Auto sales in China surged in March for their 12th consecutive month of gains, as the world’s biggest car market leads the sector’s recovery from the COVID-19 pandemic.

Sales reached 2.53 million vehicles in March, up 74.9% year-on-year, data from the China Association of Automobile Manufacturers (CAAM) showed.

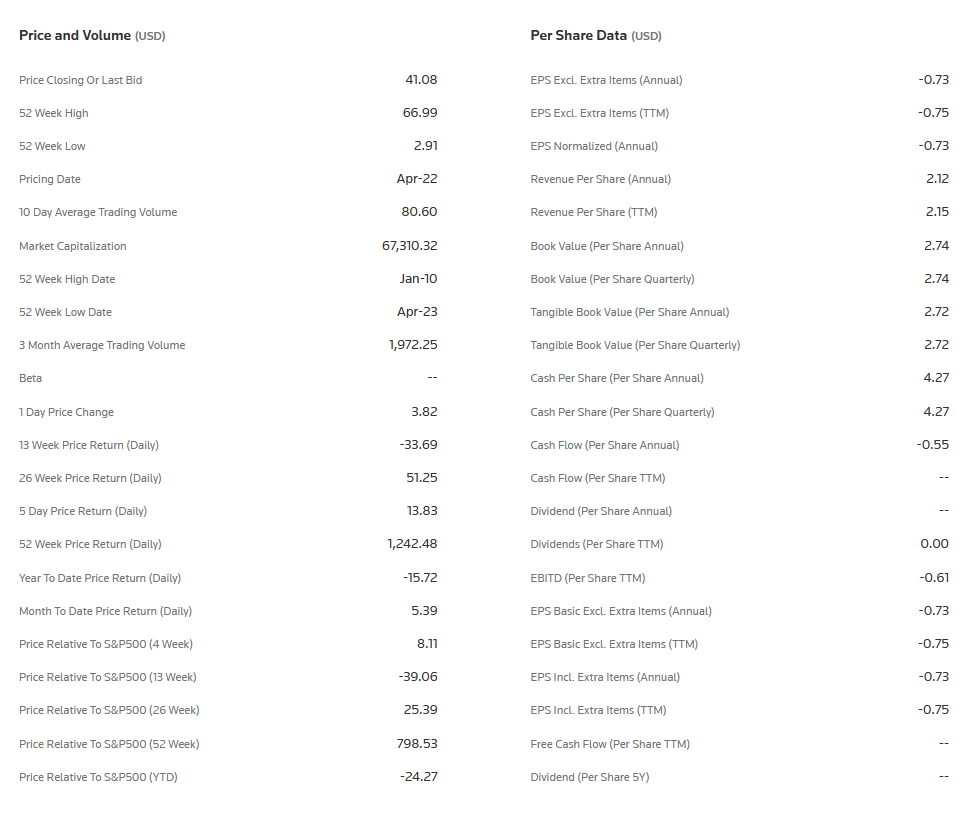

NIO INC is currently 15.3% above its 200-period moving average and is in an upward trend. Volatility is extremely low when compared to the average volatility over the last 10 periods. There is a good possibility that there will be an increase in volatility along with sharp price fluctuations in the near future. Our volume indicators reflect volume flowing into and out of NIO at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on NIO and have had this outlook for the last 9 periods.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Candlesticks

A white body occurred (because prices closed higher than they opened).

During the past 10 bars, there have been 5 white candles and 4 black candles for a net of 1 white candles. During the past 50 bars, there have been 20 white candles and 29 black candles for a net of 9 black candles.

Three white candles occurred in the last three days. Although these candles were not big enough to create three white soldiers, the steady upward pattern is bullish.

Momentum

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 93.8120. This is an overbought reading. However, a signal is not generated until the Oscillator crosses below 80 The last signal was a buy 18 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 54.21. This is not a topping or bottoming area. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a buy 32 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 174.This is an overbought reading. However, a signal isn’t generated until the indicator crosses below 100. The last signal was a buy 4 period(s) ago.