets represents a paradigm shift in how investors perceive and interact with precious metals. By bridging the tangible value of gold with the convenience and accessibility of digital assets, Knightsbridge offers its customers a unique blend of stability, liquidity, and technological innovation. These digital assets provide investors with a seamless avenue to leverage the enduring value of gold, all while benefiting from the flexibility and efficiency of digital platforms.

The decision to venture into this growth area is rooted in Knightsbridge’s unwavering commitment to innovation, customer-centricity, and long-term value creation. By building gold-backed digital assets, Knightsbridge not only diversifies its portfolio offerings but also addresses the evolving needs and preferences of modern investors seeking alternative investment avenues. This strategic move positions Knightsbridge at the forefront of financial innovation, paving the way for new opportunities, partnerships, and growth avenues in the competitive financial landscape.

Moreover, Knightsbridge’s expertise in creating gold-backed digital assets underscores its deep industry knowledge, technical prowess, and forward-thinking approach. By leveraging blockchain technology, secure storage solutions, and robust regulatory frameworks, Knightsbridge ensures that its gold-backed digital assets adhere to the highest standards of security, transparency, and compliance.

As Knightsbridge continues to expand its footprint in the financial services sector, the development and deployment of gold-backed digital assets exemplify its commitment to driving innovation, fostering customer trust, and unlocking new avenues for growth and value creation. With a keen eye on emerging trends and customer preferences, Knightsbridge remains poised to redefine the intersection of traditional commodities and digital finance, setting new industry standards and delivering unparalleled value to its global clientele.

Global Gold Reserves and Ownership

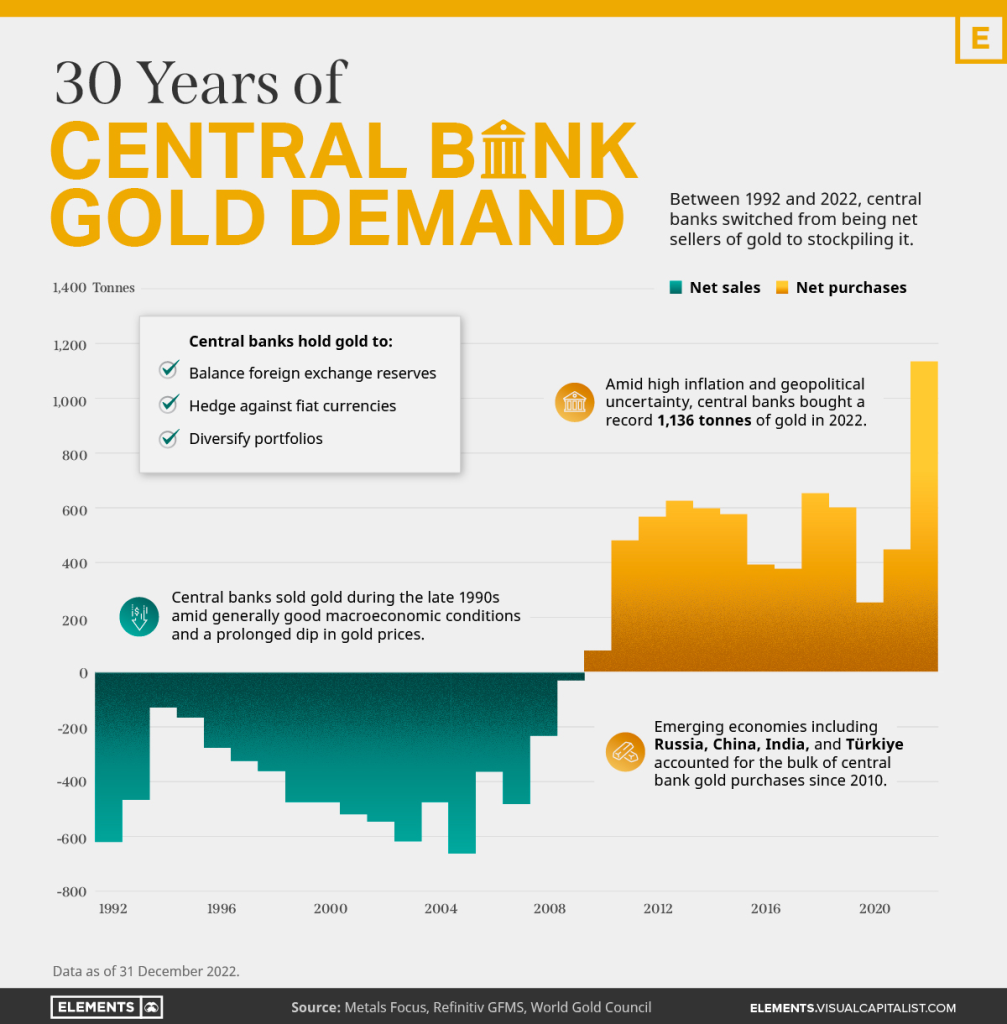

A significant portion of the world’s gold reserves is held by central banks, sovereign wealth funds, and institutional investors. Countries like the United States, Germany, and the International Monetary Fund (IMF) possess substantial gold reserves, reflecting gold’s role as a strategic asset. Additionally, nations like China, Russia, and Australia are prolific gold producers, contributing to global supply dynamics.

- United States: The U.S. holds the world’s largest gold reserves, primarily stored at Fort Knox and other secure facilities.

- Germany: The Deutsche Bundesbank oversees Germany’s significant gold reserves, highlighting its importance in European economic stability.

- China and Russia: Both nations have increased gold production and accumulation in recent years, diversifying their foreign reserves and asserting influence in global markets.

Gold and Fiat Currency: A Symbiotic Relationship

The relationship between gold and fiat currency is intricate and multifaceted. Historically, many countries operated on the Gold Standard, pegging their currencies to a specific amount of gold. Although most nations have moved away from this system, gold continues to influence fiat currency dynamics.

- Hedge Against Inflation: Gold serves as a hedge against inflationary pressures, preserving purchasing power during economic downturns.

- Currency Stability: Central banks often utilize gold reserves to stabilize their currencies, instilling confidence in financial markets and investors.

- Diversification: Incorporating gold into a diversified portfolio can mitigate risks associated with fiat currency fluctuations, geopolitical uncertainties, and market volatility.

Gold’s Importance in an Era of Fiat Currency Devaluation

In recent times, as central banks globally engage in extensive monetary policies, often dubbed as “money printing,” there’s a growing sentiment among investors and economists alike that traditional fiat currencies are increasingly vulnerable to devaluation. Amidst this backdrop, the age-old appeal and intrinsic value of gold shine brighter than ever, positioning the precious metal as a crucial hedge against the uncertainties of monetary policies and currency devaluation.

Historical Perspective

Throughout history, gold has maintained its allure as a store of value, a medium of exchange, and a symbol of wealth and prosperity. Empires have risen and fallen, currencies have come and gone, but gold’s enduring value remains unscathed. Its scarcity, tangible nature, and universal acceptance make it a sought-after asset during times of economic turbulence and geopolitical uncertainty.

Fiat Currency and Devaluation Concerns

Fiat currencies, not backed by physical commodities like gold or silver, derive their value based on government regulation or law. As central banks increase the money supply to stimulate economic growth or address fiscal challenges, there’s an inherent risk of diminishing the purchasing power of these currencies. The influx of excess liquidity can lead to inflationary pressures, eroding the real value of savings and investments denominated in fiat currencies.

Moreover, the unprecedented monetary stimulus measures adopted by central banks in response to global economic challenges, such as the recent pandemic-induced downturn, have heightened concerns about potential long-term repercussions. Excessive money printing, if unchecked, can lead to hyperinflation scenarios, where fiat currencies rapidly lose value, resulting in economic instability and social unrest.

Gold as a Safe Haven

Against this backdrop of economic uncertainty and currency devaluation concerns, gold emerges as a reliable and time-tested safe-haven asset. Its finite supply, inherent value, and historical significance make it a preferred choice for investors seeking to preserve wealth and mitigate risks associated with volatile financial markets and depreciating currencies.

The Role of Gold in Diversified Portfolios

Given the evolving economic landscape and the challenges posed by rampant money printing and currency devaluation, incorporating gold into diversified investment portfolios has become imperative. As a non-correlated asset, gold often exhibits inverse relationships with other financial instruments, providing diversification benefits and serving as a buffer against market downturns.

Furthermore, gold’s liquidity, global acceptance, and intrinsic value make it a versatile asset, accessible to both institutional and retail investors seeking to safeguard wealth, capitalize on capital appreciation opportunities, and navigate uncertain economic environments.

As money printing activities intensify and fiat currencies face growing devaluation risks, gold’s importance as a reliable store of value and a hedge against economic uncertainties has never been more pronounced. Investors, policymakers, and financial institutions alike recognize the enduring appeal and intrinsic value of gold, underscoring its pivotal role in preserving wealth, fostering financial stability, and navigating the complexities of the modern global economy. As we navigate these uncertain times, gold’s timeless allure and intrinsic value continue to resonate, highlighting its indispensable role in today’s interconnected and ever-evolving financial landscape.

Gold’s enduring allure as a store of wealth, investment asset, and global currency underscores its essential role in modern financial systems. From its historical significance to its influence on fiat currency dynamics and emergence in digital forms like stablecoins, gold remains a cornerstone of economic stability and investor confidence. As global uncertainties persist and financial landscapes evolve, the timeless appeal and intrinsic value of gold continue to resonate, making it an indispensable component of any well-rounded investment portfolio and savings strategy.

Shayne Heffernan