Short Squeeze Stocks hot list is $MSFT $CAUD $TSLA

A short squeeze refers to a situation in the stock market where the price of a stock increases rapidly, forcing investors who had bet against the stock (short sellers) to cover their positions. This sudden surge in buying activity can result in a cascading effect, leading to further price increases. The term “squeeze” arises from the pressure on short sellers to exit their positions to limit potential losses.

Here’s a breakdown of how a short squeeze typically occurs:

- Short Selling: Short selling involves borrowing shares of a stock and selling them with the expectation that the stock’s price will decline. The goal is to buy back the shares at a lower price, returning them to the lender and profiting from the price difference.

- Rising Stock Price: If the stock price starts to rise instead of fall, short sellers incur losses. As the price climbs, short sellers may face margin calls, requiring them to deposit additional funds to cover potential losses or close out their short positions.

- Forced Buying: As more short sellers rush to cover their positions by buying shares, the increased demand for the stock drives its price higher. This surge in buying activity can create a feedback loop, triggering more short sellers to exit their positions.

- Cascading Effect: The rapid rise in the stock’s price can create a domino effect, leading to more short sellers capitulating and covering their positions. This further fuels buying pressure, resulting in a significant and often rapid increase in the stock’s value.

- Volatility and Momentum: Short squeezes are often characterized by heightened volatility and strong upward momentum. Traders and investors may join the buying frenzy, attracted by the potential for quick profits, further contributing to the stock’s upward trajectory.

- Impact on Market Dynamics: A short squeeze can disrupt normal market dynamics and create distortions in stock prices. It may also attract attention from regulators who monitor market activities to ensure fair and orderly trading.

Here are the Short Squeeze Stock that look ready to explode

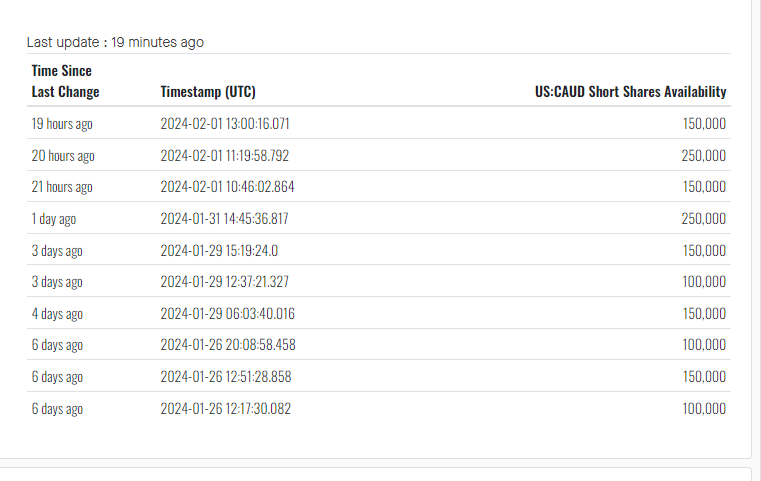

Collective Audience, Inc. $CAUD

Insiders are buyers, and have bought way above the current price

Before the last sell-off, a large amount of stock was available for shorting

The total short compared to the daily volume looks to be at a tipping point

Microsoft Corporation $MSFT

Short volume to total volume here also looks like it is about to reverse

Institutional Shorts

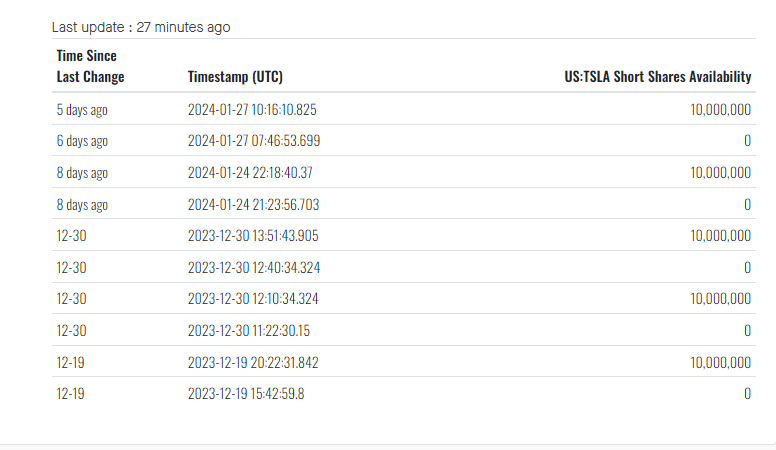

Tesla $TSLA

Tesla, Inc. (US:TSLA) has 4294 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutions hold a total of 1,521,822,397 shares. Largest shareholders include Vanguard Group Inc, BlackRock Inc., State Street Corp, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, VFINX – Vanguard 500 Index Fund Investor Shares, Susquehanna International Group, Llp, Geode Capital Management, Llc, Jane Street Group, Llc, Citadel Advisors Llc, and Susquehanna International Group, Llp .