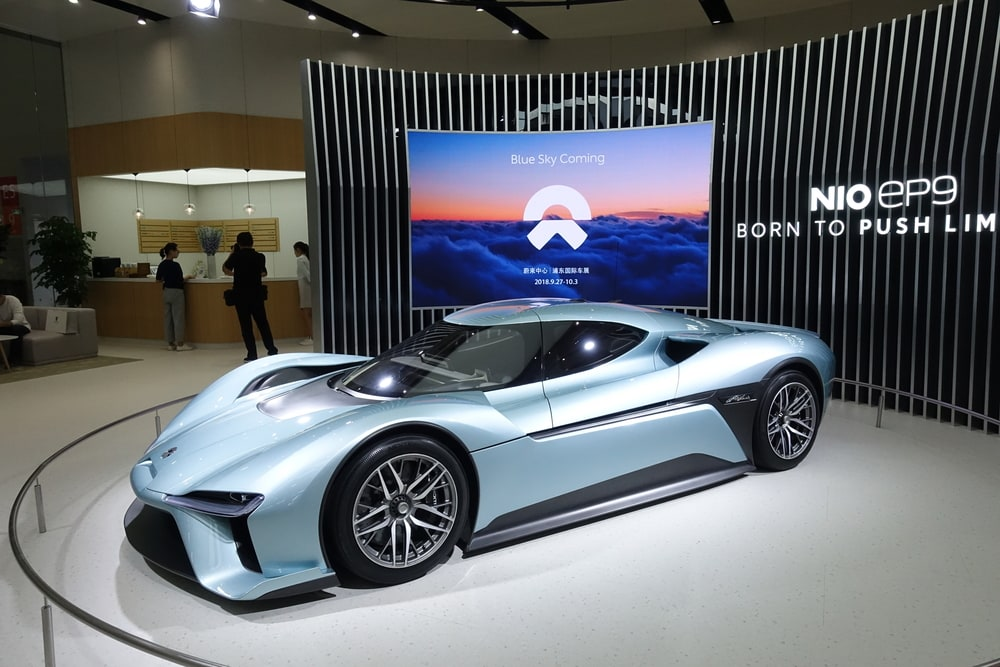

NIO, a Chinese electric vehicle (EV) manufacturer, has rapidly gained prominence as a key player in the global automotive industry. Renowned for its commitment to innovation and sustainable mobility, NIO has successfully positioned itself at the forefront of the electric vehicle revolution.

The company is acclaimed for its high-performance electric cars, which incorporate cutting-edge technology and futuristic design elements.

NIO’s flagship models, including the ES6 and ES8, have garnered attention for their impressive range, advanced battery technology, and a user-friendly ecosystem. Additionally, NIO’s battery-swapping technology addresses concerns about charging infrastructure, offering a convenient solution for users.

As the electric vehicle market continues to evolve, NIO stands out as a symbol of China’s prowess in driving the future of clean and intelligent transportation.

The electric vehicle (EV) market in China has undergone a remarkable transformation, positioning the country as a global leader in the realm of electric mobility.

Fueled by a combination of government incentives, environmental consciousness, and technological advancements, China has witnessed a surge in the adoption of electric vehicles. Domestic EV manufacturers, such as NIO, BYD, and XPeng Motors, have played a pivotal role in shaping this burgeoning market.

The Chinese government’s supportive policies, including subsidies and infrastructure development, have significantly contributed to the widespread acceptance of electric vehicles.

The nation’s commitment to reducing carbon emissions and promoting sustainable transportation aligns with the rapid expansion of the EV charging infrastructure across urban centers. With a growing emphasis on innovation and a shift toward green energy, China’s electric vehicle market continues to evolve, poised to have a profound impact on the future of the automotive industry.

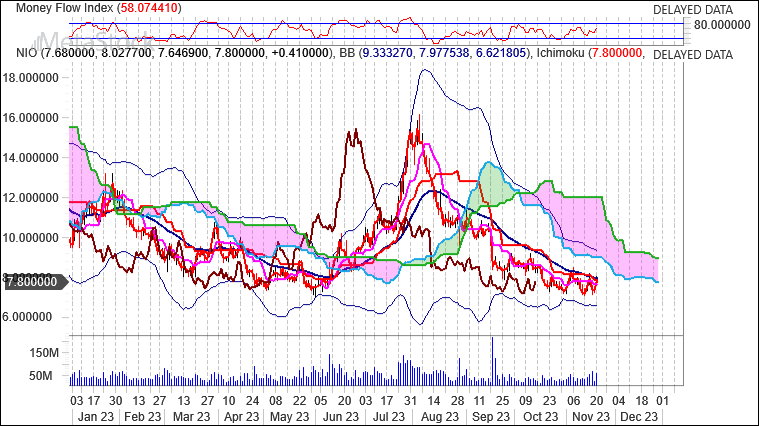

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 5 white candles and 5 black candles. During the past 50 bars, there have been 27 white candles and 22 black candles for a net of 5 white candles.

A rising window occurred (where the top of the previous shadow is below the bottom of the current shadow). This usually implies a continuation of a bullish trend. There have been 3 rising windows in the last 50 candles–this makes the current rising window even more bullish.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 37.9630. This is not an overbought or oversold reading. The last signal was a buy 4 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 48.84. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 43 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 40. This is not a topping or bottoming area. The last signal was a buy 4 period(s) ago.

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 13 period(s) ago.

Shayne Heffernan