Republican Congressman Kevin Hern of Oklahoma purchased stock in each of the following companies on May 15th, 2023:

- ONEOK, Inc. (OKE): A natural gas midstream company

- Texas Instruments Incorporated (TXN): A semiconductor company

- Accenture plc (ACN): A consulting company

- ABB Ltd (ABB): A Swiss multinational conglomerate

Hern filed the trades with the House Ethics Committee on June 13th, 2023.

Hern is a member of the House Energy and Commerce Committee, which oversees the energy industry. Hern has said that his trades were made in accordance with the STOCK Act, a federal law that requires members of Congress to disclose their financial transactions.

As a member of the House Energy and Commerce Committee, he has access to non-public information about the energy industry. This information could give him an unique advantage when making investment decisions.

Here is a table summarizing the financial information of the companies that Hern invested in:

| Company | Market Cap (USD) | Stock Price (USD) | Change in Stock Price (%, 3 months) |

|---|---|---|---|

| ONEOK, Inc. | 34.7 billion | 67.05 | -10.2% |

| Texas Instruments Incorporated | 169.6 billion | 179.16 | -9.0% |

| Accenture plc | 164.2 billion | 247.00 | -7.6% |

| ABB Ltd | 48.9 billion | 23.20 | -11.1% |

As you can see, the stock prices of all four companies have declined in the past three months. This suggests that Hern may have purchased the stocks at a time when they were undervalued. However, it is also possible that the stock prices will continue to decline, in which case Hern could lose money on his investments.

Only time will tell whether Hern’s trades were a wise investment.

Livetradingnews.com used MetaStock for the below information, if you are looking for a powerful charting and analysis tool, MetaStock is a great option. With MetaStock, you can gain the insights you need to make informed trading decisions. Buy 1 month get 2 months free showcasing MetaStock.

ONEOK INC

JUNE 10th 2023 – NYSE ORDER IMBALANCE OKE.N 187813.0 SHARES ON SELL SIDE

JUNE 9th 2023 – ONEOK INC OKE.N: JP MORGAN CUTS TARGET PRICE TO $74 FROM $78

June 8 (Reuters) – Asset manager Energy Income Partners LLC, one of the top shareholders in Magellan Midstream Partners MMP.N, said on Thursday that it intends to vote against pipeline operator ONEOK Inc’s OKE.N deal to buy Magellan.

ONEOK, Inc., incorporated on May 16, 1997, is a midstream service provider. The Company owns natural gas liquids (NGLs) systems, connecting NGL supply in the Rocky Mountain, Permian and Mid-Continent regions with market centers and a network of natural gas gathering, processing, storage, and transportation assets. The Company operates through three segments: Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment provides midstream services to producers in North Dakota, Montana, Wyoming, Kansas and Oklahoma. The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, and distribute NGLs and store NGL products, primarily in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region, which includes the Williston, Powder River and DJ Basins. The Company’s Natural Gas Pipelines segment, through its wholly owned assets, provides intrastate and interstate transportation and storage services to end-users.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Summary

ONEOK INC(Trade Price) is currently 2.3% above its 200-period moving average and is in an upward trend. Volatility is relatively normal as compared to the average volatility over the last 10 periods. Our volume indicators reflect volume flowing into and out of OKE at a relatively equal pace (neutral). Our trend forecasting oscillators are currently bullish on OKE and have had this outlook for the last 10 periods.

Bollinger Bands

Bollinger Bands are 43.14% narrower than normal. The narrow width of the bands suggests low volatility as compared to ONEOK INC(Trade Price)’s normal range. Therefore, the probability of volatility increasing with a sharp price move has increased for the near-term. The bands have been in this narrow range for 1 period(s). The probability of a significant price move increases the longer the bands remain in this narrow range.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.

Candlesticks

During the past 10 bars, there have been 3 white candles and 5 black candles for a net of 2 black candles. During the past 50 bars, there have been 23 white candles and 20 black candles for a net of 3 white candles.

A gravestone doji occurred. This often signifies a top (the longer the upper shadow, the more bearish the signal).

TEXAS INSTRUMENTS INC

TAIPEI, May 31, 2023 /PRNewswire/ — Today, Sameer Wasson, vice president and general manager for Processors at Texas Instruments (TI), shared his insights on the future trends, challenges, and solutions of embedded systems in his speech “Making the Future of Embedded Possible” at the COMPUTEX 2023 Taipei forum.

Texas Instruments Incorporated designs, makes and sells semiconductors to electronics designers and manufacturers across the world. The Company operates through two segments: Analog and Embedded Processing. The Company’s Analog segment product lines include Power and Signal Chain. Power includes products that help customers manage power in electronic systems. Its broad portfolio is designed to manage power requirements across different voltage levels, including battery-management solutions, direct current (DC)/DC switching regulators, alternating current (AC)/DC and isolated controllers and converters, power switches, linear regulators, voltage references and lighting products. Signal Chain includes products that sense, condition, and measure signals to allow information to be transferred or converted for further processing and control. The Embedded Processing segment includes microcontrollers, digital signal processors (DSPs), and applications processors.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Summary

TEXAS INSTRUMENT(Trade Price) is currently 4.2% above its 200-period moving average and is in an upward trend. Volatility is relatively normal as compared to the average volatility over the last 10 periods. Our volume indicators reflect very strong flows of volume into TXN.O (bullish). Our trend forecasting oscillators are currently bullish on TXN.O and have had this outlook for the last 38 periods.

Bollinger Bands

On 6/14/2023 5:00 PM, TEXAS INSTRUMENT(Trade Price) closed below the upper band by 38.5%.

Bollinger Bands are 7.03% wider than normal. The current width of the bands (alone) does not suggest anything conclusive about the future volatility or movement of prices.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.

Candlesticks

A black body occurred (because prices closed lower than they opened).

During the past 10 bars, there have been 6 white candles and 4 black candles for a net of 2 white candles. During the past 50 bars, there have been 27 white candles and 20 black candles for a net of 7 white candles.

A spinning top occurred (a spinning top is a candle with a small real body). Spinning tops identify a session in which there is little price action (as defined by the difference between the open and the close). During a rally or near new highs, a spinning top can be a sign that prices are losing momentum and the bulls may be in trouble.

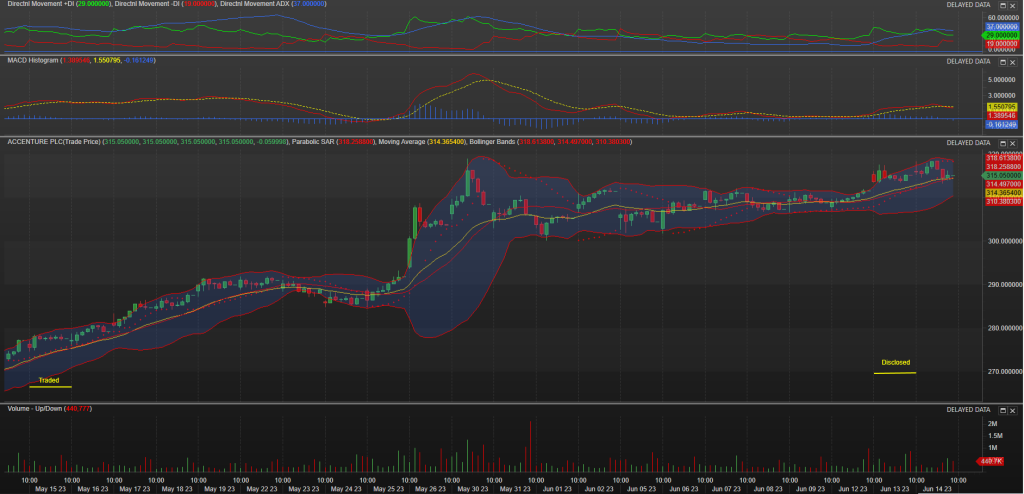

ACCENTURE PLC

NYSE ORDER IMBALANCE ACN.N 72681.0 SHARES ON SELL SIDE – Reuters News 15 Jun 2023

14 Jun 2023 03:15:15 PM ABU DHABI – Accenture (NYSE: ACN) today announced a $3 billion investment over three years in its Data & AI practice to help clients across all industries rapidly and responsibly advance and use AI to achieve greater growth, efficiency and resilience.

- Also launches AI Navigator for Enterprise platform to guide AI strategy, use cases, rigorous business cases, decision-making and responsible policies; and Center for Advanced AI to help maximize value of generative and other AI

- Will double AI talent to 80,000 people through hiring, acquisitions and training

“There is unprecedented interest in all areas of AI, and the substantial investment we are making in our Data & AI practice will help our clients move from interest to action to value, and in a responsible way with clear business cases,” said Julie Sweet, chair and CEO, Accenture. “Companies that build a strong foundation of AI by adopting and scaling it now, where the technology is mature and delivers clear value, will be better positioned to reinvent, compete and achieve new levels of performance. Our clients have complex environments, and at a time when the technology is changing rapidly, our deep understanding of ecosystem solutions allows us to help them navigate quickly and cost-effectively to make smart decisions.”

Accenture plc is a global professional services company. The Company is engaged in providing a range of services and solutions across strategy and consulting, technology, operations, Industry X and Song. The Company serves clients in three geographic markets: North America, Europe, and Growth Markets (Asia Pacific, Latin America, Africa, and the Middle East). It provides a range of services, including application services, artificial intelligence, automation, business process outsourcing, business strategy, change management, cloud, customer experience, data and analytics, ecosystem partners, finance consulting, Industry X, infrastructure, marketing, operating models, security, supply chain management, technology consulting, technology innovation, and zero-based budgeting (ZBB). The Company also specializes in the SAP business technology platform that designs digital products and experiences for enterprise customers, including custom portals and Web solutions, and mobile applications.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Summary

ACCENTURE PLC(Trade Price) is currently 6.4% above its 200-period moving average and is in an upward trend. Volatility is extremely high when compared to the average volatility over the last 10 periods. There is a good possibility that volatility will decrease and prices will stabilize in the near term. Our volume indicators reflect moderate flows of volume into ACN (mildly bullish). Our trend forecasting oscillators are currently bullish on ACN and have had this outlook for the last 29 periods.

Bollinger Bands

On 6/14/2023 5:00 PM, ACCENTURE PLC(Trade Price) closed below the upper band by 43.3%.

Bollinger Bands are 21.71% narrower than normal. The current width of the bands (alone) does not suggest anything conclusive about the future volatility or movement of prices.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.

Candlesticks

During the past 10 bars, there have been 4 white candles and 5 black candles for a net of 1 black candles. During the past 50 bars, there have been 23 white candles and 21 black candles for a net of 2 white candles.

A gravestone doji occurred. This often signifies a top (the longer the upper shadow, the more bearish the signal).

ABB LTD

** Shares of Perenti Ltd PRN.AX jump as much as 3.7% to A$1.250, hitting their highest level since May 11

** The mining services provider and ABB in collaboration have been awarded a contract by IGO Ltd IGO.AX

** Co says contract to undertake a study for full underground electrification of IGO’s Cosmos Nickel Project

** Shares post their biggest intraday pct gain since June 6

** Stock on track for a fourth consecutive session of gains, if trend holds

** PRN stock down 8.4% YTD as of last close

Abb Ltd is a holding company. The Company’s segments include Electrification Products, Robotics and Motion, Industrial Automation, Power Grids, and Corporate and Other. It operates through four divisions: Electrification Products, Robotics and Motion, Industrial Automation and Power Grids. It is engaged in serving customers in utilities, industry and transport and infrastructure. The Electrification Products segment manufactures and sells products and services including low and medium-voltage switchgear, breakers, switches and control products. The Robotics and Motion segment manufactures and sells motors, generators, variable speed drives and robots and robotics. The Industrial Automation segment develops and sells control and plant optimization systems, and automation products and solutions. The Power Grids segment supplies power and automation products, systems, and service and software solutions.

Technical Outlook

Short Term: Neutral

Intermediate Term: Bullish

Long Term: Bullish

Summary

ABB LTD N(Trade Price) is currently 5.0% above its 200-period moving average and is in an upward trend. Volatility is high as compared to the average volatility over the last 10 periods. Our volume indicators reflect moderate flows of volume into ABBN.S (mildly bullish). Our trend forecasting oscillators are currently bullish on ABBN.S and have had this outlook for the last 41 periods. Our momentum oscillator is currently indicating that ABBN.S is currently in an overbought condition. our momentum oscillator has set a new 14-period low while the security price has not. This is a bearish divergence.

Bollinger Bands

On 6/14/2023 6:00 PM, ABB LTD N(Trade Price) closed below the upper band by 32.4%.

Bollinger Bands are 43.39% wider than normal. The large width of the bands suggest high volatility as compared to ABB LTD N(Trade Price)’s normal range. Therefore, the probability of volatility decreasing and prices entering (or remaining in) a trading range has increased for the near-term. The bands have been in this wide range for 15 period(s). The probability of prices consolidating into a less volatile trading range increases the longer the bands remain in this wide range.

The recent price action around the bands compared to the action of the Relative Strength Index (RSI) does not suggest any trading opportunities at this time.

Candlesticks

During the past 10 bars, there have been 3 white candles and 4 black candles for a net of 1 black candles. During the past 50 bars, there have been 28 white candles and 19 black candles for a net of 9 white candles.