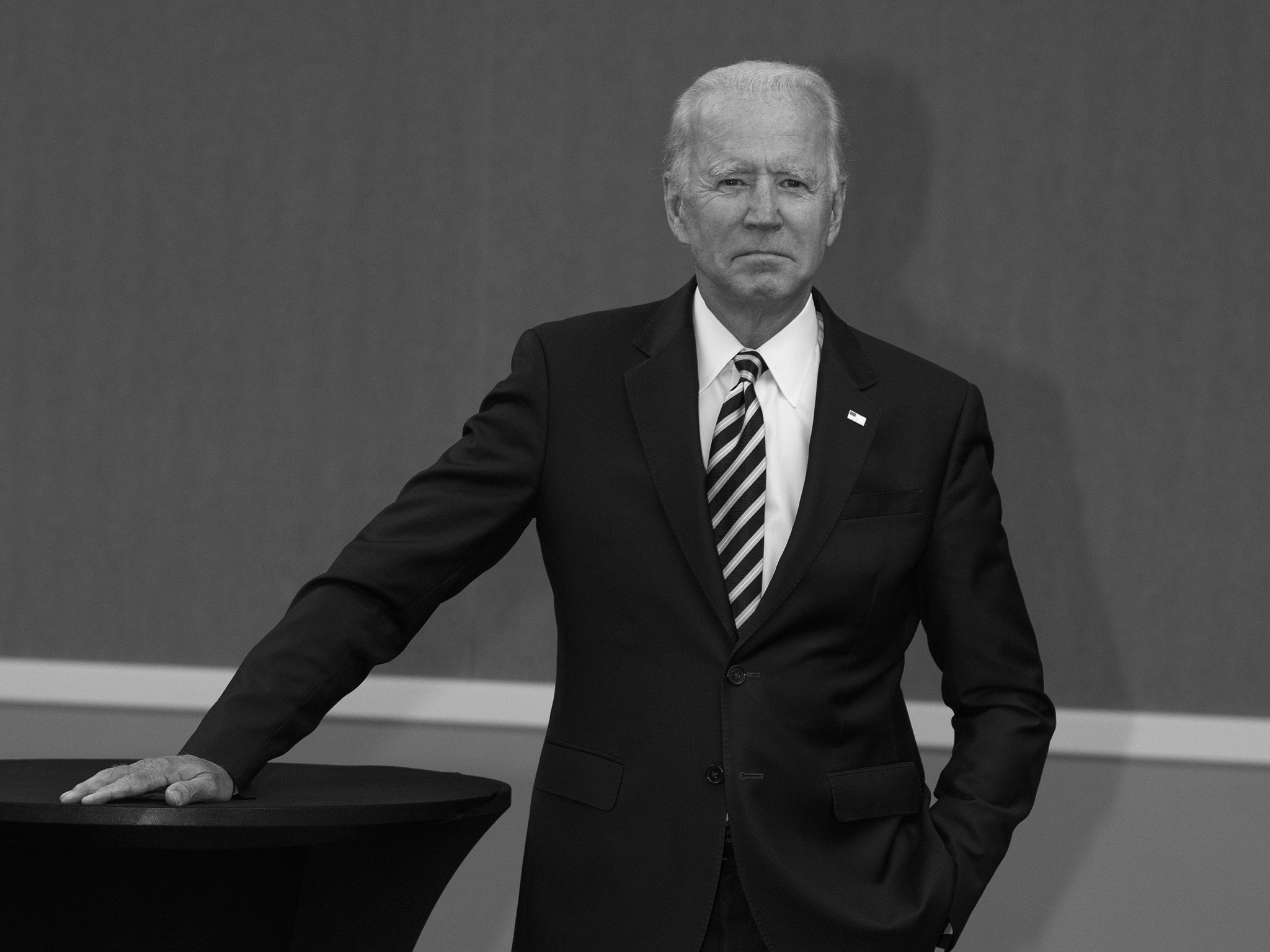

#Biden #jobs #employers #business #destroy

“What the president proposed this week is not an infrastructure bill. It’s a huge tax increase, it is a tax increase on small businesses, on job creators in the United States of America.” Senator Roger Wicker (R-Miss) said on TV Sunday.

“How can the president expect to have bipartisanship when the proposal is a repeal of one of our signature issues in 2017 where we cut the tax rate and made the United States finally more competitive when it comes to the way we treat job creators. He reverses all that,” he added.

Mr. Biden’s massive $2.3-T plan includes just $155-B for repairing roads and bridges; $80-B dedicated to Amtrak repairs; $40-B for public housing improvements; $111-B for repairing lead pipes; $42-B for ports and airports; $100-B for public school improvements; and $180-B for research and development. The rest?

“When you talk about big businesses and you’re saying we should raise their tax rate from 21% corporate rate to 28%, let me just tell you, that’s going to cut job creation …It’s the very reason we lowered those tax rates in 2017. It’s a plan that worked. If the president wants a bipartisan plan, how can he possibly try to get something passed that … repeals a bill that every single Republican in the Senate voted for in 2017? To me I don’t see the bipartisan gesture there.”

Senator Wicker said the Senate has passed infrastructure bills in the past, though not nearly as large, he insisted, “I don’t want to do it by raising taxes and cutting jobs for Americans.”

“What is extremely interesting, in a recent study by American Express, here’s what was learned. Some 77 percent of small-business owners who were polled thought their taxes were likely to increase and now the reality is at their doorstep. If taxes rise further, the majority (66 percent) of small-business owners plan to deal with it by passing the added costs on to their customers, thus increasing already inflationary pressures. Also, devastating is that ore than half (58 percent) will postpone plans to expand their businesses, 55 percent will cut back on personal investments in their companies and 54 percent will institute a hiring freeze. Just 28 percent plan to cut back on existing staff.

“In essence, all is bad for in actuality the result would be either a pass-through to higher prices for the consumer, resulting in more inflation, and cut backs or freezing in employment, adding to an already urgent need to get Americans back to work.

“Already, small-business owners report they’ve been taking similar steps to survive in an unsteady economy and to prepare for the unknown ahead. Some 80 percent are cutting business costs. Of those, 68 percent report taking less money out of their companies, 57 percent say they’re cutting back on expansion investments, 52 percent are cutting back on their own salaries or other compensation and 50 percent are hiring less. “

So, increasing taxes for small businesses is not a positive idea. What the current Administration does not understand is that small businesses are the very backbone of our economy!” says LTN’s economist Bruce WD Barren.

Have a healthy week, Keep the Faith!