Satoshi Nakamoto, the pseudonymous creator of Bitcoin and author of the original Bitcoin whitepaper, did not explicitly comment on inflation and printing money in their writings. However, the design of Bitcoin can be seen as a response to concerns about inflation and the traditional monetary system.

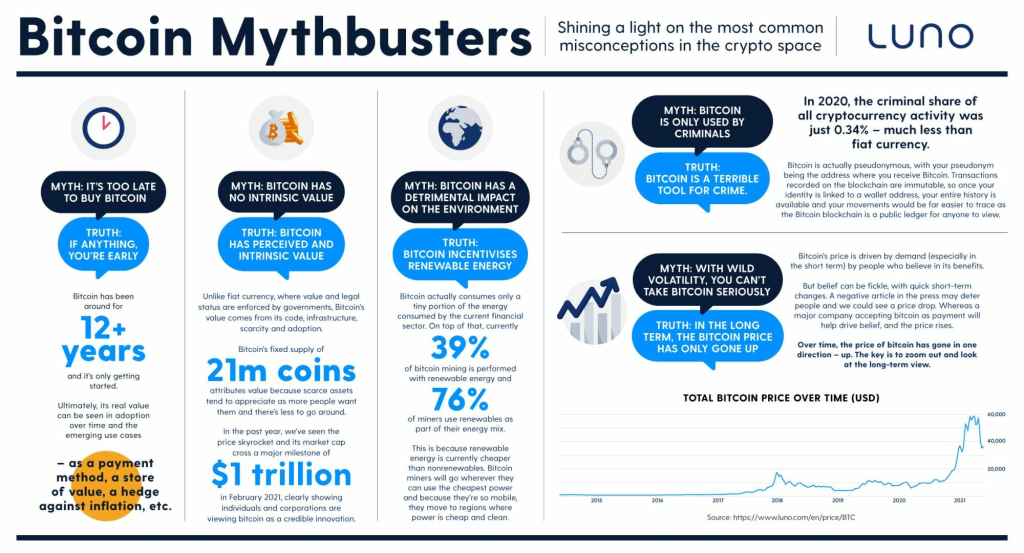

Bitcoin was created as a decentralized digital currency that operates on a peer-to-peer network, without the need for a central authority like a government or central bank. One of the key features of Bitcoin is its limited supply. The total number of bitcoins that can ever exist is fixed at 21 million, which is achieved through a process known as mining.

By limiting the supply of bitcoins, Nakamoto intended to create a deflationary currency, meaning its value could potentially increase over time. This design choice reflects a concern about the inflationary nature of traditional fiat currencies, which can be influenced by central banks’ policies, including printing more money.

In the Bitcoin whitepaper, Nakamoto emphasized the importance of a decentralized system and how it can eliminate the need for trust in intermediaries. While they did not specifically discuss inflation or printing money, Bitcoin’s design and underlying principles can be seen as a response to the perceived shortcomings of traditional monetary systems.

The History Lesson

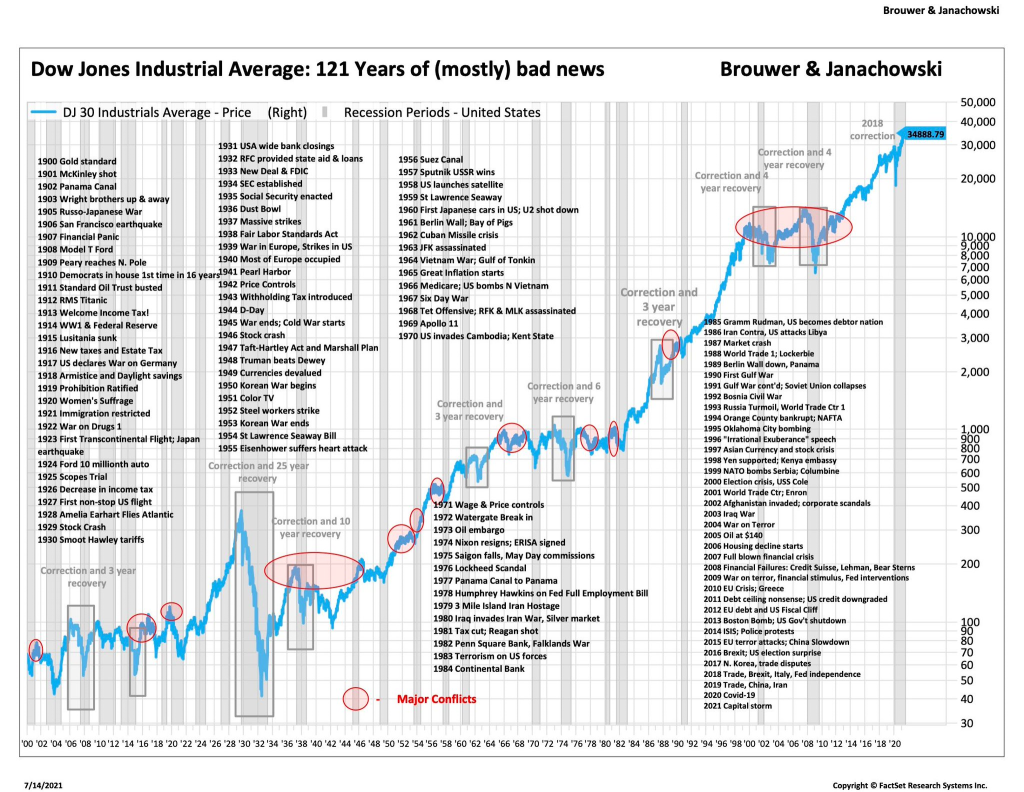

The highest inflation in the United States occurred in the 1970s and early 1980s, particularly during the period known as the “Great Inflation.” In the 1970s, inflation rose significantly due to a combination of factors, including rising energy prices following the 1973 oil crisis, expansionary fiscal policies, and wage-price spirals.

The economy faced several challenges during this period. High inflation eroded purchasing power, making it difficult for individuals and businesses to plan for the future. It also created uncertainty and reduced investor confidence. Consumers experienced higher costs of living, and businesses faced rising input costs, which often led to lower profit margins. Additionally, high inflation distorted economic decision-making, as people focused on short-term gains rather than long-term investments.

To combat inflation, the Federal Reserve implemented tight monetary policies, raising interest rates to reduce money supply growth. This policy aimed to curb inflation but also had the side effect of slowing economic growth and increasing unemployment. The recession in the early 1980s, induced in part by these policies, resulted in high unemployment rates.

The Federal Reserve’s efforts, along with fiscal tightening measures implemented by the government, eventually succeeded in reducing inflation. The policies implemented during this period helped set the stage for a period of relative stability in the following decades, with inflation remaining relatively low and stable in the United States.

While the 1970s and early 1980s were marked by high inflation and economic challenges in the United States, certain sectors performed relatively well during this period. Here are a few sectors that saw notable performance:

- Energy: The energy sector experienced significant growth during the 1970s due to rising oil prices and increased domestic production. As oil prices surged following the 1973 oil crisis and subsequent disruptions, oil companies and energy-related industries benefited from higher revenues and profitability.

- Commodities: Commodity sectors, such as agriculture and metals, experienced strong performance during the 1970s. Rising inflation and global demand for resources contributed to increased prices for commodities like wheat, soybeans, corn, copper, and silver. This resulted in higher revenues for agricultural and mining companies.

- Defense and Military: Increased defense spending during the Cold War era drove growth in the defense and military sectors. The United States significantly expanded its defense budget, leading to increased orders for weapons, equipment, and related services. Defense contractors and suppliers experienced robust demand and growth during this period.

- Real Estate: Despite the challenges of high inflation, the real estate sector experienced periods of growth in certain regions. Inflation often led to rising property values, benefiting real estate developers and investors. However, the sector also faced challenges as high inflation made borrowing costs more expensive.

It’s important to note that while these sectors performed relatively well, the overall economic environment during the 1970s and early 1980s was characterized by stagflation, which refers to a combination of stagnant economic growth and high inflation. This made it challenging for many businesses and individuals to navigate the period successfully.

What to Do Now

Preserving wealth in a high inflation environment requires careful planning and consideration of various strategies. Here are a few approaches that individuals may consider:

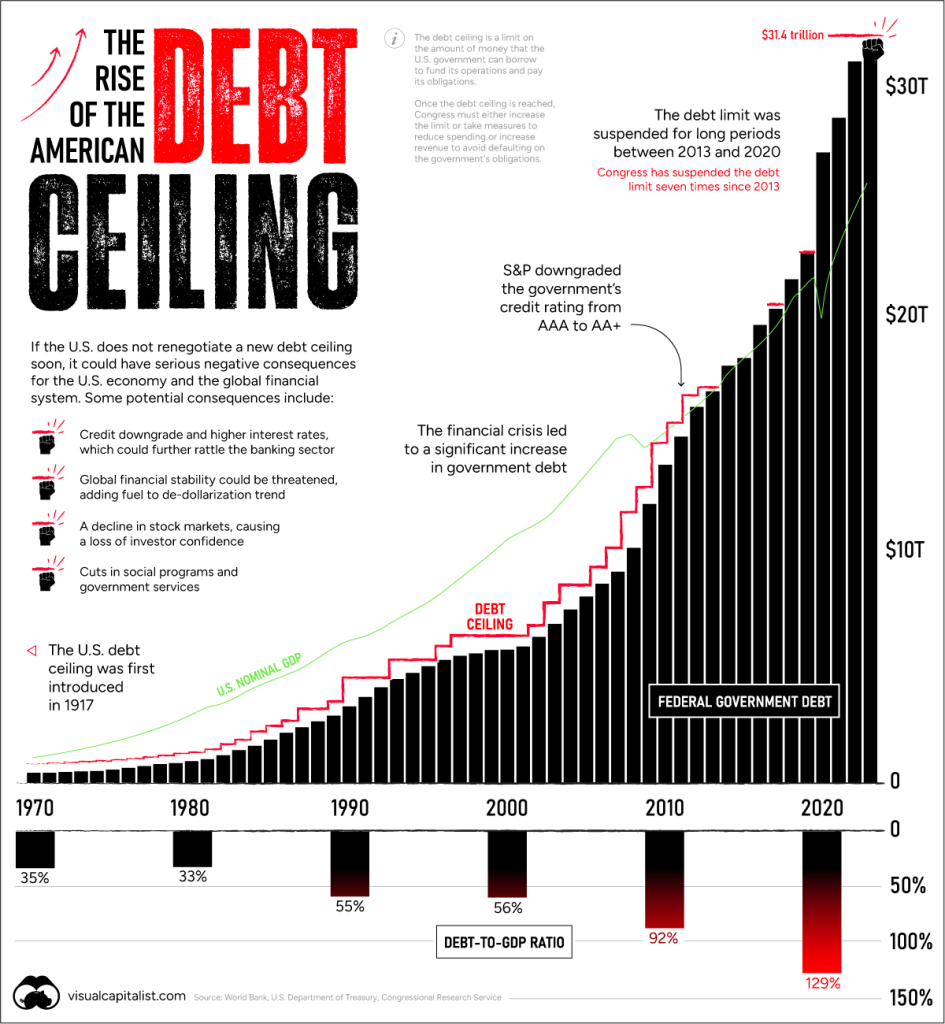

- Diversify Investments: Diversification is crucial to mitigate risk and preserve wealth during inflationary periods. Allocating investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help balance the impact of inflation on a portfolio.

- Invest in Inflation-Protected Assets: Certain assets, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed bonds, are specifically designed to protect against inflation, but the results are not particularly good.

- Consider Hard Assets: Investing in tangible assets like real estate, precious metals (gold, silver), or commodities (oil, natural gas) can act as a hedge against inflation. These assets have historically retained value during inflationary periods.

- Preserve Purchasing Power: During high inflation, the value of cash erodes over time. To preserve purchasing power, consider allocating funds to investments that have the potential to outpace inflation, such as stocks or investment funds that focus on growth-oriented sectors.

- Review Debt and Interest Rates: Inflation erodes the real value of debt over time, so it may be advantageous to have fixed-rate debt in a high inflation environment. As inflation rises, the relative cost of debt decreases. However, it is essential to assess individual financial circumstances and seek professional advice to determine the best course of action.

- Monitor and Adjust: Regularly review and adjust investment strategies based on changing economic conditions and inflation expectations. Staying informed about economic indicators, inflation rates, and policy changes can help make informed decisions.

It’s important to note that each individual’s financial situation is unique, and it is advisable to consult with a financial advisor or wealth management professional to tailor strategies to personal circumstances and goals.

Buy FBX

Shayne Heffernan