#stocks #investing #trading

$SPY $RUT $DIA $QQQ $VXX

“The best trading week of the year is happening as we lead into November, which as a whole looks to be good too”--Paul Ebeling

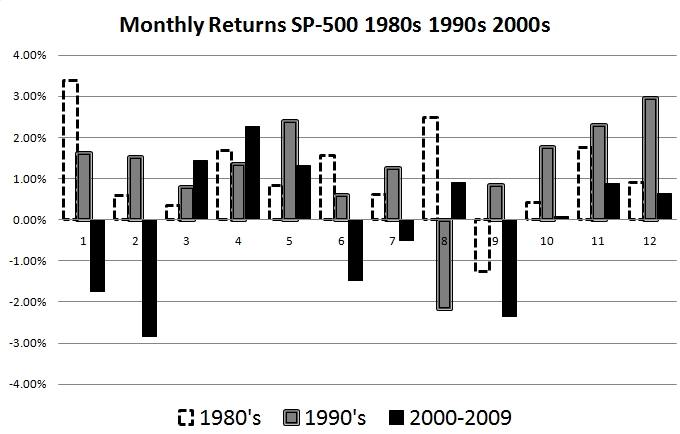

From Ys 1980 to 2009, the best months to buy stocks have been October, November, April, and May, registering positive returns in each of the 30yrs we analyzed.

These are the average monthly returns in percent broken into decades, Ys 1980 to 1989 and Ys 1990 to 2009.

There is a seasonal effect that repeats itself. This could be due to a whole lot of factors: retail sales, Summer commodities harvest, and the build-up to the Christmas holiday selling season.

Plus, the state of the economy and the governments managing of fiscal and monetary policy play a leading role.

I have been in the markets for the past 40yrs+ and learned that the 1980s and 1990s brought about unprecedented growth, and the 2000s was a decade of consolidation with 2 snaps back to the line: Dotcom 2000 and the Y 2007 Financial Crisis.

What you buy is Key.

If you invest in a ETF (Exchange Traded Fund) that tracks the S&P 500 or any major market index, this trend is your friend until changes.

If you invest in individual stocks, then our market data will correlate to the winning stocks covered.

Remember, although a stock may increase or decrease due to the ebb and flow of the market, the technicals of the stock you purchase, combined with your timing, will determine the long-term trading and/or investing success.

Have a prosperous day, Keep the Faith!